Company Overview

AmpliPhi Biosciences Corporation (NYSEMKT: APHB) is a biopharmaceutical company engaged in the discovery, development, and commercialization of phage therapeutics. The company has developed a pipeline of naturally occurring viruses called bacteriophages which are natural predators of pathogenic bacteria. Phage-based therapy is an alternative approach to treating bacterial infections, especially those that have developed resistance to current therapies.

The company was originally incorporated in 1989 as a wholly owned subsidiary of Immunex Corporation, and began operations as an independent company in 1992 as Targeted Genetics Corporation. The company, which was renamed AmpliPhi Biosciences Corporation in February 2011, is headquartered in San Diego, California.

Technology

Phages are environmental viruses that grow only within bacteria. As they grow, phages kill their bacterial host by multiplying inside and then bursting through the cell membrane. The process is repeated as more bacteriophages are created until all hostile bacteria is eliminated. See below for an illustration:

Source: Company Presentation

The primary benefit of using bacteriophages is their ability to disrupt biofilms, external layers of aggregated bacteria and other extracellular components which serve as a defense mechanism. These biofilms, which are present in the majority of infections, can render traditional antibiotics almost completely ineffective. In comparison, bacteriophages can penetrate these biofilms and are highly effective at treating infections. Other benefits include:

- Limited side effects as compared to conventional antibiotics;

- Phages are precise – they cannot kill mammalian cells and have a minimal impact on beneficial bacteria; and

- As bacteria evolve to resist phage infection, phages have the potential to evolve and develop countermeasures to overcome new defense mechanisms.

Product Pipeline

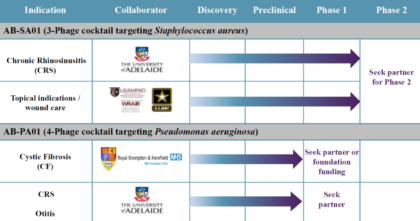

AmpliPhi’s most advanced product candidates are for the treatment of S. aureus infections (including Methicillin-resistant Staphylococcus aureus or MRSA) and P. aeruginosa infections. The status of each of is detailed below:

Source: Company Presentation

AB-SA01 is being developed for the treatment of acute and chronic infections caused by S. aureus, including infections caused by MRSA, which is one of the most common hospital-acquired infections. The company has already completed two Phase 1 clinical trials.

AB-PA01 is being developed for the treatment of P. aeruginosa, the most prevalent infection in Cystic Fibrosis patients. AmpliPhi has also begun an evaluation of its P. aeruginosa phages in animal models of CRS. With successful proof-of-concept studies, the company may consider developing this compound to treat other chronic lung infections such as ventilator associated bacterial pneumonia, chronic obstructive pulmonary disease, and chronic suppurative otitis media, where P. aeruginosa is the primary pathogen.

Development Strategy

We previously wrote about AmpliPhi in late April (https://tradersnewssource.com/aphb/) and the main concern at the time was the company’s long-term capital plan. With a relatively high burn rate and dwindling cash reserves, the company retained investment bank H.C. Wainright & Co. to explore strategic alternatives.

AmpliPhi announced in May that it was shifting toward a new development strategy for its product candidates. The company will now focus on personalized phage treatments for patients with antibiotic-resistant infections under compassionate use guidelines, which gives seriously ill patients access to unapproved drugs when no other treatments are available. The company intends to treat at least 10 patients in 2017 suffering from serious or life-threatening multi-drug resistant infections.

The hope is that personalized treatments can be used to demonstrate clinical efficiency. On a recent conference call, Chief Operating Officer Dr. Igor P. Billinsky noted that data gleaned from compassionate use treatments could then be presented to the FDA to define a regulatory approval path. At a February Type B meeting, the FDA said it was open for continued discussion regarding phage therapy and suggested various next steps.

AmpliPhi intends to continue its full-scale clinical studies for AB-SA01 and AB-PA01, but is currently seeking partners and/or non-dilutive financing to do so. The current strategy allows the company to continue collecting data while maximizing the longevity its remaining financial resources. Depending on the results of the compassionate use treatments, the company could initiate Phase II / registrational studies as early as the middle of 2018.

Market Overview

The market for antibiotics is estimated to reach $44.7 billion in annual sales globally by 2020. Nearly one in five deaths worldwide occurs due to infection, and according to the World Health Organization (WHO), many bacterial infections will become difficult or impossible to cure as the efficacy of current antibiotic drugs wanes.

The 2016 O’Neill Report commissioned by the UK government projects that the failure to respond to the threat of antibiotic resistance and the rise of superbugs could lead to an estimated 10 million deaths from antibiotic-resistant infections worldwide by 2050, with an accumulated global cost of $100 trillion and a 3.5% reduction in global GDP.

The CDC estimates that more than 850,000 patients were treated for S. aureus infections of the skin or soft tissue in 2013, and many initial treatments were not successful. Global Data estimates the market for MRSA infection treatments alone was more than $2.7 billion in 2007. This market is forecasted to grow to more than $3.5 billion by 2019. It should also be noted that the major European Union and United States markets for C. difficile therapies grew to more than $314 million in 2011, and they are expected to grow to more than $500 million by 2019.

Recent Developments

- On May 10, 2017, the company closed on a public offering of common stock and warrants that yielded net proceeds of approximately $9.1 million. This was slightly less than the $9.8 million originally projected.

- On May 15, 2017, the company held a conference call announcing its new personalized phage therapy initiative.

- On May 31, 2017, M. Scott Salka was replaced as CEO by Dr. Paul C. Grint, who will lead the company’s new product development strategy.

First Quarter Earnings Review

In the first quarter ended March 31, 2017, AmpliPhi reported revenue of $29,000 related to its former gene therapy program. This revenue has been declining, and the company does not expect to generate revenue from the commercial sale of its product candidates for the foreseeable future.

Research and development expenses decreased 25 percent year-over-year to $1.5 million. The company cited $0.4 million of nonrecurring expenses associated with the acquisition of Novolytics in January 2016. General and administrative expenses decreased 28 percent over the same period to $1.9 million. This was primarily attributable to reductions in non-cash stock-based compensation and professional fees.

Cash used in operating activities for the quarter ended March 31, 2017 increased to $3.3 million, slightly higher than the $3.1 million reported in the first quarter of 2016. As of March 31, 2017, the company listed a cash balance of $2.2 million.

As noted above, AmpliPhi netted $9.1 million from its May 2017 public offering. The company has also filed for a $1.8 million tax rebate from the Australian government. Current cash resources are expected to fund operations through the second quarter of 2018.

Stock Influences

- Significant developments related to the company’s personalized phage therapy program;

- Additional guidance from the FDA regarding future clinical studies;

- Partnerships and/or other non-dilutive sources of financing for AB-SA01 and AB-PA01; and

- Changes to the company’s capital structure.

Risk Factors

- The company has recently shifted its product development strategy, which could significantly extend the marketing and approval timeline for its product candidates;

- The company does not have material sources of revenue, and current financing is projected to last approximately one year;

- The biopharmaceutical industry is highly competitive and relies heavily on the protection of intellectual property;

- There are no approved bacteriophage products in the United States, and there is no guarantee any of the company’s products will advance beyond clinical testing.

Stock Performance

As of July 7, 2017, shares of AmpliPhi closed at $0.95, losing nearly 20 percent for the day and yielding a market capitalization of approximately $10 million. This capped off a rocky holiday week that saw shares trading as high as $1.18 and as low as $0.78. Trading volume in the past two days has increased significantly, reaching nearly 10 million shares on July 6th and four million shares on July 7th. In the month prior to the recent spikes, the average daily volume was 350,000 shares.

Summary

Our prior coverage of AmpliPhi questioned whether the company could secure long-term financing. With the latest public offering, management is confident that it has sufficient cash to fund operations through the middle of 2018. This is partly due to the fact that the company’s strategic focus on personalized phage therapies will be less capital-intensive. While this new approach will preserve cash, it could extend the development timeline for AB-SA01 and AB-PA01 outside of compassionate use guidelines. It will be critical for AmpliPhi to leverage the patient data collected from personalized phage therapies to secure an efficient path towards regulatory approval.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.