Star Bulk Carriers Corp. (Nasdaq: SBLK), Star Bulk is a global shipping company providing worldwide seaborne transportation solutions in the dry bulk sector. Star Bulk’s vessels transport major bulks, which include iron ore, coal and grain, and minor bulks, which include bauxite, fertilizers and steel products.

On November 20th, the company announced results for the quarter ended September 30, 2017, reporting $63.0 million in Net TCE Revenues, $18.1 million in operating cash flow, $15.7 million in free cash flow and a total cash position of $249 million. The cash flow generation of Q3 2017 will allow SBLK to repay approximately $4.8 million of debt and capital lease obligations through the cash sweep mechanism.

The company’s operating and market risk profile continues to remain strong and has consistently outperformed industry benchmarks. The Star Bulk fleet is excellently situated, and it is one of the most significant US listed dry bulk operators with 74 ships on a fully delivered basis. From a peer comparison perspective, only Golden Ocean has more vessels and more cargo capacity. This large fleet provides excellent economies of scale to the company.

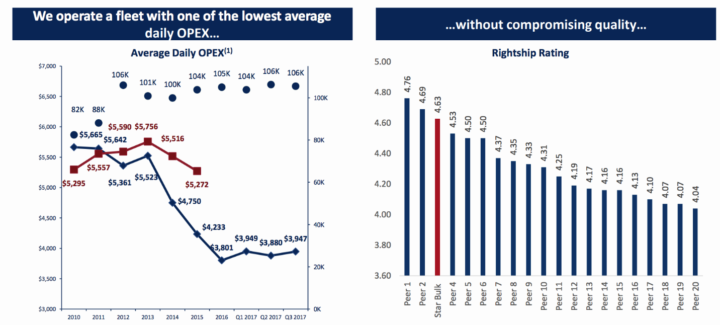

Furthermore, the company continues to leverage on its operational strengths including, in-house technical and commercial management for all vessels, which allows it to manage its costs efficiently and maintain its position as Low-cost operator with industry-leading OPEX and SG&A expenses.

Moreover, the company has the highest corporate governance ranking amongst drybulk peers. Bulk shipping firms are infamous for their bad corporate governance, but SBLK stands out to be ahead of the pack here.

Due to its superior fleet composition, low cost operating structure, comfortable liquidity/financial flexibility and sound corporate governance practices, SBLK is considered as one of the premium bulk company (relative to its peers), and it is currently trading at a non-premium valuation. Analysts have placed a $13.80 price target on Star Bulk Carriers Corp., suggesting above ~40% gain from the recent close.

A few weeks ago, SBLK announced the launch of a new subsidiary Star Logistics Management S.A.

Star Logistics will focus on servicing the end user by connecting origination and destination of dry bulk commodities. The move is expected to further expand the commercial capability of Star Bulk through additional commercial expertise and advanced tools on the Kamsarmax and geared bulk carriers. Moreover, it will provide the Company with access to considerable cargo flow and market information.

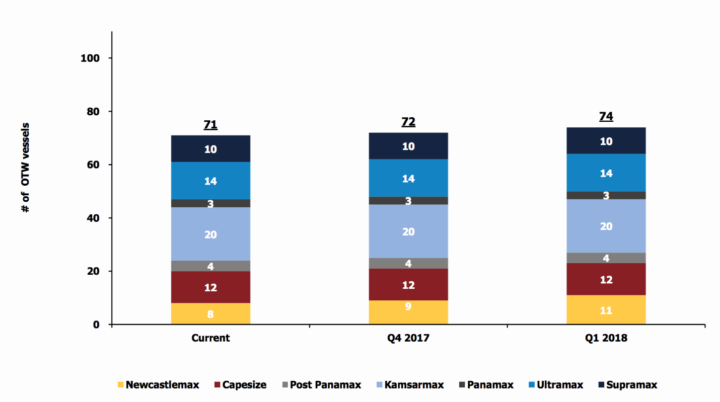

About the company: Star Bulk Carriers is a bulk shipping company with 71 active bulk vessels and three newbuilds to be delivered to it over the next couple of quarters. The fleet has a total capacity of 8.1 million dwt, including Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax and Supramax vessels with carrying capacities between 52k dwt and 210k Dwt.

Star Bulk was incorporated in the Marshall Islands on December 13, 2006, and maintains executive offices in Athens, Greece. Its common stock trades on the Nasdaq Global Select Market under the symbol “SBLK.”

Fleet Update: On a fully delivered basis, SBLK’ fleet will consist of 74 vessels with 8.1 million dwt with average age of 7.8 years (1)

Industry Supply/Demand Update:

- Asset values have rebounded from multi-year lows but remain at historically low levels

- Low fleet growth anticipated from record low contracting during 2016/2017 and inflated demolition activity due to new environmental regulations

- 2017 trade growth has rebounded to 4.0% and expected to remain firm on the back of healthy global economic growth

- Market potential and offtake drivers: Trade growth expected to further improve towards end of 2017

- Global recovery of commodity prices and profit margins, World steel production up +5.0% during first half 2017

- Healthy steel consumption from China infrastructure & real estate on the back of 2016 stimuli and destocking.

- China substitution of scrap with iron ore for higher quality steel, China first half pig iron production up +5.0% y-o-y

- Healthy Pacific demand for high-grade iron ore mainly produced in Brazil to boost ton-miles. New SD11 mine is gradually coming into the stream during 2017-19 and Samarco recovery expected during 2018.

- China total power generation up 7.0% during the first half of 2017. Underperformance of hydropower and thermal coal stocks at power plants

- Strong grains consumption and healthy crops boosting exports

- Global minor bulk growth recovery. West African bauxite ton-mile generation, ASEAN, and India infrastructure development acceleration

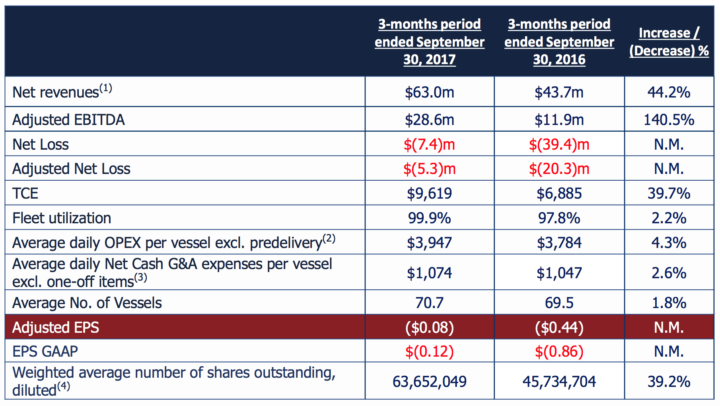

3rd Quarter 2017 Financial Results:

Revenue and Profitability:

- For the third quarter of 2017, total net voyage revenues were $63.0 million, compared to $43.7 million for the third quarter of 2016. This increase was primarily driven by the rise in charter hire rates during the third quarter of 2017, which led to a TCE rate of $9,619 compared to a TCE rate of $6,885 for the third quarter of 2016, representing a 40% increase, as well as the slight increase in the average number of vessels in SBLK’s fleet during the third quarter of 2017 of 70.7 compared to 69.5 during the third quarter of 2016.

- Net loss for the third quarter of 2017 was $7.4 million, or $0.12 loss per share, basic and diluted. Net loss for the third quarter of 2016 was $39.4 million, or $0.86 loss per share.

Liquidity and financial flexibility:

- Total cash of ~$245.4 million, one of the highest cash balances amongst dry bulk peers

- Low operating and G&A cost v Fleet wide cash breakeven rates at ~$7,600 per day

- Minimal equity CapEx requirements going forward

- Successfully raised $103.0 million of new equity over the last 12 months

- Pushed back debt repayments of $223.9 million (for a period starting June 1st, 2016 and ending June 30th,2018)

Key risk factors and potential stock drivers:

The company’s outlook over the long term is significantly dependent on the overall economic situations and various macro factors.

In fact, the bulk shipping sector went through 7-8 muted years in the past, due to massive over ordering of ships during the booming years before. Therefore, improvement in macro factors would continue to drive the prospects of the company.

Notwithstanding its comfortable liquidity position as on date, the company continues to remain highly levered, and if the bulk shipping becomes heavily cash flow negative again, then a highly leveraged entity like SBLK is likely to suffer more in comparison to its lesser geared peers.

SBLK’s business is competitive in nature. If the company is not able to maintain or improve its market share, its business could suffer.

Stock Chart:

Comments:

- On Monday, November 27th, 2017, SBLK was at $9.82 on volume of 252K shares exchanging hands. Market capitalization is $625.49 million. The current RSI is 47.91

- In the past 52 weeks, shares of SBLK have traded as low as $4.63 and as high as $13.40

- At $9.82, shares of SBLK are trading below its 50-day moving average (MA) at $10.09 and below its 200-day moving average (MA) at $9.91.

Welcome to Traders News Source

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.