Company Overview

Vivus, Inc. (NASDAQ: VVUS) is a pharmaceutical company that seeks to develop therapies to address unmet medical needs in human health. The company’s product portfolio consists of two approved therapies and one product candidate in active clinical development.

Qsymia has been approved by the FDA to treat obesity, while Stendra has been approved by the FDA for the treatment of erectile dysfunction (ED). The company is currently developing Tacrolimus for treatment of Pulmonary Arterial Hypertension (PAH).

Vivus was originally incorporated in 1991, and is headquartered in Campbell, California.

Pipeline and Products

As noted above, the company has two actively marketed products:

Qsymia, which received FDA approval in July 2012, is used for chronic weight management for adult patients with a body mass index (BMI) greater than 30, or patients with a BMI greater than 27 in the presence of at least one comorbidity, such as hypertension or type 2 diabetes.

Qsymia incorporates low dosages of active ingredients from two previously approved drugs, phentermine and topiramate. The primary benefits of Qsymia are believed to be appetite suppression and increased satiety, i.e. feeling full, the two most significant influences of eating behavior.

It should be noted that upon approving Qsymia for marketing, the FDA required that Vivus perform additional studies, including a cardiovascular outcome trial (CVOT). To date, there have been no indications of increased cardiovascular risk, and the company is working with cardiovascular and epidemiology experts to remove the requirement of a randomized placebo-controlled CVOT, although there is no assurance that these efforts will be successful. The cost of a CVOT is expected to range from $180 million to $220 million over five years.

Vivus is also considering developing Qsymia to treat a variety of other diseases including obstructive sleep apnea, diabetes, non-alcoholic steathepatitis, non-alcoholic fatty liver disease, hyperlipidemia, and hypertension. However, the company does not expect any future development for these additional indications until it has concluded its discussions with the FDA regarding a CVOT for Qsymia.

Stendra (avanafil) is a phosphodiesterase type 5 (PDE5) inhibitor that received FDA approval in April 2012 for the treatment of ED. The European Commission subsequently granted Vivus marketing authorization for Spedra (the trade name of avanafil in the EU) in July 2013.

Stendra is licensed from Mitsibushi Tanabe Pharma Corporation, and the company has entered into several sub-license agreements for most major territories. The sub-licensees consist of the Menarini Group (Europe), Metuchen Pharmaceuticals LLC (United States, Canada, South America, India), and Sanofi (Africa, Middle East, Turkey, Commonwealth of Independent States).

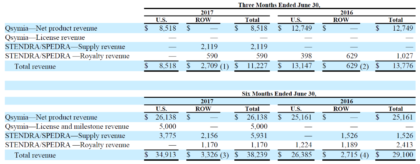

As shown below, Vivus derived more than 75 percent of revenue in the most recent quarter from Qsymia, with the balance attributable to Stendra / Spedra:

Source: Company Filing

Tacrolimus is currently being developed as a treatment for PAH, a chronic life-threatening disease characterized by elevated blood pressure in the pulmonary arteries between the heart and lungs due to constriction. The current medical therapies aim to reduce symptoms and improve quality of life but do not address the underlying disease. Vivus believes that tacrolimus may be able to address fundamental causes of PAH, and hopes to hold a pre-IND meeting with the FDA later this year.

Market Overview

More than 110 million Americans are obese or overweight with at least one weight-related comorbidity. Excess weight increases the risk of other conditions such as heart disease, sleep apnea, stroke, and osteoarthritis. The National Institutes of Health maintains that losing just 10 percent of body weight can reduce the risk of developing these conditions, while making a meaningful difference in health and well-being.

ED affects an estimated 52 percent of men between the ages 40 and 70 years old. Prevalence increases with age and can be caused by a variety of factors including medications, lifestyle, diseases, and spinal cord injuries. The company estimates that approximately half of the men being treated with competing PDE5 inhibitors are dissatisfied with their treatment.

Recent Developments

- On July 5, 2017, Vivus announced that it had reached a settlement agreement with Actavis Laboratories FL resolving patent litigation related to Qsymia. The agreement will allow Actavis to begin selling a generic version of Qsymia on December 1, 2024. If Actavis begins marketing prior to that time, Vivus will be entitled to royalty payments.

- On March 27, 2017, the company reacquired the commercial rights to Stendra from Sanofi for the territories in Africa, the Middle East, Turkey, and the Commonwealth of Independent States.

Second Quarter Earnings Review

In the quarter ended June 30, 2017, revenue declined 19 percent year-over-year to $11.2 million. This decline was partially attributable to a change in accounting methodology that resulted in a revenue reduction of $2.3 million. Net product revenue from Qsymia also decreased significantly, from $12.7 to $8.5 million.

Total operating expenses for the second quarter fell seven percent to $16.2 million. This was largely due to decreases to selling, general, and administrative costs driven by the company’s ongoing cost control initiatives. However, Vivus’ net loss for the quarter increased to $13.4 million ($0.13 per share), up from $11.4 million ($0.11 per share) one year ago.

At June 30, 2017, Vivus listed cash, equivalents, and available-for-sale securities of $251.5 million and debt equal to $244.8 million, yielding a net cash position of $6.7 million. Stockholders’ equity totaled $5.5 million.

Stock Influences

- Approval to market Qsiva in the European Union;

- Resolution of the CVOT requirement for Qsymia;

- Progress regarding additional applications for Qsymia; and

- Significant developments related to tacrolimus.

Risk Factors

- Qsymia is a combination of two active ingredient drugs which are approved individually by the FDA. As a result, Qsymia is subject to substitution by prescribing physicians;

- While the company currently has a strong reserve of cash and securities, completing a CVOT for Qsymia could significant drain its resources;

- The company has faced multiple challenges to its intellectual property from generic drug manufacturers; and

- The company has enacted several changes to its charter documents that could make an acquisition of the company difficult, even if such an acquisition would benefit shareholders.

Stock Performance

As of August 8, 2017, shares of Vivus closed at $1.01, yielding a market capitalization of approximately $100 million. The stock hit a 12-month high of $1.47 in November 2016, but has failed to trade near that level since. While the shares did experience a run-up in the weeks following the first quarter earnings announcement, the market for the stock has cooled. Shares now trade near the 12-month low of $0.99. The stock has lost 10 percent in the last year and is down 12 percent year-to-date.

Summary

Vivus has two products designed to treat conditions that affect a significant proportion of the population in the United States and abroad. Furthermore, the company plans to develop additional applications for Qsymia and tacrolimus for the treatment of PAH.

The company has significant cash and security reserves, but the company is also highly levered. Interest expense in the most recent quarter totaled $8.4 million, and the company has approximately $25 million of senior secured notes due in 2018. Combined with the ongoing possibility of having to fund a CVOT (with a price tag between $180 million and $220 million), Vivus will likely need to restructure its balance sheet in the next 1-2 years.

Limited Time Offer VIP Mobile Alerts

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.