Company Overview

Avon Products, Inc. (NYSE: AVP) is a global manufacturer of beauty and other related products that has operated for more than 130 years. Unlike many competitors that distribute their products through third-party retailers, Avon sells its products directly to consumers through affiliated sales representatives.

On March 1, 2016, Avon split into two distinct operating entities: the company and New Avon, LLC. Avon is publicly traded and operates and/or distributes in 65 countries outside of the United States, Canada, and Puerto Rico. Operations in the excluded territories are controlled by New Avon, a privately-held company majority owned by Cerberus Capital Management, L.P. The two companies remain integrated commercial and financial partners, with Avon holding a 20 percent stake in New Avon. Avon is headquartered in London, United Kingdom.

Products and Services

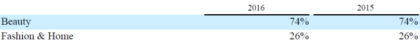

Avon’s primary product categories are Beauty and Fashion & Home. Beauty is comprised of skincare, personal care, fragrance, and cosmetics. Fashion and Home includes jewelry, watches, apparel, footwear, accessories, gift and decorative products, housewares, entertainment and leisure products, children’s products, and nutritional products. The company’s net sales attributable to each category is detailed below:

Source: Company Reports

As noted above, Avon distributes its products using sales representatives who are independent contractors and not employees of the company. As of June 2017, the company has approximately six million active representatives. These Representatives contact customers directly and market using company-produced sales materials. They generate revenue by buying products from the company at a discount and selling at the published retail price.

Due to the company’s distribution model, Avon must not only compete for customers against other consumer packaged goods manufacturers, but for sales representatives as well, who could be lured to other direct selling competitors by better earning potential. A decline in the number/productivity of sales representatives directly impacts the company’s revenue.

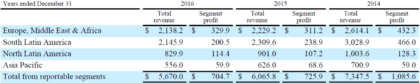

Avon has four reportable segments: (1) Europe, Middle East & Africa, (2) South Latin America, (3) North Latin America, and (4) Asia Pacific. 2016 segment revenue and profit is detailed in the table below:

Source: Company Reports

The segment profit determined above was determined by deducting related costs and expenses associated with revenues, including an allocation of global marketing expenses. However, it excludes other global expenses such as restructuring and asset impairment charges. Segment profit margin in 2016 ranged from 9.3 percent for South Latin America to 15.4 percent for Europe, Middle East & Africa.

Market Outlook

CFRA analyst Joseph Agnese believes that the long-term outlook for the personal products sub-industry is favorable, and that growth in emerging markets will provide new opportunities. In particular, he projects rising demand for packaged products in emerging markets that consumers could previously not afford. Due to the company’s geographic exposure, Avon is well-positioned to benefit from growth in consumer discretionary income.

An important factor to consider is the strength of the U.S. dollar which can impact the company’s reported results. Given that Avon’s sales are primarily generated outside of the United States, a stronger dollar will generally depress the company’s revenue due to currency translation. It should be noted that Avon does not engage in significant currency hedging operations.

First Quarter Earnings Review

After a weak fourth quarter, Avon followed up with first quarter results that disappointed most analysts. According to the company, it was broadly in line with expectations. Revenue for the quarter ended March 31, 2017, was $1.3 billion, a two percent increase from the same period one year earlier. In order to exclude the impact of currency fluctuations, the company also calculates results using constant exchange rates which are updated annually. On a constant-dollar basis, revenue in the first quarter decreased one percent. While the number of active representatives declined three percent, the company’s adjusted gross margin increased 90 basis points to 61.2 percent (primarily attributable to price/product mix). Operating margin increased 160 basis points to 2.2 percent.

Net cash used in operations in the first quarter fell to $80 million compared to $191 million in the first quarter of 2016, attributable to lower inventory and certain taxes that did not recur. At March 31, 2017, Avon listed cash of $560 million, almost $95 million less than at March 31, 2016. The company had a net working capital balance of $498 million, and listed long-term debt of $1.9 billion.

Turnaround Plan

In January 2016, the company initiated a turnaround plan with the hope of achieving sustainable mid single-digit constant-dollar revenue growth, low double-digit operating margins, and active representative growth between one and two percent. The three priorities for this plan are investments in growth, cost reductions, and strengthening the balance sheet.

The company reported good progress in 2016, achieving cost savings of approximately $120 million, and reducing long-term debt by $260 million while extending the remaining maturities. This was achieved primarily by selling the North American business to Cerberus. Based on cost savings achieved in the first quarter of 2017, Avon believes that it is on track to meet its full-year cost savings target of $230 million.

However, some investors are not happy with the progress so far. Activist investors Barington Capital Group LP and NuOrion Partners AG, which collectively own three percent of the company’s shares, believe the turnaround is not progressing quickly enough, and that CEO Sheri McCoy should be replaced. Avon’s stock has declined 84 percent since she took over in 2012, but jumped nearly five percent last week when it was reported that she was considering retirement. A decision regarding her future may come soon.

Stock Influences

- Shifts in the strength of the U.S. dollar;

- Changes in the company’s cost structure;

- Changes to the number of active representatives;

- Economic growth in emerging markets, particularly Latin America; and

- Further M&A activity.

Risk Factors

- The company is highly dependent on its sales representatives which have a high turnover rate;

- The company is subject to foreign exchange risk and does not have material hedging positions;

- The company is currently subject to a deferred prosecution agreement with the U.S. department of justice resulting from a December 2014 settlement. If there is a breach of this agreement, the company may be subject to criminal prosecution; and

- The company’s credit ratings have been downgraded in each of the last three years.

Stock Performance

On June 20, 2017, Avon traded at $3.58, roughly flat for the day. The stock recently hit a one-year low of $3.24, but has since regained some ground. After reporting weaker than expected first quarter earnings in early May, shares of Avon dropped 22 percent. Overall, the stock is down more than 30 percent year to date, but down only 13 percent from 12 months ago.

Avon previously paid a quarterly dividend of $0.06 per share, but that policy was discontinued following the sale of the North America business. There are no immediate plans to resume the dividend.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Joseph Agnese | CFRA | Hold | $4.00 | 5/24/2017 |

| Lauren Lieberman | Barclays | Equal Weight | $4.00 | 5/5/2017 |

Summary

While Avon has struggled within the past year, it has taken steps to address the underlying problems. By selling its North America business, it was able to improve its balance sheet and give the company additional operating flexibility. Now, it hopes to shore up its remaining business by investing in its sales platform and cutting costs.

Still, the company remains highly levered, and activist investors are skeptical that current management can execute on the lofty goals for revenue growth set out in its turnaround plan. Furthermore, the company continues to burn cash. It seems that CEO Sheri McCoy is on the way out, but whoever takes over will need to produce results quickly.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has NOT been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.