Collaboration is a critical element to any scientific breakthrough. Due to the complexity of scientific experimentation, companies that are capable of working together with one another have the potential to grow and succeed much faster than isolated competitors. In the pursuit of developing treatments for rare and life-threatening diseases, Fortress Biotech, Inc’s wholly-owned subsidiary Caelum has announced a strategic partnership with Alexion in order to move closer towards the development of CAEL-101 for light chain (AL) amyloidosis.

CAEL-101 is a first-in-class amyloid fibril targeted therapy designed to improve organ function by reducing or eliminating amyloid deposits in patients with AL amyloidosis. AL amyloidosis is a rare systemic disorder that causes misfolded immunoglobulin light chain protein to build up in and around tissues, resulting in progressive and widespread organ damage, most commonly the heart and kidneys.

According to the agreement, Alexion will acquire an equity interest in Caelum in addition to an exclusive option to acquire the remaining equity in the company depending on Phase 2 data for pre-negotiated economics. Alexion is expected to make payments to Caelum of up to $60 million, which will include the upfront, regulatory, and commercial milestone payments in the event Alexion decides to go through with the option.

“This collaboration with Alexion, a global leader in the rare disease field, is a testament to the Fortress team’s expertise in identifying and developing promising treatments to their full potential. Fortress founded Caelum in January 2017 on the potential of CAEL-101, with the goal of improving treatment options for patients with AL amyloidosis. This partnership represents an exciting opportunity for CAEL-101 to help patients, as well as create value for Fortress investors. We look forward to seeing what Caelum and Alexion will achieve through this collaboration while we continue to develop a robust pipeline of compelling product candidates at Fortress.” – Lindsay A. Rosenwald, M.D., Fortress’ Chairman, President and Chief Executive Officer

Strategic Rationale

The agreement between Caelum and Alexion is a confirmation of Fortress’ business strategy, which focuses on identifying and targeting high-potential assets. Fortress has over 25 programs in clinical development at this time, including projects in the fields of oncology, rare diseases and gene therapy. This diversified approach to project development is intended to advance individual projects rapidly while mitigating risk for shareholders through asset diversity.

Of the 25 programs in the Fortress Biotech Inc. portfolio, several late-stage developments have shown progress:

- Intravenous (IV) tramadol for post-surgical acute pain

- MB-107 for X-linked severe combined immunodeficiency (X-SCID)

- CUTX-101 (Copper Histidinate) for Menkes disease

- CK-101, a third-generation irreversible mutant selective EGFR, for frontline small cell lung cancer with EGFR mutations

- CK-301, an anti-PD-L1 mAb, for selected recurrent or metastatic cancers

- Triplex for cytomegalovirus (CMV)

- CEVA101 for pediatric and adult severe traumatic brain injury

The company also owns a number of marketed products, including Targadox®, Exelderm®, Cercade®, Luxamend®, Ala-Quin®, Ala-Scalp® and Triderm™.

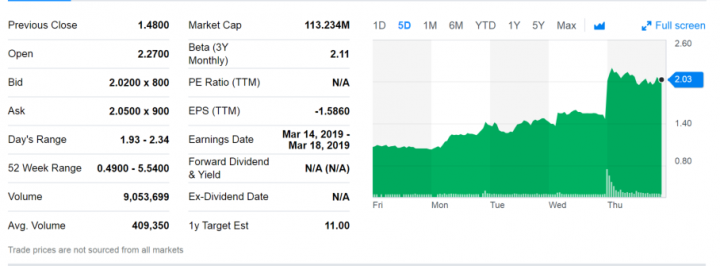

Market Reaction

Following the announcement of Caelum’s partnership with Alexion the stock price of Fortress Biotech Inc. (NASDAQ:FBIO) jumped 53% to open at $2.27 per share after closing the previous day at $1.48.

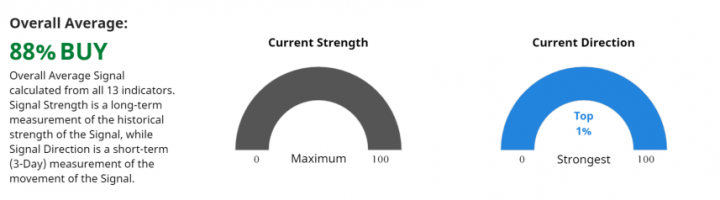

What Are Analysts Saying?

According to Barchart, Fortress Biotech Inc. (NASDAQ:FBIO) has been given an 88% buy recommendation based on 13 different indicators and currently ranks in the top 1% of all short term signal directions.

According to Market Beat, Three Wall Street analysts have given ratings and price targets for Fortress Biotech Inc. over the last 12 months. Between the three analysts, their 12-month price target is a collective $10.67, suggesting that the stock has a potential upside of 430.68%. The high price target for Fortress Biotech Inc. (NASDAQ:FBIO) is $11.00 and the low price target is $10.00. All three analysts are currently listing a “buy” rating for the stock, resulting in a consensus “buy” recommendation.

______________________________________________________

About Traders News Source

Over 75% in realistic bookable gains so far in 2019

Any trader in any market would fall all over themselves to book gains like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in class. We know with a large following comes a large responsibility as we have everyone from the institutional investor to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

View our track record, currently featured reports and updates here- https://tradersnewssource.com/traders-news-source-new-members/

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Traders” to the phone number 25827 from your cell phone.

Pay attention, if you’re just joining us you are about to see why everyone wants to be like us. There are a lot of imitators but only one Traders News Group.

The Traders News Team

______________________________________________________________

Disclaimer:

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Kevin Vanston. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

Fortress BioTech, Late Stage Development Progress and Caelum Partnership with Alexion

February 1, 2019 / Traders News Source, a leading independent equity research and corporate access firm focused on small and mid-cap public companies is issuing a comprehensive report on Fortress Biotech, Inc. (FBIO), a biopharmaceutical company dedicated to acquiring, developing and commercializing unique pharmaceutical and biotechnology products.

Copy and paste to your browser may be required to view the report: *REPORT LINK*

The company recently announced a strategic partnership with Alexion Pharmaceuticals to advance the development CAEL-101 for light chain (AL) amyloidosis. CAEL-101 is a first-in-class amyloid fibril targeted therapy designed to improve organ function by reducing or eliminating amyloid deposits in patients with AL amyloidosis. AL amyloidosis is a rare systemic disorder that causes misfolded immunoglobulin light chain protein to build up in and around tissues, resulting in progressive and widespread organ damage, often found in the heart and kidneys.

Copy and paste to your browser may be required to view the report: *REPORT LINK*

Fortress Biotech, Inc. (NASDAQ: FBIO) jumped 53% to a high of 2.27 following the announcement of the partnership with Alexion Pharmaceuticals.

See what analysts are saying about Fortress Biotech, Inc. and its future prospects *READ MORE*

This document is not intended as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed and is to be used for informational purposes only. Please read all associated disclosures and disclaimers in full before investing. Neither TNS nor any party affiliated with us is a registered investment adviser or broker-dealer with any agency or in any jurisdiction whatsoever. To download our report(s), read our disclosures, or for more information, visit https://www.tradersnewssource.com.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

CONTACT: editor@tradersnewssource.com

SOURCE: Traders News

Source