Acorda Therapeutics, Inc. (NASDAQ: ACOR) develops therapies to restore function and improve the lives of people with neurological disorders. INBRIJA™ (levodopa inhalation powder), an investigational inhaled formulation of levodopa for symptoms of OFF periods for people with Parkinson’s on a carbidopa/levodopa regimen, is under FDA review with a PDUFA date of January 5, 2019. INBRIJA utilizes Acorda’s innovative ARCUS® pulmonary delivery system, a technology platform designed to deliver medication through inhalation. Acorda also markets the branded AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg.

On Oct. 31st, 2018, the company announced its financial results for the quarter ended September 30, 2018 and provided an update on its operations and upcoming milestones.

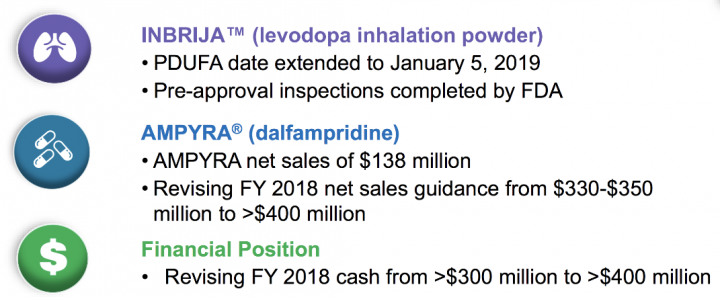

Third Quarter 2018 Highlights

INBRIJA™ (levodopa inhalation powder) in Parkinson’s disease

- In September, the FDA extended the PDUFA goal date for its review of the New Drug Application (NDA) of INBRIJA from October 5, 2018, to January 5, 2019, based on submissions the Company made in response to requests from FDA for additional information on chemistry, manufacturing, and controls (CMC). FDA determined that these submissions constituted a major amendment and will take additional time to review.

- The Company reported that the inspection of its Chelsea, Massachusetts manufacturing facility and the Inbrija inhaler device manufacturer’s facility were completed and closed without the need for any further action by the FDA.

- INBRIJA is an investigational treatment for symptoms of OFF periods in people with Parkinson’s disease taking a carbidopa/levodopa regimen.

AMPYRA (dalfampridine)

- In September, the United States Court of Appeals for the Federal Circuit, by a 2-1 vote, upheld the United States District Court for the District of Delaware’s decision to invalidate four Ampyra patents.

- In October, the Company filed a petition for en banc hearing with the United States Court of Appeals for the Federal Circuit.

- The Company announced that it had settled with Mylan AG to market an authorized generic version of Ampyra. In mid-September, Mylan announced the U.S. launch of the authorized generic.

Acorda’s highest priority is preparing for the expected launch of Inbrija. The Company’ market research indicates that healthcare professionals, patients, and care partners consider OFF periods, or the re-emergence of Parkinson’s symptoms, to be one of the most significant unmet needs in Parkinson’s and that they are enthusiastic about the prospect of an inhaled formulation of levodopa as a treatment option.

Management commentary:

“We were disappointed and disagree with the decision of the Federal appeals court regarding Ampyra, and we have filed an en banc petition requesting review by the entire court. At the same time, we were prepared for that potential outcome, and our original projections had us well capitalized to fully fund the launch of Inbrija and to develop the ARCUS pipeline. We have taken several steps over the past year both to conserve and to increase cash. Based on these, as well as greater than forecasted Ampyra sales, we are in now in an even stronger financial position and are increasing our guidance for both cash and Ampyra sales in 2018.”

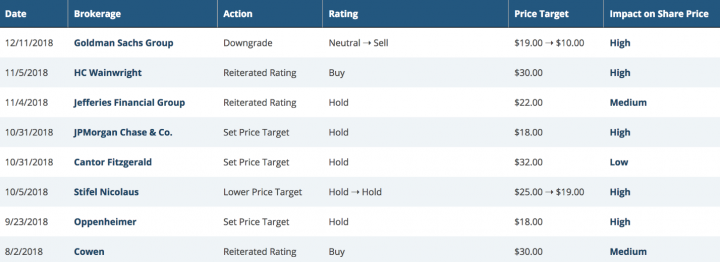

Analyst ratings and target price:

Per www.marketbeat.com, Their average twelve-month price target is $24.00, suggesting that the stock has a possible upside of 48.33%. The high price target for ACOR is $37.00, and the low-price target for ACOR is $10.00. There is currently one sell rating, five hold ratings and 3 buy ratings for the stock, resulting in a consensus rating of “Hold.”

Below are the excerpts of recent analyst rating/Price targets on the company:

Source: www.marketbeat.com

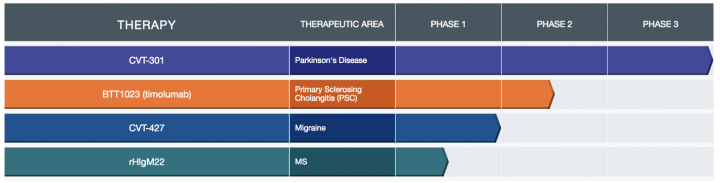

Product Pipeline: Acorda’s R&D efforts are designed to:

- Develop CVT-301 as a potential therapy for Parkinson’s disease

- Advance CVT-427 as a potential acute treatment for migraine

- Advance clinical development of rHIgM22, a remyelinating antibody, as a potential treatment for people with MS

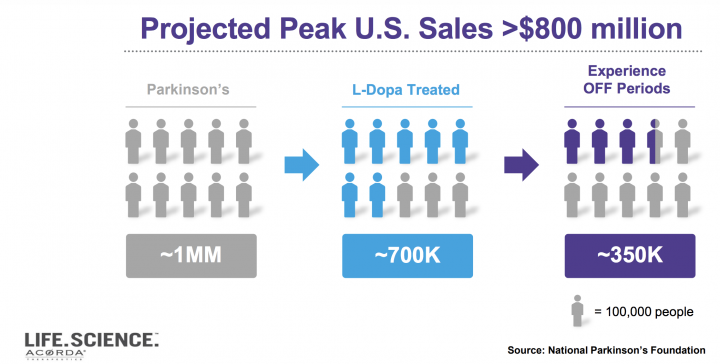

Market potential and key demand drivers: Both healthcare professionals and people with Parkinson’s consider oral levodopa to be the gold standard of treatment for Parkinson’s, and there is consistent enthusiasm for an inhaled form of levodopa to treat OFF periods. Based on the company’s extensive market research and its increased understanding of the Parkinson’s space, ACOR has increased its US peak net sales figure for INBRIJA to greater than $800 million.

Financial Results:

Revenue and profitability:

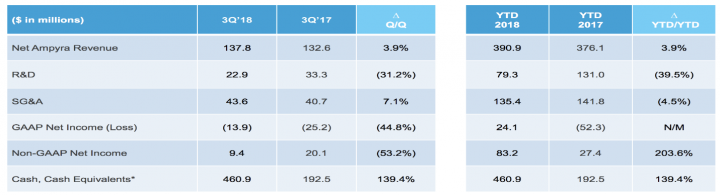

- AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg – For the quarter ended September 30, 2018; the Company reported AMPYRA net revenue of $137.8 million compared to $132.6 million for the same quarter in 2017.

- Research and development (R&D) expenses for the quarter ended September 30, 2018, were $22.9 million, including $1.1 million of share-based compensation compared to $33.3 million, including $2.0 million of share-based compensation, for the same quarter in 2017.

- The Company reported a GAAP net loss of $(13.9) million for the quarter ended September 30, 2018, or $(0.29) per diluted share. GAAP net loss in the same quarter of 2017 was $(25.2) million, or $(0.55) per diluted share.

- Non-GAAP net income for the quarter ended September 30, 2018, was $8.1 million, or $0.17 per diluted share. Non-GAAP net income in the same quarter of 2017 was $20.1 million, or $0.43 per diluted share.

Liquidity and financial flexibility:

- At September 30, 2018, the Company had cash, cash equivalents and short-term investments of $460.9 million.

- ACOR’ capitalization is now significantly better than it projected at the beginning of this year, and the company expect that this will enable us to fund the launch of INBRIJA to cash flow positivity with approval by the PDUFA date of January 5, 2019.

Guidance for 2018

- AMPYRA 2018 net revenue guidance increased from $330-$350 million to more than $400 million.

- R&D expenses for the full year 2018 reiterated and expected to be $100-$110 million including pre-launch manufacturing expenses associated with INBRIJA. This guidance is a non-GAAP projection that excludes share-based compensation, as more fully described below under “Non-GAAP Financial Measures.”

- SG&A expenses for the full year 2018 reiterated and expected to be $170-$180 million. This guidance is a non-GAAP projection that excludes share-based compensation, as more fully described below under “Non-GAAP Financial Measures.”

- The Company has increased projected 2018 year-end cash balance from more than $300 million to more than $400 million.

Key Stock Influences:

- Successful completion of the upcoming milestones would lead future direction for the company. Any adversities related to these upcoming milestones might adversely impact the overall investor sentiments.

- ACOR is still an early stage entity and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it.

- ACOR has a history of operating losses. Therefore, any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor.

Stock Chart:

- On Friday, December 14th, 2018, ACOR closed at $16.18 on an average volume of 790,482 shares exchanging hands. Market capitalization is $769.493 million. The current RSI is 36.81

- In the past 52 weeks, shares of ACOR have traded as low as $15.60 and as high as $36.35

- At $16.18, shares of ACOR are trading below its 50-day moving average (MA) at $18.72 and below its 200-day MA at $23.72

- The present support and resistance levels for the stock are at $15.23 & $16.95 respectively.