Auxly Cannabis Group. (OTCQB: CBWTF), established in 1987 in Vancouver (Canada), engages in the cannabis streaming industry where it also provides funding for cannabis facility expansions, operations, and initial construction in exchange for minority equity interests and a portion of the cultivation production. CBWTF is world’s first-ever cannabis streaming company with more than 15 streaming agreements so far.

The company continues to make a massive investment in the Canadian market and in the recent past, CBWTF entered into multiple agreements across different provinces to fund facility construction, expansion and innovations in exchange for minority equity interests and portions of the cultivation production.

Company’s expansion model:

Most recently, on July 3rd, the company provided construction development update on the joint venture with FV Pharma Inc. (“FV Pharma”), a wholly-owned subsidiary of FSD Pharma Inc. (CSE: HUGE) at the former Kraft food-production facility (the “Facility”) located in Cobourg, Ontario.

The Facility hosts an initial 620,000 square feet of building space, a portion of which is currently licensed for cultivation pursuant to the Access to Cannabis for Medical Purposes Regulations and can support additional expansion capacity of approximately 3,800,000 square feet on the existing property, pending completion of all phases of the project.

Before this on June 18th, the company announced that it has entered into a definitive joint venture agreement with Peter Quiring, one of Canada’s largest greenhouse builders and operators, via a newly formed subsidiary (the “JVCo”), to develop, construct and operate a fully-automated, state-of-the-art, purpose-built greenhouse for cannabis cultivation in Leamington, Ontario.

In consideration for the agreement, the Company will issue 5,250,000 common shares to Mr. Quiring at a price of $1.12 per share, with 1,250,000 common shares to be issued upon the closing of the transaction, and the remainder to be held in escrow and released in tranches. The Company will also issue 10,000,000 common share purchase warrants. The Warrants are exercisable at a price of $1.57 per share and have a term of five years from issuance.

As per management, the combination of being the largest builder of greenhouses in Canada and the experience of operating 175 acres of greenhouses in Canada and the United States, truly places Peter in a league of his own. As a cornerstone partnership in the Auxly platform, JVco is a unique opportunity to achieve large-scale, low-cost production of cannabis with one of North America’s premier greenhouse operators.

Before this, on May 22nd, CBWTF announced that it has agreed with a syndicate of underwriters for buying on a bought deal basis, 71,500,000 units of the Company at a price of C$1.40 per Unit, representing aggregate gross proceeds of C$100 million. The Company plans to use the proceeds from for capital expenditures relating to domestic and international operations and capacity expansion, for potential new investment opportunities and general working capital purposes.

Canada is on track to significantly expand its regulated cannabis market and to capitalize on Canada’s rapidly burgeoning regulated cannabis market CBWTF continues to find projects that seek to boost their inflows and engages in acquisitions and strategic alliances meant to get them well positioned within the industry.

In fact, the company’s mandate is to facilitate the growth of its partners by providing them with financial and liquidity and sharing its vast industry experience. Currently, CBWTF has invested heavily in the cannabis sector in Canada. This is expected to pay off quite soon given the legalization of cannabis in the country. It is upon this backdrop that analysts believe that investors are likely to benefit from taking a position in CBWTF.

The company’s stock has been powering due to the favorable impact of the company’s recent announcements and growing popularity of the industry.

Description & about the Company:

Cannabis Wheaton is a collective of entrepreneurs with a passion for the cannabis industry past, present, and future. Its mandate is to facilitate growth for its partners by providing them with financial support and sharing collective industry experience. Its partners all have different visions, voices, and brand values, and all share a common goal—to build a world-class industry based on ethics, diversity, quality, and innovation.

Other recent announcements:

Licensing agreement with Dixie Brands, Inc: On May 14th, the company announced that it has entered into a definitive licensing agreement with Dixie Brands, Inc. pursuant to which Cannabis Wheaton will have the exclusive license to Dixie’s intellectual property, product branding and formulation methodologies related to over 100 cannabinoid-infused products (the “Dixie IP”) in Canada and Mexico (the “Territory”).

The closing of Robinson’s Cannabis Acquisition: On May 11th, the company announced that it had closed its previously announced acquisition of its streaming partner Robinson’s Cannabis Inc., acquiring all of the issued and outstanding shares of Robinson’s. The Company has acquired all of the issued and outstanding shares of Robinson’s for an aggregate purchase price of $14,000,000. As a result of the Transaction, Robinson’s is now a wholly-owned subsidiary of the Company.

Definitive Acquisition Agreement with Dosecann: On April 4th, 2018, CBWTF announced that it has entered into a definitive acquisition agreement to acquire Dosecann Inc. (“Dosecann”). Dosecann is a late-stage “Licensed Dealer” applicant pursuant to the Narcotic Control Regulations with a purpose-built 42,000 square foot facility located in Charlottetown, Prince Edward Island. Upon the completion of the Acquisition, Dosecann will become a wholly-owned subsidiary of Cannabis Wheaton.

As consideration, the Company will pay $38,000,000, in common shares of Cannabis Wheaton, subject to the satisfaction of certain post-closing time and performance-based milestones. The Acquisition is subject to some conditions, including shareholder and regulatory approvals. The Transaction is expected to close on or about April 30, 2018.

Strategic Alliance Agreement with Province Brands of Canada: Before this on March 15th, the company announced a strategic alliance with Ontario-based research and development firm Honest Inc. (d/b/a Province Brands of Canada), whereby the Company will assist Province with the establishment and licensing of a cannabis facility focused on the research, development, and commercialization of cannabis-based beverages.

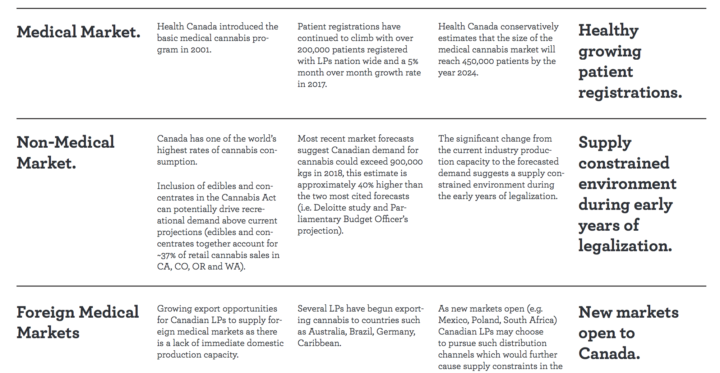

Canada market overview:

Cannabis industry timeline

Cannabis industry growth – Projected Stabilized Values By 2024 ($ Billions In Revenue)

Financials

The company has made no revenues thus far. They, however, stand to generate significant revenues with the legalization of marijuana in Canada given their investment in the industry. Moving forward, given their investments, they are well poised for substantial traction.

Key risk factors and potential stock drivers:

CBWTF is still an early stage cannabis company and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it.

It said the company is likely to see meaningful results from their current investments. Analysts remain hopeful that these payoffs will take shape quite soon and stay bullish about the stock price.

Licensing Risk: While the number of LPs continues to climb, sales approval remains a significant constraint to supplying the market. Despite Health Canada’s “expedited licensing,” it is estimated that Health Canada has approved less than 4% of all licensed producer applications.

In addition, many applicants that complete Health Canada’s paper review find it challenging to secure the necessary capital to complete the build-out of the proposed facility and move towards licensing. Regulatory uncertainty is obstructing some LPs ability to make definitive expansion plans.

Regulatory Risk: Notwithstanding the current operational and marketing progress, the company continues to remain exposed to regulatory and legal risk.

While the number of LPs continues to climb, sales approval remains a significant constraint to supplying the market. Despite Health Canada’s “expedited licensing,” it is estimated that Health Canada has approved less than 4% of all licensed producer applications.

Scaling risk: Cannabis is a difficult plant to grow in scale while meeting Health Canada quality standards and no LP has yet demonstrated the ability to cultivate cannabis on a large scale. Several of the large LPs have already experienced construction delays, which can range from 4 to 8 months behind original schedule, resulting in revisions to management forecasts. Therefore, any time or cost overrun in CBWTF’s ongoing activities and its impact on business & financial profile will continue to remain a key investor sensitivity factor.

CBWTF’s ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a challenge for the company. Additionally, the industry is competitive, and CBWTF will be competing with many other and better-financed companies.

Stock Performance

Comments:

- On July 13th, 2018, CBWTF closed at $0.73, on an above average volume of 1.32M shares exchanging hands. Market capitalization is $417.832 million. The current RSI is 32.65

- In the past 52 weeks, shares of CBWTF have traded as low as $0.55 and as high as $2.70

- At $0.73, shares of CBWTF are trading below its 50-day moving average (MA) at $1.00 and below its 200-day moving average (MA) at $1.11

- The present support and resistance levels for the stock are at $0.6787 & $0.8127 respectively.