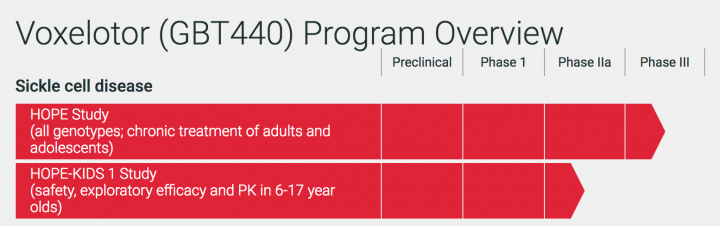

Global Blood Therapeutics, Inc. (NASDAQ: GBT) is a clinical-stage biopharmaceutical company determined to discover, develop and deliver innovative treatments that provide hope to underserved patient communities. GBT is developing two therapies for the potential treatment of sickle cell disease, including its late-stage product candidate, voxelotor, as an oral, once-daily therapy.

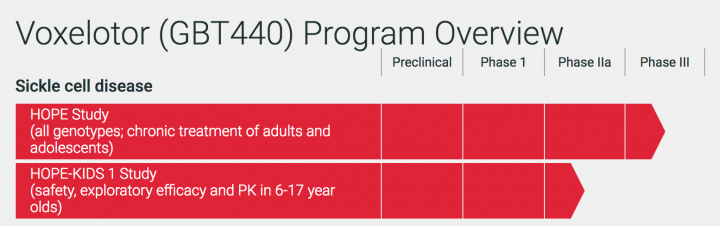

GBT pipeline: GBT is advancing a strategic drug discovery, development, and commercialization approach that leverages the team’s expertise in blood biology and structural and medicinal chemistry.

On Nov. 06, 2018, the Company reported business progress and financial results for the third quarter ended September 30, 2018.

Recent Business Progress:

- Global Blood announced an agreement to sell $150.0 million in shares of its common stock in a registered underwritten public offering. In addition, GBT has granted the underwriter a 30-day option to purchase up to $22.5 million in shares of its common stock. The offering is expected to close on or about December 11, 2018, subject to customary closing conditions.

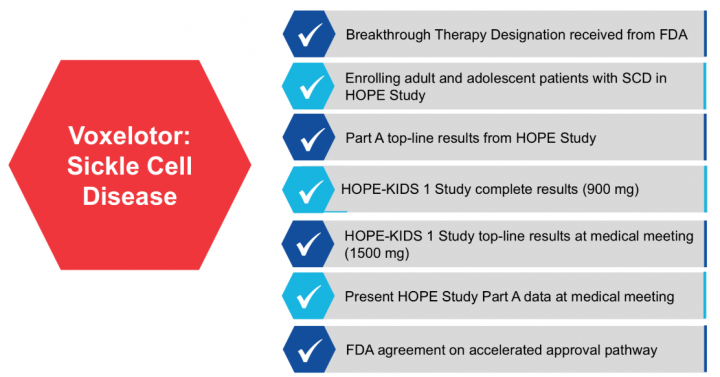

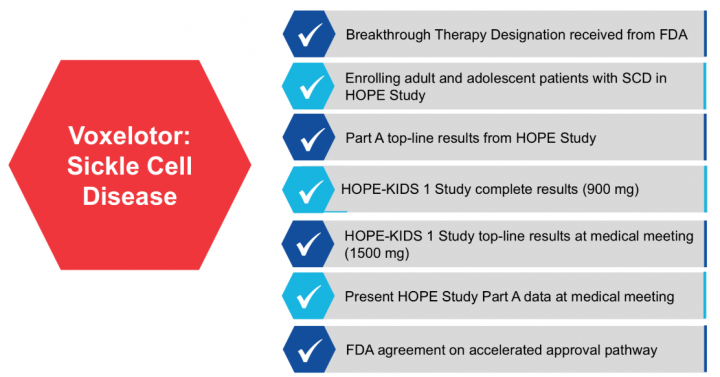

- The company announced positive 24-week Results from Phase 3 HOPE Study Demonstrating Clinically and Statistically Significant Improvements in Hemoglobin and Clinical Measures of Hemolysis and a Favorable Safety Profile. Interim Analysis of Data from 1500 mg Cohort of HOPE-KIDS 1 Study Consistent with Phase 3 HOPE- Results in Demonstrating Improvement in Hemoglobin and Clinical Measures of Hemolysis and Favorable Safety in Pediatric Patients

- The Company announced that U.S. FDA Agrees with its Proposal Relating to Accelerated Approval Pathway for Voxelotor for the Treatment of Sickle Cell Disease and GBT Plans to Submit New Drug Application (NDA).

- GBT plans to request a pre-NDA meeting for the first quarter of 2019 and intends to provide further details regarding its plans and timing for an NDA submission as well as additional specifics on the TCD confirmatory study following this meeting.

- Received acceptance of three oral presentations and one poster presentation at the upcoming 60th American Society of Hematology (ASH) Annual Meeting and Exposition, which will be held December 1-4in San Diego.

- Presented three oral presentations during the 46th Annual National Sickle Cell Disease Association of America (SCDAA) Convention in Baltimore.

- Hosted two SCD-focused conferences: the inaugural Access to Care Summit, designed to bring together members of the SCD community to discuss solutions to improve access to SCD care, and the 7th Annual SCD Therapeutics Conference, which highlighted the latest medical advances and future trends in the treatment of patients with SCD.

- Participated in the FDA-ASH SCD Clinical Endpoints Workshop in Rockville, Maryland. GBT’s Senior Vice President of Development Josh Lehrer, M.D., participated in the workshop’s industry panel.

Major Value Drivers in 2018:

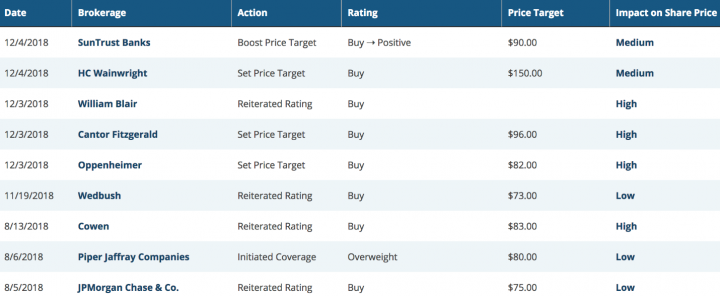

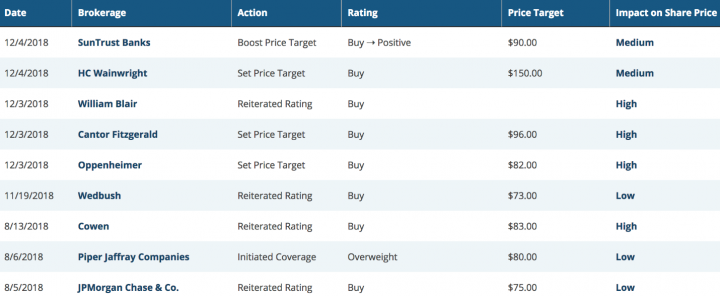

Analyst ratings and target price:

GBT recently updated extraordinarily encouraging and positive trial results and therefore attracting considerable analyst attention. Per www.marketbeat.com, their average twelve-month price target is $86.3571, suggesting that the stock has a possible upside of 102.45%. The high price target for GBT is $150.00, and the low-price target for GBT is $61.00. There are currently one hold rating and 13 buy ratings for the stock, resulting in a consensus rating of “Buy.”

Below are the excerpts of recent analyst rating/Price targets on the company:

Source: www.marketbeat.com

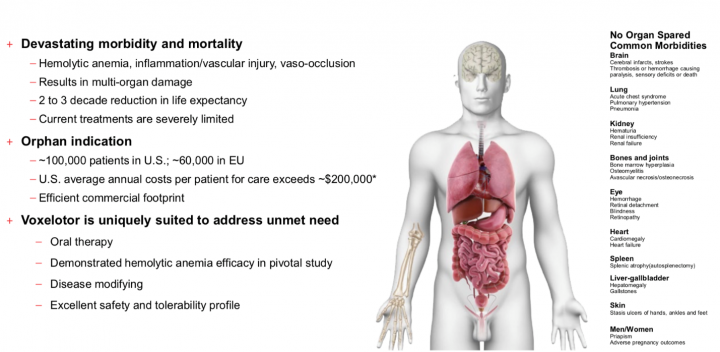

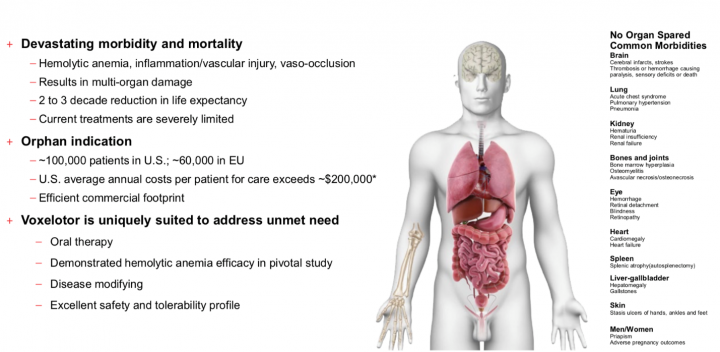

About SCD: Sickle cell disease (SCD) is a chronic, inherited blood disorder that impacts hemoglobin, a protein found in red blood cells (RBCs) that carries oxygen throughout the body. The disease is caused by a genetic mutation in the beta-chain of hemoglobin, which results in the formation of abnormal hemoglobin known as sickle hemoglobin (HbS).

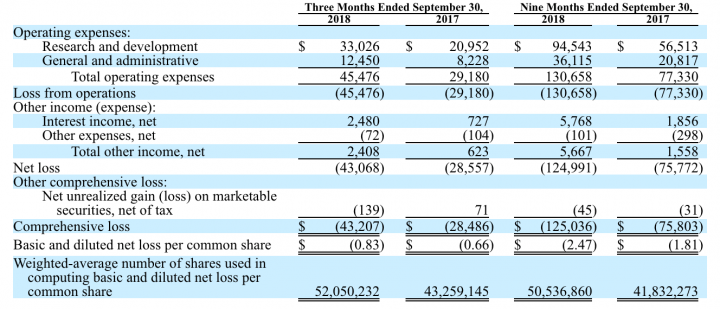

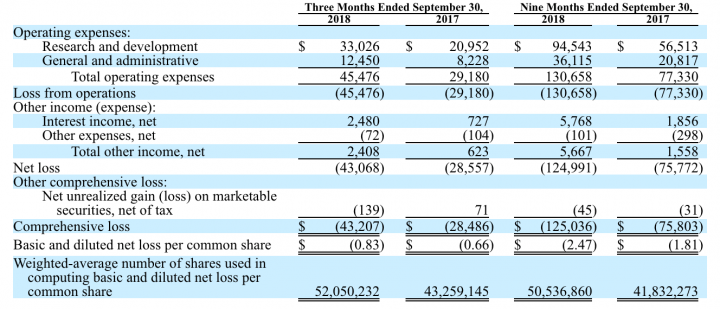

Financial Highlights: (In thousands, except share and per share amounts)

- Cash, cash equivalents and marketable securities totaled $482.1 million at September 30, 2018, compared with $329.4 million at December 31, 2017.

- Net loss for the three months ended September 30, 2018, was $43.1 million compared with $28.6 million for the same period in 2017. Basic and diluted net loss per share for the three months ended September 30, 2018, was $0.83 compared with $0.66 for the same period in 2017.

- Based on the Company’s operating plan, Operating expenses are expected to increase in Q4 2018 primarily due to manufacturing and pre-commercial activities.

Key risk factors and potential stock drivers:

- GBT recently confirmed that the FDA is willing to support a voxelotor accelerated approval filing. Voxelotor’s ability to improve TCD flow, post-approval, would be one of the major near to medium term catalyst for the company.

- GBT plans to request a pre-NDA meeting for the first quarter of 2019 and intends to provide further details regarding its plans and timing for an NDA submission as well as additional specifics on the TCD confirmatory study following this meeting.

- Company’ ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a critical challenge for the company.

- Pharmaceutical and biotech industries are subject to extensive regulation by government agencies, including the FDA, the Drug Enforcement Administration (“DEA”), the FTC and other federal, state and local agencies.

Stock Performance

Comments:

- On Friday, Dec 7th, 2018, GBT closed at $42.65, with an average volume of 1.2 million shares exchanging hands. Market capitalization is $2.228 billion. The current RSI is 58.83

- In the past 52 weeks, shares of GBT have traded as low as $30.15 and as high as $68.05

- At $42.65, shares of GBT are trading above its 50-day moving average (MA) at $36.59 and below its 200-day moving average (MA) at $44.19

- The present support and resistance levels for the stock are at $39.83 & $46.01 respectively.

Traders News Source Track Record

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.