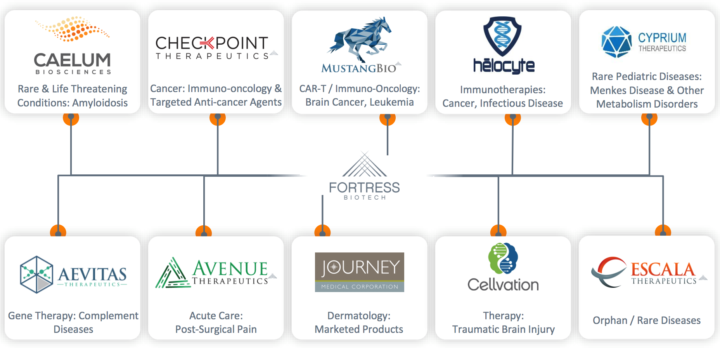

Fortress Biotech, Inc. (NASDAQ: FBIO) is a biopharmaceutical company dedicated to acquiring, developing, and commercializing novel pharmaceutical and biotechnology products. Fortress develops and commercializes products both within Fortress and through certain subsidiary companies, also known as Fortress Companies.

On November 9th, the company announced results for the quarter ended September 30, 2017, reporting revenue of $46.9 million for the third quarter of 2017 and $142.3 million for the first nine months of 2017, compared to $1.0 million for the third quarter of 2016 and $3.9 million for the first nine months of 2016.

Fortress had a robust third quarter performance, beginning with the formation of a new gene therapy subsidiary company, Aevitas Therapeutics. Fortress’ other subsidiaries also continued to achieve critical corporate and clinical milestones during the quarter.

Avenue dosed the first patient in its pivotal Phase 3 study of IV tramadol for the management of moderate to moderately severe pain in patients following bunionectomy surgery. Additionally, Checkpoint dosed the first patient in its Phase 1 clinical study evaluating the safety and tolerability of its anti-PD-L1 antibody, CK-301, in selected recurrent or metastatic cancers.

The FDA also granted Orphan Drug Designation to Checkpoint’s third-generation EGFR inhibitor, CK- 101, for the treatment of EGFR mutation-positive NSCLC. Mustang Bio has continued to make meaningful progress throughout the quarter, with its common stock commencing trading on the NASDAQ Global Market, and the licensing of a CD20 CAR T cell therapy from the Fred Hutchinson Cancer Research Centre, expanding its pipeline to six novel CAR T candidates.

The management is looking forward to oral data presentations on both Mustang Bio’s and Caelum Biosciences’ clinical programs at the 59th American Society of Hematology Annual Meeting in December, and plan to continue delivering on meaningful milestones for the remainder of the year.

With these developments, FBIO has become an attractive option among small caps biotech plays. The upcoming presentations results/developments are likely to be the near-term catalysts for the stock. The stock currently has an average rating of “BUY” and a consensus price target of $9.00. Considering present valuation, FBIO is at a favorable risk-reward position.

About the company: Fortress Biotech, Inc. (“Fortress”) is a biopharmaceutical company dedicated to acquiring, developing, and commercializing novel pharmaceutical and biotechnology products. Fortress develops and commercializes products both within Fortress and through certain of its subsidiary companies, also known as Fortress Companies. In addition to its internal development programs, Fortress leverages its biopharmaceutical business expertise and drug development capabilities and provides funding and management services to help the Fortress Companies achieve their goals.

Subsidiaries’ Relationship to Fortress:

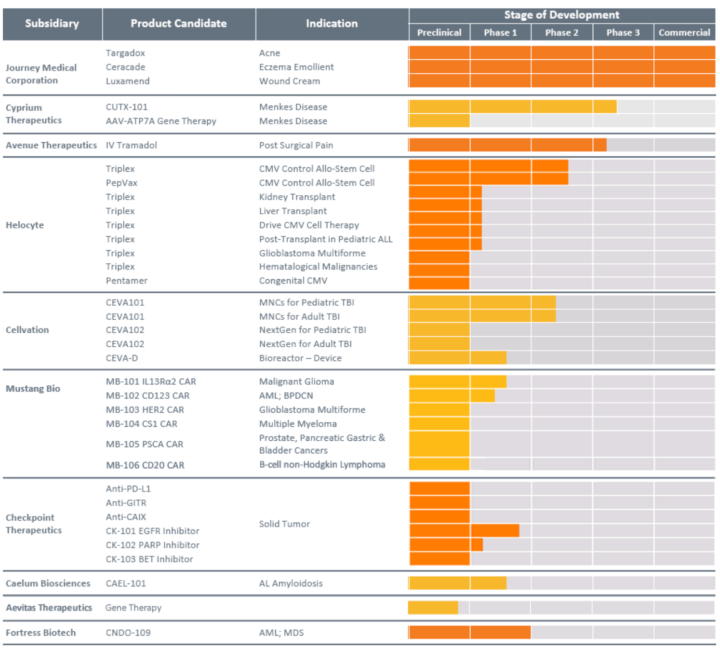

Product Pipeline:

Marketed Products:

- Targadox (doxycyline tablets): Severe acne

- Ceracade (skin emulsion): Atopic and various types of dermatitis

- Luxamend (wound cream): Wounds from superficial to full thickness and 1st and 2nd-degree burns

Recent Fortress Biotech and Fortress Company Highlights:

Fortress Biotech, Inc.

- In November 2017, Fortress announced the public offering of one million shares of its 9.375% Series A Cumulative Redeemable Perpetual Preferred Stock at a price of $25.00 per share, with expected gross proceeds to Fortress of $25 million.

- In July 2017, Fortress formed a new subsidiary company, Aevitas Therapeutics, Inc. (“Aevitas”), to develop novel gene therapy approaches for complement-mediated diseases. The proprietary technology, licensed from a leading university, uses adeno-associated virus (AAV)-based gene therapy to restore lasting production of functional complement regulatory proteins, providing a potentially curative treatment.

Avenue Therapeutics, Inc.

- In September 2017, Avenue announced that the first patient had been dosed in the pivotal Phase 3 clinical trial of intravenous (IV) tramadol for the management of moderate to moderately severe pain in patients following bunionectomy surgery.

Caelum Biosciences, Inc.

- In November 2017, Caelum announced that Columbia University would present the final analysis of CAEL-101 (11-1F4) Phase 1a/1b data for the treatment of relapsed or refractory amyloid light chain “AL” amyloidosis during an oral session at the 59th American Society of Hematology (ASH) Annual Meeting in December 2017.

- During the third quarter of 2017, Caelum completed a third-party Convertible Note financing. In connection with this financing, Caelum raised $9.9 million.

Cellvation, Inc.

- In November 2017, Cellvation announced that the U.S. Food and Drug Administration (FDA) granted CEVA101 (autologous bone marrow-derived stem cells) Regenerative Medicine Advanced Therapy (“RMAT”) designation for the treatment of traumatic brain injury (“TBI”). Under terms of the RMAT designation, the FDA will help facilitate the program’s expedited development and review, and will provide guidance on generating the evidence needed to support approval of CEVA101 for TBI.

Checkpoint Therapeutics, Inc.

- In October 2017, Checkpoint announced that the first patient had been dosed in Phase 1 clinical study evaluating the safety and tolerability of its anti-PD-L1 antibody, CK-301, in checkpoint therapy-naïve patients with selected recurrent or metastatic cancers.

- In September 2017, Checkpoint announced that the U.S. Food and Drug Administration (FDA) granted Orphan Drug Designation to CK-101 (also known as RX518), the Company’s third-generation epidermal growth-factor receptor (EGFR) inhibitor, for the treatment of EGFR mutation-positive non-small cell lung cancer (NSCLC).

Mustang Bio, Inc.

- In November 2017, Mustang announced that its research and development partner, City of Hope (“COH”), will present initial Phase 1 data for MB-102 (CD123 CAR) in acute myeloid leukemia (AML) and blastic plasmacytoid dendritic cell neoplasm (BPDCN) during an oral session at the ASH Annual Meeting.

Latest Quarter Financial position:

- Liquidity and financial flexibility: As of September 30, 2017, Fortress’ consolidated cash, cash equivalents and short-term investments totaled $154.6 million, compared to $88.3 million at December 31, 2016, an increase of $66.3 million year-to-date.

- Net revenue totaled $46.9 million for the third quarter of 2017 and $142.3 million for the first nine months of 2017, compared to $1.0 million for the third quarter of 2016 and $3.9 million for the first nine months of 2016. Net total revenue for the third quarter ending September 30, 2017, includes $2.5 million of Fortress revenue and $44.4 million of revenue from National Holdings Corporation (“National”), which Fortress acquired in September 2016, with no revenue attributable to National before the acquisition.

- Net loss attributable to common stockholders was $27.1 million, or $0.67 per share, for the third quarter of 2017, compared to a net loss attributable to common stockholders of $13.0 million, or $0.32 per share, for the third quarter of 2016.

Key risk factors and potential stock drivers:

- The favorable outcome of the upcoming catalysts (as mentioned above) is expected to provide a boost to the stock to retain its momentum. Any adversities related with the same could upset the stock performance significantly.

- FBIO presently has net level losses. Therefore, any crunch in its liquidity and financial flexibility will further impact its business & financial profile.

- The company’s near-term stock movement is also dependent on its upcoming quarterly result, any significant adversities/lower than expected guidance could adversely affect the investor sentiments.

- Biotech space is a high-risk sector due to uncertainties associated with the novel drug development. Therefore, favorable outcome of the upcoming catalyst is necessary for the stock to retain its momentum. Any adversities related to the same could impinge the stock performance significantly.

Stock Chart:

Comments:

- On Monday, November 27th, 2017, FBIO closed at $4.01 (down by -1.23%) on an average volume of 92,654.00 exchanging hands. Market capitalization is $203.13 million. The current RSI is 51.72

- In the past 52 weeks, shares of FBIO have traded as low as $1.88 and as high as $5.13

- At $4.01, shares of FBIO are trading below its 50-day moving average (MA) at $4.17 and below its 200-day moving average (MA) at $4.04

- The present support and resistance levels for the stock are at $3.87 & $4.17 respectively.

Welcome to Traders News Source, watch your inbox our next small cap stock profile is coming soon.

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone in 2017! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.