Aegean Marine Petroleum Network Inc. (NYSE: ANW), is an international marine fuel logistics company that markets and physically supplies refined marine fuel and lubricants to ships in port and at sea. The company’ goal is to create a global one-stop-shop for the shipping industry that integrates bunkering and waste management services and delivers to clients around the world a branded, high quality, transparent and efficient total service solution.

On July 5th, the company announced that it has entered into a Memorandum of Understanding with Mercuria Energy Group Limited, one of the world’s largest independent commodities and energy groups, to support Aegean’s existing U.S. and global revolving credit facilities and to explore a global strategic partnership.

Under the terms of the Agreement, Mercuria intends to provide a US$1 billion trade finance facility intended to support the Company’s existing U.S. and global revolving credit facilities. Mercuria will also provide increased liquidity to Aegean of not less than US$30 million, adding flexibility to Aegean’s operations. Upon closing of the trade finance facility, the Company will issue new shares equal to 30% of its common stock (on proforma basis) to Mercuria and will invite a representative of Mercuria to join the Company’s Board of Directors.

The Agreement provides for immediate credit support from Mercuria for the benefit of Aegean’s banks, customers, suppliers, and logistics providers, putting the strength of one of the world’s largest independent energy and commodity companies behind Aegean.

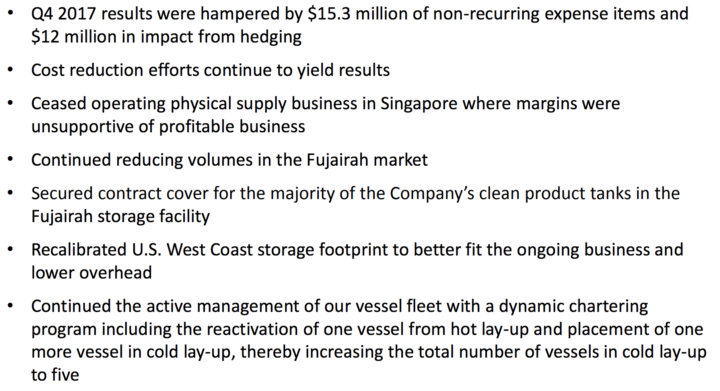

Before this, on March 8th, the company provided business and financial updates for Q42017. The company results continue to reflect a highly-competitive market that remains under pressure. During this period, ANW focused on the consistent implementation of its optimization strategy, while simultaneously pursuing new business opportunities to create value and position Aegean for long-term success.

Aegean Business Update

While company’ recent results show the significant pressures on the markets in which it operates, Management remains confident that they are taking the right steps to position Aegean for long-term growth.

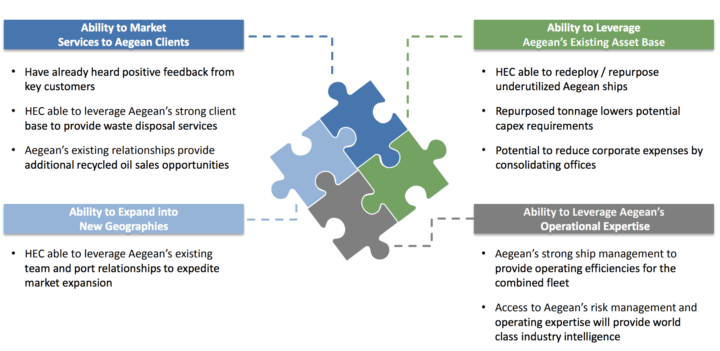

On Feb 20th, the company announced Agreement to Acquire H.E.C. Europe Limited. The Aegean Board unanimously approved the acquisition. The opportunity and decision to acquire H.E.C. comes at a pivotal time in Aegean’s development and is likely to set the course for the future growth of the company. H.E.C. is a complementary growth and high-margin business which is supported by regulatory trends and the growing industry sensitivity to marine pollution issues.

From an operational and market risk profile perspective, the acquisition of HEC diversifies the Company’s revenue streams, opens up growth opportunities in the environmental services market and creates the potential for synergies within its existing network. Once completed, the company expects the addition of HEC to be immediately accretive to its operating and financial results and the combined company to accelerate growth moving forward. ANQ will continue its focus on reducing cost, rationalizing and optimizing its presence in key operating hubs and on maximizing asset utilization in order to create value for Aegean shareholders.

From a liquidity and financial flexibility perspective, the company’ liquidity continues to improve with Mercuria deal, and the Agreement also contemplates a potential broader strategic partnership between the Company and Mercuria, including operational services, trading, and hedging arrangements, and other support provided by Mercuria to Aegean.

The market is hugely excited about these positive developments. Moreover, taking a forward-looking perspective, the company is expected to achieve further improvement in reducing expenses, rationalizing its global footprint and repositioning Aegean for future success, with an eye towards driving shareholder returns over the long term.

Analysts tracking the stock see promise in the company and believe it will provide a robust fundamental appeal to the investors as well as momentum players trading the stock. The average twelve-month price target is $5.33, suggesting that the stock has a possible upside of over 180 %. The high price target for ANW is $7.00, and the low-price target for ANW is $3.00.

Source: www.marketbeat.com

About the company: Aegean Marine Petroleum Network Inc. is an international marine fuel logistics company that markets and physically supplies refined marine fuel and lubricants to ships in port and at sea. The Company procures product from various sources (such as refineries, oil producers, and traders) and resells it to a diverse group of customers across all major commercial shipping sectors and leading cruise lines. Currently, Aegean has a global presence in more than 30 markets.

Synergies through of HEC transactions: HEC’s complementary business model is expected to unlock benefits from Aegean’s global footprint, enhanced asset utilization and diverse customer base

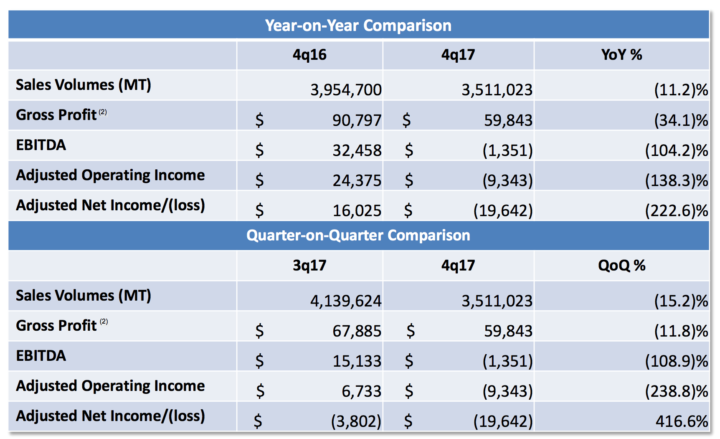

Financial Results (Thousands’USD)

- Revenue – The Company reported total revenue of $1,365.2 million for the fourth quarter of 2017, an increase of 14.1% compared to the same period in 2016, primarily due to the increase in oil prices. Voyage and other revenues decreased to $16.7 million or by 18.9% compared to the same period in 2016.

- Gross Profit – Gross Profit, which equals total revenue less directly attributable cost of revenue, decreased by 34.1% to $59.8 million in the fourth quarter of 2017 compared to $90.8 million in the same period in 2016.

- Operating Loss – Operating loss for the fourth quarter of 2017 adjusted for the sale of non-core assets, vessel impairment charge and the accelerated amortization of restricted shares was $9.3 million, a decrease of 138.1% compared to the same period in the prior year.

- Net Loss – Net loss attributable to Aegean shareholders adjusted for the sale of non-core assets, vessel impairment charge and the accelerated amortization of restricted shares and deferred financing fees was $19.6 million, or $0.48 basic and diluted losses per share, a decrease of $35.6 million or 222.5% compared to the same period in 2016.

Operational Metrics

- Sales Volume – For the three months ended December 31, 2017, the Company reported marine fuel sales volumes of 3,511,023 metric tons, a decrease of 11.2% compared to the same period in 2016.

Liquidity and Capital Resources

- As of December 31, 2017, the Company had cash and cash equivalents of $71.1 million. Non-cash working capital, or working capital excluding cash and debt, was $831.9 million.

- As of December 31, 2017, the Company had $438.3 million of undrawn amounts under its working capital facilities and $71.1 million of unrestricted cash and cash equivalents to finance working capital requirements.

Reduction of Dividend

- The Company also announced that it is reducing its dividend, effective immediately to $0.01 per share. Aegean’s board of directors will re-evaluate its dividend policy following the integration of the HEC transaction.

Other Update: On June 4th, provided an update on its ongoing internal review by the audit committee of the Company’s Board of Director. Audit Committee of the company believes that approximately $200 million of accounts receivable owed to the Company on December 31, 2017, will need to be written off. These amounts are currently due from four counterparties that were reflected in the Company’s financial statements as of December 31, 2017. At this time, the Company cannot determine the full impact on the financial statements or how this adjustment will be recorded. Besides, there could be other adjustments that result from the Audit Committee’s review that could impact the financial statements.

Key risk factors and potential stock drivers:

- The company’ business risk profile is exposed to significant industry and regulatory risk. The oil industry is affected by many factors. Government regulations, particularly in the areas of taxation, energy, climate change and the environment, can have a significant impact on operations and profitability.

- The industry will continue to evolve through the 2020 IMO regulatory changes and beyond. Company ability to respond to these market dynamics would continue to remain a critical business sensitivity factor.

- The successful outcome of the HEC deal and its impact on company’ business and financial would be one of the most significant catalysts for the Company over the near to medium term.

- The company’s operational and market risk profile is exposed to risk related to competitive forces. The oil industry is intensely competitive, and ANW competes with numerous other players. Some of these companies have substantially greater operational and financial resources than ANW.

Stock Chart:

Comments:

- On Monday, July 9th, 2018, ANW was at $1.82, on volume of 2.9 million shares exchanging hands. Market capitalization is $74.37 million. The current RSI is at 59.95

- In the past 52 weeks, shares of ANW have traded as low as $0.60 and as high as $6.00

- At $1.82, shares of ANW are trading below its 50-day moving average (MA) at $2.03 and below its 200-day moving average (MA) at $3.33

- The present support and resistance levels for the stock are at $1.31 & $2.24 respectively.