Be among the first to receive our next potential triple digit gainer, text the keyword “Traders” to 52736

Update 11/09/22 News out…

Mullen Enters into Agreement with Newgate Motor Group, One of Ireland’s Most Recognized Auto Groups, to Distribute Mullen I-GO in Ireland and United Kingdom

Full Story

Mullen Retires Debt – Mullen Automotive Announces Elimination of Approximately $13 Million in Debt, with Less than $10 Million of Debt Remaining

Full Story

Investors had all but given up on Mullen Automotive, Inc. (NASDAQ: MULN), driving the share price down from $1.60 in late June, to $.21/share on Tuesday. The electric vehicle maker seemed to be going nowhere fast and there was no shortage of disparaging headlines about the company. The EV market is dominated by Tesla and the major auto companies and the barriers to entry by those seeking to carve out an EV niche are mountainous.

The barriers faced by Mullen in their entry into the EV market seemed less foreboding with the announcement they made on Wednesday this week. In a bankruptcy court auction, MULN purchased the assets of EV company ELMS (Electric Last Mile Solutions).

The purchase price was $275M in cash. The asset purchase includes all tangible and non-tangible assets of ELMS including a factory in Mishawaka, IN. To put the factory in scope, it previously produced General Motors Hummer H2 SUV and SUT and subsequently contract manufactured the Mercedes-Benz R-Class vehicle. MULN expects to produce 50,000 EV’s annually at the factory.

According to MULN, this new asset purchase, combined with the acquisition last month of the majority ownership of Bollinger Motors, gives Mullen the ability to integrate Bollinger’s vehicle platforms, B1 and B2 along with Mullen’s FIVE and FIVE RS platforms into an already existing and capable high volume manufacturing facility. As a result, this will accelerate the launch of the Bollinger B1, B2 retail vehicles by twelve or more months.

We will see how it works out for Mullen. As I write this just six hours after the MULN press release, the company shares are +57% and 640M shares have traded hands today.

Revised 11/02/22

MULN already has the facilities to produce 50,000 electric vehicles annually, with leadership focused on growth and investing in game-changing battery advancements. For these reasons, I believe there could be a lot of upside potential for this very cheap stock in the long run while the company begins to enter its growth stage of the business cycle. However, we cannot ignore that this is a loss-making micro-cap company with little historical performance and a long road to potential profitability, which will include heavy dependence on vast amounts of financial backing to be successful. Investors may want to take a cautious but bullish stance on this company if we look at its successful history of acquisitions, the workforce onboarded to run the show, and the company’s strategic partnership deals recently made.

Stock Price Forecast

According to 7 stock analysts, the average 12-month stock price forecast for MULN stock is $23.46, which predicts an increase of 5809.32%. The lowest target is $23.23 and the highest is $24.15. On average, analysts rate MULN stock as a buy.

ANALYST CONSENSUS: BUY

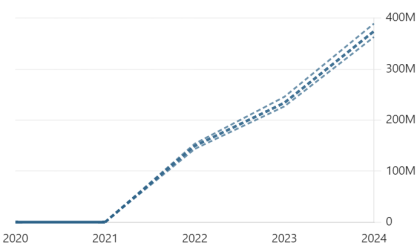

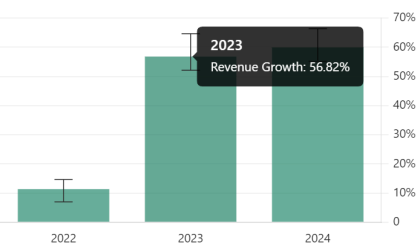

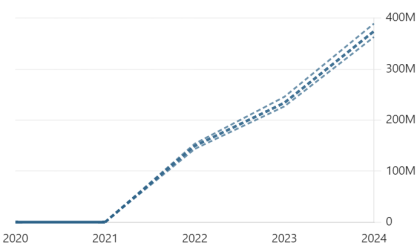

Revenue This Year

149.23M

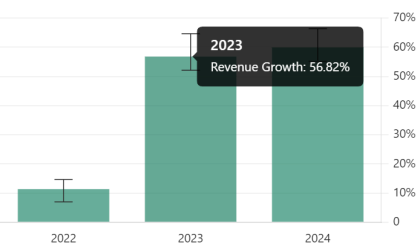

Revenue Next Year

234.01MIncreased by 56.82%

from 149.23M

EPS This Year

0.77

from -1.89

EPS Next Year

1.56

Increased by 104.08%

from 0.77

source: stockanalysis.com

MULN Reddit Post/Sentiment Over Time

23 Last Week

34 Current Week

MULN Summary

- Over the last 5 days Mullen Automotive’s stock price has been on the decline.

- Stock market has responded well to a $240 million cash acquisition of bankrupt Electric Last Mile; gaining an active manufacturing plant and assets which could speed up production.

- The company announced that its new CCO will be a former General Motors exec, John Schwegman, along with onboarding former Tesla staff.

- Electric vehicle companies are benefiting from the Inflation Reduction Act through tax credits and other incentives.

- Fiercely competitive and evolving market, MULN is incurring heavy losses, requires ongoing large sums of capital for business plans, and investors have to bet on futures rather than historic performance.

Keep on eye on MULN they may surprise.

The Traders News Trading Group

Mark Roberts

Senior Editor

***The owners and operators of this website have NOT been compensated in any way for conducting or distributing this article/interview. Furthermore, we do not hold any form of equity in the publicly traded company/companies or cryptocurrency mentioned above***

Privacy Policy and Disclaimer

Your Consent

By using our site, you consent to our online privacy policy and disclaimer.

Do we disclose any information to outside parties?

We do not sell your information to anyone.

What information do we collect?

We collect information from you when you subscribe to our newsletter or fill out a form on one of our social platforms. This includes your email address and or mobile phone number.

When registering on our site, as appropriate, you may be asked to enter your: e-mail address and or mobile number.

What do we use your information for?

When we collect your email or mobile number it is used for one purpose to send you the information you requested about small cap stocks. Please read our disclaimer carefully before viewing our emails.

Your information, whether public or private, will not be sold, exchanged, transferred, or given to any other company for any reason whatsoever, other than for the express purpose of delivering the information on small cap stocks that you requested.

We send periodic emails.

The email address you provide may be used to send you information, the small cap stock reports you requested, respond to inquiries, and/or other requests or questions.

How do we protect your information?

We implement a variety of security measures to maintain the safety of your personal information when you enter, submit, your email address. We use secure third parties to send email and sms messages to you.

Because we value your privacy we have taken the necessary precautions to be in compliance with the California Online Privacy Protection Act.

Online Privacy Policy Policy

This online privacy policy applies to information collected through our website and social media platforms.

Contacting Us

If there are any questions regarding this privacy policy or disclaimer you may contact us using the information below.

Editor@TradersNewsSource.com

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

Please Note: TNS LLC and its employees are not a registered investment advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice.

All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement.

TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

TNS LLC is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission or FINRA. TNS LLC is not a Broker/Dealer and does not engage in high frequency trading