Ocera Therapeutics, Inc. (NASDAQ: OCRX), is a clinical stage biopharmaceutical company focused on acute and chronic orphan liver diseases. The company was founded by Wu Xiaoyun, John C. Kappes, and Eckard Weber on January 12, 1998 and is headquartered in Palo.

On March 8th 2017, OCRX announced that it would report additional encouraging data from its Phase 2b STOP-HE study of intravenous (IV) OCR-002 in hospitalized patients with Hepatic Encephalopathy (HE) at the Cowen and Company Annual Healthcare Conference. In January 2017, it already announced positive results from its Phase 1 study of orally administered OCR-002 in patients with chronic liver cirrhosis.

Currently, there are no drug treatments for HE that can be given intravenously to hospitalized patients with acute HE. OCR-002 is rapidly progressing to be an extremely promising ammonia scavenger therapy being explored for HE. Moreover, this formulation is being developed both as intravenous as well as oral therapy, and is targeting a market size of around $2.0 billion in USA.

Also, OCR-002 has been granted orphan drug designation and Fast Track status by the U.S. Food and Drug Administration. Which means, that it will enjoy 7 years of market exclusivity.

The company’s business risk profile is likely to derive significant strength from the favorable competitive landscape, expanding market size in HE segment, superior clinical profile of OCR-002, multiple modes of drug administration, and high probability of obtaining reimbursement. Moreover, Biotech as a sector is showing enormous strength in 2017 (unlike 2016) & is supported by a boost in overall M&A activities, the election outcome and expectations for significant tax & regulatory reform.

As a result of which, investors are really bullish about the potential growth for this orphan liver disease player.

Furthermore, on March 10th, OCRX also announced its Fourth Quarter and Full Year 2016 Financial Results. It reported a Net loss for the three and twelve months ended December 31, 2016 at $5.2 million and $26.9 million, respectively. As of December 31, 2016.It had cash, cash equivalents and investments of $28.4 million.

Management anticipates that it will have sufficient cash to fund operations into the second quarter of 2018 based on its current operating plan and re-prioritization of certain development activities. To continue its ongoing research and development operations beyond 2018, the company might need to raise incremental capital by way of equity or debt.

The company’s stock has unsurprisingly found enormous strength in the recent past. OCRX reported increase in the stock price backed by these announcements laying foundation for product viability and business growth.

Description & about the Company:

Ocera Therapeutics, Inc. is a clinical stage biopharmaceutical company focused on the development and commercialization of OCR-002 (ornithine phenylacetate) in both intravenous and oral formulations. OCR-002 is an ammonia scavenger and has been granted orphan drug designation and Fast Track status by the U.S. Food and Drug Administration (FDA) for the treatment of hyperammonemia and resultant hepatic encephalopathy in patients with acute liver failure and acute-on-chronic liver disease.

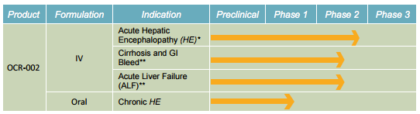

Major product pipeline & application:

Ocera’s drug candidate OCR-002 (ornithine phenylacetate) is designed to treat hyperammonemia (elevated ammonia in the blood) and associated hepatic encephalopathy, a complication of patients with liver cirrhosis or acute liver failure. When the liver is no longer able to remove toxic substances from the blood, there is an accumulation of such toxins, particularly ammonia. Ammonia accumulation in the blood impairs brain cell function, and can lead to a neuropsychiatric condition called hepatic encephalopathy, or HE.

Multi modal drug administration:

Source: Company presentation

Recent developments:

OCRX recently announced that it will report additional encouraging results from its Phase 2b STOP-HE study of intravenous (IV) OCR-002 in hospitalized patients with Hepatic Encephalopathy (HE) at the Cowen and Company 37th Annual Healthcare Conference.

As per management, further analysis of the data from its STOP-HE trial confirms that OCR-002 rapidly and safely lowered ammonia and, importantly, the ammonia reduction correlated statistically with clinical improvement. OCRX believe the most relevant efficacy considerations likely include earlier timing of drug administration, measuring efficacy sooner after drug administration, and administering the appropriate and tolerable dose regimen of OCR-002. The company look forward to discussing these data as well as Phase 3 development with FDA later this year.

2016 was a progressive year for the company, culminating with the timely completion of enrollment in the fourth quarter of STOP-HE, a landmark study evaluating intravenous OCR-002 (ornithine phenylacetate) in patients hospitalized with acute hepatic encephalopathy (HE). OCRX also advanced its oral program testing orally administered OCR-002 in patients with cirrhosis and developing a tablet formulation, which is poised for clinical evaluation in 2017.

In January 2017, OCRX reported positive results from its Phase 1 study of orally administered OCR-002 in patients with chronic liver cirrhosis. The study demonstrated robust bioavailability and promising pharmacokinetic and safety profiles in the intended use population.

Outlook & Anticipated 2017 Activity:

• Initiate Phase 2a multi-dose study of oral OCR-002 in cirrhotic patients in H1 2017

• Meet with the Food and Drug Administration in Q3 2017 regarding STOP-HE with goal of clarifying Phase 3 development plan

Key Stock Influences:

Some key influences that might govern future stock price performance include:

• Successful initiation of enrollment for Phase 3 clinical trials, completion of subject enrollment, and positive announcement related with these ongoing trials would lead future direction for OCRX. Any adversities related to these upcoming milestones might adversely impact the overall investor sentiments.

• Also, significant product concentration continues to impinge the business risk profile of OCRX. The company’s future prospects largely depend on the positive outcome of clinical and commercial success of OCR-002. This dependence on a single product exposes it to a high degree of product & business concentration risks.

• Also, meaningful commercialization of OCR-002 is substantially dependent on the level of competition that it might face from its rival Xifaxin. As per present data, OCR-002 is expected to be a relatively safer and stronger option to treat HE in an acute setting. However, degree of competition it is likely to face from other biotech firms is still a contingency.

• OCRX is still at a pre-commercialization stage and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it. Therefore, any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor. Moreover, meaningful commercialization of OCR-002 is not likely to happen before 2020. Which is a significantly long time span from today.

Earnings Review:

Revenue for the three and twelve months ended December 31, 2016 was $512,000 and $609,000, respectively. Revenue for the three and twelve months ended December 31, 2015 was $24,000 and $133,000, respectively. Revenue in all periods consisted of royalty and licensing revenue generated from certain clinical-stage assets acquired in connection with the 2013 reverse merger between OCRX and Tranzyme, Inc.

Profitability:

Net loss for the three and twelve months ended December 31, 2016 was $5.2 million and $26.9 million, respectively. Net loss for the three and twelve months ended December 31, 2015 was $7.1 million and $26.5 million, respectively. Basic and diluted net loss per share for the three and twelve months ended December 31, 2016 was $0.22 and $1.22, respectively. Basic and diluted net loss per share for the three and twelve months ended December 31, 2015 was $0.34 and $1.32, respectively.

Cash Flow & Balance Sheet:

As of December 31, 2016, OCRX had cash, cash equivalents and investments of $28.4 million, compared with $43.3 million at December 31, 2015.

Net use of cash for 2016 was $22.1 million, which was consistent with OCRX’s most recent guidance of the low end of the range of $22.0 to $26.0 million. Net use of cash equals the difference of cash, cash equivalents and investments at December 31, 2016 and 2015, less cash provided by financing activities, consisting of net proceeds of $7.1 million generated by an “At-the-Market” equity program during 2016.

Management anticipates that they will have sufficient cash to fund operations into the second quarter of 2018 based on its current operating plan and re-prioritization of certain development activities.

Stock Performance

On Friday, March 10th, 2017, OCRX shares declined by 25.93% to $1.4 on an average volume of 4.76 million shares exchanging hands. Market capitalization is $55.67 million. The current RSI is 36.92.

In the past 52 weeks, shares of OCRX have traded as low as $0.52 and as high as $3.75.

At $0.110, shares of OCRX are trading above their 50-day moving average (MA) at $1.31 and below their 200-day MA at $2.13.

The present support and resistance levels for the stock are at $1.28 & $1.60 respectively.

Traders News Source Mission Statement

We strive to highlight the future potential as well as the inherent risk in each small cap company we cover while remaining neutral as a leading third-party equity research firm. Please read our privacy policy and full disclaimer below.

***Receive updates and real time small cap stock profiles from Traders News Source by sending a text from your mobile phone to the number “25-827” with the word “Traders” as the message. Opt out anytime by replying “Stop”

Our group has experienced potential gains of over 200% since January 2017 with four profiles. Stay tuned our next small cap profile will be issued via text and email soon.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.