Company Overview

Angie’s List, Inc. (NASDAQ: ANGI) is a consumer review platform and marketplace (www.angieslist.com) for home services professionals. The company’s online tools allow members to research and purchase local services, as well as leave detailed feedback on the completed work. Angie’s has more than five million members nationwide and 55,000 affiliated service professionals. In addition, the company has amassed more than 10 million verified customer reviews. Angie’s is headquartered in Indianapolis, Indiana.

Products and Services

Angie’s generates revenue from both members and service providers, and offers a differentiated suite of products for each.

Members

Customers may choose between three membership tiers. Green members do not pay an annual membership fee and have access to all ratings and reviews. Silver and Gold members receive extra benefits such as customer support, quality guarantees, and complaint resolution. These memberships come with annual fees of $24.99 and $99.99, respectively,

Angie’s has more than 700 categories of home services, a representative sample of which is shown below:

Members can rate service providers on a letter-grade scale ranging from A to F. Criteria include overall experience, availability, price, quality, responsiveness, punctuality, professionalism, and other criteria depending on the service provided. Members are also encouraged to leave detailed feedback.

Angie’s deploys a variety of resources to maintain the integrity of its member reviews, including proprietary fraud detection technology and a team of quality control and certification personnel.

Service Providers

Angie’s offers service providers a large pool of members seeking reputable providers for home services. Service providers on the company’s platform with a Grade of B or higher are invited to complete the service provider certification process which includes a criminal background check, attesting to proper licensing, maintaining a company-verified profile page, and purchasing advertising from Angie’s. Certified service providers rotate among the first service providers listed in search results for a given category.

The company also has an e-commerce platform where service providers can market to members directly. These transactions are processed by Angie’s who receives a portion of the price paid as revenue.

HomeAdvisor Merger

Deal Terms

On May 1, 2017, the company announced that it had reached an agreement to merge with HomeAdvisor, a division of IAC/InterActiveCorp (NASDAQ: IAC). HomeAdvisor is the largest online marketplace for home services, and provides homeowners with tools and resources for home repair, maintenance, and improvement projects.

Angie’s and HomeAdvisor will form a new publicly traded company, ANGI Homeservices Inc. The combined business will maintain both the Angie’s List and HomeAdvisor brands. According to the terms of the transaction, shareholders of Angie’s may elect to receive either one share of ANGI Homeservices Class A common stock or $8.50 in cash. The cap on cash payments is $130 million and will be prorated based on ownership. Post-transaction, shareholders of Angie’s will own between 10 and 13 percent of the new company’s equity, depending on the number of cash elections.

For its contribution of HomeAdvisor, IAC will receive Class B common stock and will own between 87 and 90 percent of the combined company’s equity value, depending on the number of cash elections. Class A shares will possess one vote per share, while Class B shares will have 10. Accordingly, IAC will hold approximately 98 percent of the voting power.

Market Opportunity

IAC believes that the opportunity in the $400 billion U.S. home services market is significant. Below is the estimated market share for each company pre-transaction:

Source: Company Presentation

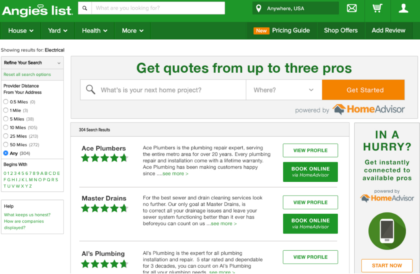

Evidence suggests that both homeowners and service providers are migrating to online platforms, and improvements in technology are improving the experience for both sides. The primary business case for the combination is to leverage Angie’s brand, traffic, and audience to accelerate the growth of the HomeAdvisor service platform. IAC believes that it could begin to monetize Angie’s traffic almost immediately by integrating new search functions to the existing site:

Source: Company Presentation

Finally, IAC believes that the combined scale of Angie’s and HomeAdvisor will improve liquidity on the platform (i.e. more users and ultimately more transactions), which will drive repeat business.

Pro Forma Financials

Potential synergies from the transaction range from $100 million to $250 million to be realized in the next 18 months. On a call discussing the transaction, IAC executives expected that many of these synergies would be realized within one year of the transaction closing, currently projected for October 2017.

The 2018 target adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for the combined entity is $270 million, excluding one-time transaction costs (up to $100 million) and the write-off of deferred revenue. The combined entity will also target a five-year revenue compound annual growth rate between 20 and 25 percent and an adjusted EBTIDA margin of 35 percent.

First Quarter Earnings Review

Total revenue for the first quarter of 2017 declined 13 percent to $73.1 million, attributable to lower service provider and membership revenue. Angie’s indicated that these decreases were caused by certain technology issues which impacted service origination and renewals, and the creation of the free (Green) membership tier.

Operating expenses declined 21 percent from the same period a year ago to $69.6 million. The company saw declines across all categories with the exception of product and technology expenses. Angie’s reported quarterly net income of $2.0 million, as compared to a net loss of $4.7 million in the first quarter of 2016.

Cash provided by operations in the first quarter of 2017 was $4.2 million, as compared to $9.2 million in the same period one year earlier. At March 31, 2017, Cash and equivalents stood at $28.8 million, and the company’s net working capital deficit was $14.5 million.

Stock Influences

- Developments regarding the timeline of the proposed merger;

- Further disclosures regarding the projected performance of the combined entity; and

- Changes in the consideration paid to shareholders of Angie’s.

Risk Factors

- The proposed merger does not close as anticipated.

Stock Performance

As of May 5, 2017, shares of Angie’s closed at $10.71, up slightly more than one percent on the day, yielding a market capitalization of approximately $650 million. The past year for Angie’s stock has been uneven, ranging from a low of $5.50 in mid-March to a high of $10.97 this past week. After the merger was announced, the stock surged more than 60 percent. The May 5, 2017, closing price represents a 26 percent premium to IAC’s cash offer price of $8.50 per share.

Summary

The combination of Angie’s and HomeAdvisor seems like a natural way to grow both companies and capitalize on the massive market for U.S. home services. Management has created some lofty expectations, and it remains to be seen whether they can deliver the promised synergies and growth.

The cash offer from IAC represents a 44 percent premium to the May 1, 2017, closing price of $5.89. While this is well below Angie’s 2011 IPO price of $13, this is still a significant premium to the pre-transaction share price. Furthermore, the stock is now trading above the IAC bid price, and shareholders have the option to simply cash out prior to the completion of the deal.

The other option is to simply wait and receive shares of ANGI Homeservices. While shareholders of Angie’s will only own between 10 and 13 percent of the company, there is significant upside potential that could provide superior returns to either IAC’s cash bid or the current market price.

Welcome to Traders News Source Small Cap Research (see our track record below)

Expect 3-4 small cap profiles per month consisting of two emails per week. We do not spam or send emails daily, we understand that is annoying! Our reports are only sent when we see an actionable situation and potential for near term gains.

Traders News Source recent profiles and track record, 534% in verifiable potential gains for our members on 3 small cap alerts alone!

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

February 6th, 2017- (NASDAQ: SCON) opened at $1.12/share hit a high of $1.80/share within 10 days our member potential gains- 60% – http://finance.yahoo.com/news/superconductor-technologies-potential-revolutionize-smart-130000844.html

March 6th, 2017 (OTC: USRM) opened at .035/share and hit over .17/share within 25 days for gains of 385% for our members- http://finance.yahoo.com/news/traders-news-issues-comprehensive-report-130000743.html

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Limited Time Offer VIP Mobile Alerts

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.