Choom Hldgs Inc. (OTCQB: CHOOF) is focused on delivering an elevated customer experience through its curated retail environments, high-grade handcrafted Cannabis supply, and a diversity of brands for the Canadian recreational consumer.

Choom currently operates two late-stage applicants under the Access to Cannabis for Medical Purposes Regulations (“ACMPR”). Choom has agreements in place to acquire two additional late-stage applicant craft growers in BC and Saskatchewan, including a facility in Sooke, British Columbia, anticipated to receive its cultivation license from Health Canada in the third quarter of 2018.

In the recent past, the company stock has shown a solid uptrend, after it announced a non-brokered private placement for gross proceeds of up to $10,000,000, including a $7,000,000 lead order from Aurora Cannabis Inc. whereby Aurora will receive 9,859,155 common shares from Choom’s treasury, priced at $0.71 per share, representing an 8% ownership interest.

The relationship between Aurora and Choom germinated through Aurora Pro, the platform through which the Company delivers a variety of services to industry participants, including cultivation, genetics, regulatory consultancy and market development services. The Aurora Pro platform was developed by Aurora to interact with craft growers who are faced with potentially unreasonable entry barriers to the adult usage market in Canada.

With the legalization of adult use cannabis in Canada on track, Choom™ is positioning itself to be one of the leading premium choice brands for Canadian consumers. This investment by Aurora accelerates the overall corporate strategy of delivering a true seed to sale experience through an offering of high-quality cannabis to Canadian consumers across the country.

Before this, on June 15th, Choom announced that it is closing its acquisition of Specialty Medijuana Products Inc. (SMP). As per management, the addition of SMP to the Choom group of companies will add value to the entire Choom supply chain, from seed to sale. The synergies among Choom companies will make for an extremely bright and exciting future as the industry approach the legalization of the recreational cannabis market in Canada.

From a liquidity perspective, during the same month, the company announced that it had issued 14,225,352 shares for total gross proceeds of $10.1 million. Aurora Cannabis is the cornerstone investor in the placement with a lead order of $7 million. The financing has created ample liquidity to accelerate the execution of Choom’ unique retail strategy moving forward. The company is now well positioned to expand its production and retail footprint, as well as, pursue further opportunities across Canada.

Led by the strong fundamentals and multiple positive catalysts in the recent past, CHOOF has become a significant player in the Canadian market. The company’ robust business and financial risk profile are marked by its healthy liquidity led by capital raise, strengthening supply chains, backward integrations, strategic acquisitions, and expansion of infrastructure that will enable it to take advantage of this critical time in the industry.

As per analysts, CHOOF is an emerging, fully-integrated cannabis company, part of one of the major success stories that are available in the market. Company’s healthy financial position, as well as a promising business profile, makes it a compelling investment/trading option.

About the Industry:

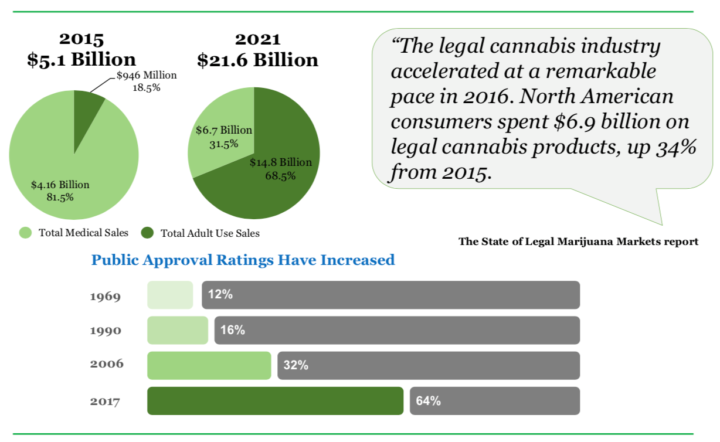

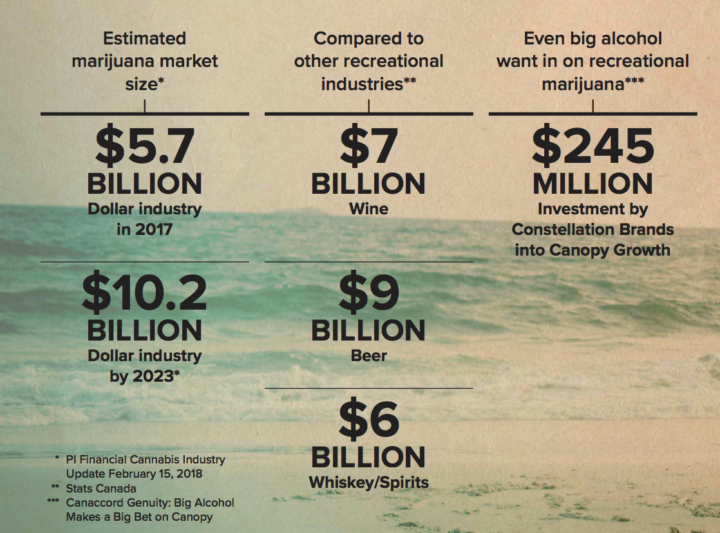

From an industry perspective, the legal cannabis industry has accelerated at a remarkable pace in the recent past. North American consumers spent $6.9 billion on legal cannabis products, up 34% from 2015 and by 2021, legal market sales are expected to surpass $21 billion. If we take that call, then that adds extreme value further.

Specific to the Canadian market: The recreational marijuana industry is expected to be almost 8x the size of medical users by 2021 — the opportunity is in this new recreational Canadian cannabis marketplace.

Choom’ strategy at a glance:

- Fully Integrated Operations; seed to sale for the recreational market offers an opportunity to build a high margin, premium recreational cannabis company.

- Develop & acquire licensed ACMPR production assets positions us to scale-up rapidly to meet the anticipated demand in the Canadian recreation market.

- Develop & acquire retail opportunities to help expand rapidly to meet the anticipated demands of the retail market.

- Develop & acquire products and brands designed and created for the Canadian recreation consumer.

Other recent announcements:

On June 19th, the company announced that it had advanced the build-out of its cannabis retail store network in Alberta and British Columbia. Choom™ has secured the rights to an additional seven retail locations in Alberta. Choom has 25 leases in highly strategic and secure locations in Alberta with 24 applications submitted. Choom has also secured three additional B.C retail leases, combined with the existing 7, for a total of 10 retail opportunities in B.C. In all cases, the retail opportunities are subject to all necessary governmental and municipal approvals being granted. This number is expected to grow over the coming months as the Company is currently negotiating additional leases with the intention of submitting applications for retail licenses.

Latest Quarter Financial position: The company is still at a pre-commercialisation stage and yet to generate revenue. For 2017, the company Net loss was $0.51 million as against $0.47 for 2016.

Key risk factors and potential stock drivers:

- The company’ ability to ramp-up it commercial operations via meaningful sales and profitability, leading to higher cash accrual.

- Company’s ability to maintain its liquidity and financial flexibility to fund its incremental capital requirements.

- Notwithstanding the recent boom, this is still a nascent stage space and only time would differentiate between real winners and laggards. As far as choosing an option with a relative advantage is concerned, CHOOF is the preferred choice with upside potential.

- CHOOF’s ability to acquire and incubate other marijuana companies as the sector consolidates

Stock Chart:

Comments:

- On Friday, July 13th, 2018, CHOOF closed at $1.03, on an above average volume of 568,138 shares exchanging hands. Market capitalization is $125.369 million. The current RSI is 59.87

- At $1.03, shares of CHOOF are trading above its 50-day moving average (MA) at $0.81 and above its 200-day moving average (MA) at $0.52

- The present support and resistance levels for the stock are at $0.9929 & $1.0843 respectively.