Novavax, Inc. (NASDAQ: NVAX) is a late-stage biotechnology company that drives improved health globally through the discovery and development of innovative vaccines to prevent serious respiratory diseases. In keeping with its stated 2018 objectives, Novavax successfully achieved the crucial milestones during the second and third quarter for its lead ResVax™ and NanoFlu™ programs.

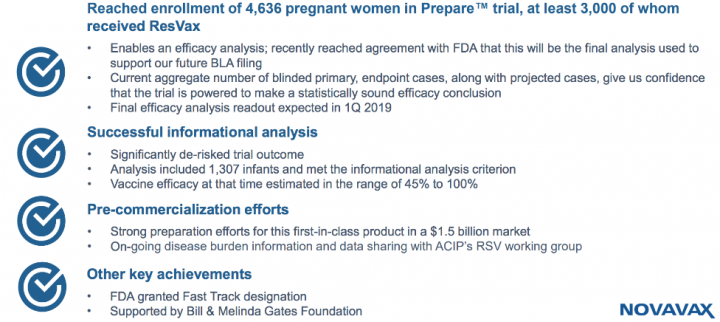

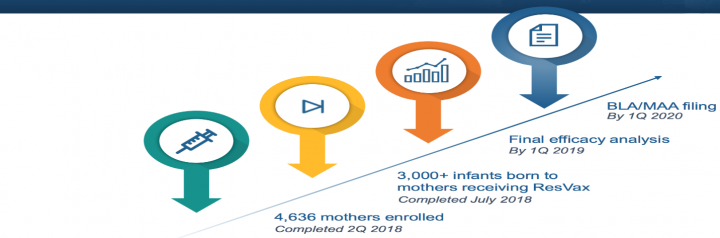

With ResVax, NVAX achieved a critical enrollment goal in the Prepare™ trial, enabling it to reach an agreement with the FDA to initiate a final efficacy analysis in the first quarter of 2019. This analysis will be used to support the future BLA and MAA in the U.S. and Europe, respectively.

Key achievements in ResVax development

Upcoming presentation – The company will share data from its RSV F vaccine program via oral and poster presentations at IDWeek 2018 in the 11th International Respiratory Syncytial Virus Symposium in Asheville, North Carolina, taking place October 31-November 4.

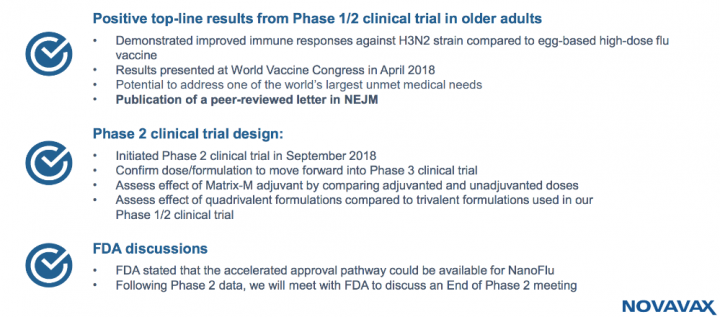

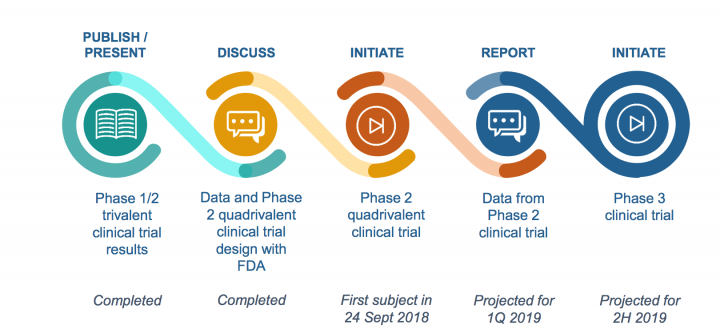

On the NanoFlu front, on Sep 25th, the company announced the initiation of a Phase 2 dose and formulation confirmation clinical trial in older adults of NanoFlu, its nanoparticle seasonal influenza vaccine candidate.

Key achievements in NanoFlu development

Looking ahead to 2019, the company is well poised for rapid growth. Both its RSV and flu programs are conducted in a manner that complies with regulatory agency guidelines in the U.S. and Europe. The company’ products are targeted for worldwide markets (read with NVAX Market Opportunities), its core commercial team is already laying the groundwork before launch with government policymakers, provider, payers, associations, advocates and opinion leaders in advance of regulatory approval.

Our members have booked up to 800% with our recent 2018 NASDAQ and NYSE small cap alerts. We will be initiating coverage on another exciting small cap security mid-week this week (10/14/18). View our recent picks, track record and sign up for our real time mobile/text alerts here

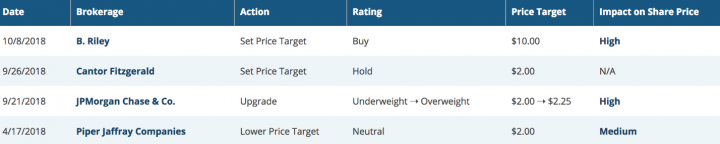

Per www.marketbeat.com, Their average twelve-month price target is $3.6063, suggesting that the stock has a possible upside of 83.06%. The high price target for NVAX is $10.00, and the low-price target for NVAX is $1.35. Considering all this, the company is in an extremely favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains favorable.

Below are the excerpts of recent analyst rating on the script:

source: www.marketbeat.com

Description & about the Company: Novavax, Inc. is a late-stage biotechnology company that drives improved health globally through the discovery and development of innovative vaccines to prevent serious respiratory diseases.

ResVax, its RSV vaccine for infants via maternal immunization, is the only vaccine in Phase 3 clinical program and is poised to help prevent the second leading cause of death in children under one year of age worldwide.

Novavax is also advancing the clinical study of its influenza nanoparticle vaccine, which addresses key factors that lead to poor efficacy by currently approved flu vaccines. Novavax is a leading innovator of recombinant vaccines; its proprietary recombinant technology platform combines the power and speed of genetic engineering to efficiently produce a new class of highly immunogenic particles addressing urgent global health needs.

Pathway to licensure

ResVax:

NanoFlu

NVAX Market Opportunities:

- RSV remains the leading cause of infant hospitalization in the United States, which is exacerbated by the absence of any vaccine to prevent the disease or any widely used treatment other than supportive care once an infant becomes adult.

- In the U.S. alone, there are approximately 4 million infants born every year, for which 70% of which are infected with RSV during their first year of life.

- Based on the large untreated market and the severity of RSV disease, management of the company believes that there is at least a $1.5 billion market for ResVax in higher-income countries and apparently, the market opportunity gets much more significant after considering infants in all geographies.

- The management also expects high uptake of ResVax similar to pediatric vaccine uptake, given the disease burden is high. For pediatric vaccines, compliance, which translates to market penetration, typically reaches in the 90% range.

- ResVax remains on track to be first-in-class, and the company expects this exclusivity to continue for the foreseeable future.

- On the flip side, the market for flu vaccines has long been established and growing. It exceeds $3 billion annually. It is generally characterized by several vaccines that historically, were not differentiated from one another. There has been a push in recent years to develop differentiated vaccines.

- One such vaccine is Fluzone High-Dose. This vaccine has been targeted toward the older-adult population and carries with it a premium price. It has been very successful in capturing the majority of the older-adult market. The Company’ goal is to differentiate its NanoFlu vaccine from Fluzone High-Dose by demonstrating higher and broader-immune responses to a broader range of flu strains.

Anticipated Events:

- Final efficacy results of the Prepare trial are expected in the first quarter of 2019.

- Top-line data from the Phase 2 clinical trial of NanoFlu and End of Phase 2 meeting with the FDA are expected in the first quarter of 2019.

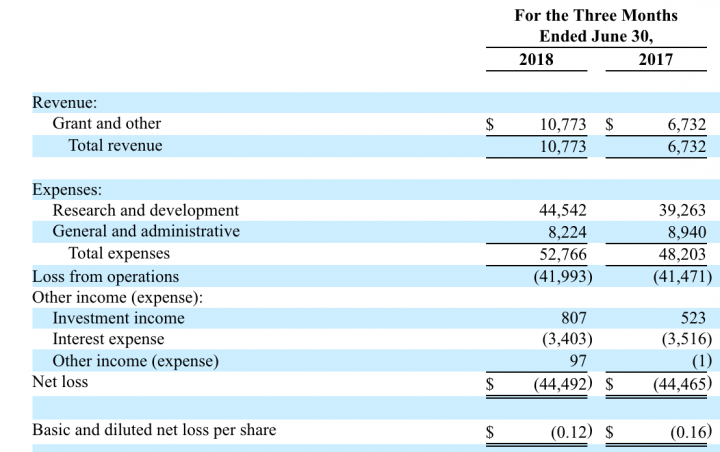

Quarterly Financial Results (in, thousands):

Revenue – Novavax revenue in the second quarter of 2018 was $10.8 million, compared to $6.7 million in the same period in 2017. This 60% increase was driven by higher revenue recorded under the Bill & Melinda Gates Foundation (BMGF) grant of $89 million as a result of increased enrollment in the Prepare trial and increased activities of Novavax AB, a wholly owned subsidiary of Novavax.

Profitability – Novavax reported a net loss of $44.5 million, or $0.12 per share, for the second quarter of 2018, compared to a net loss of $44.5 million, or $0.16per share, for the second quarter of 2017. For the six months ended June 30, 2018, the net loss was $90.8 million, or $0.25 per share, compared to a net loss of $88.3 million, or $0.32 per share, for the same period in 2017.

Liquidity and financial flexibility – As of June 30, 2018, Novavax had $178.2 million in cash, cash equivalents, marketable securities, and restricted cash, compared to $186.4 million as of December 31, 2017. Net cash used in operating activities for the second quarter of 2018 was $40.0 million, compared to $12.4 million for the same period in 2017. The increase in cash usage was primarily due to the receipt of a $25 million payment under the BMGF grant in the six months ended June 30, 2017, whereas no payment was received in the same period of 2018 (however, the company expect to receive a $15 million payment in the third quarter of 2018).

Key risk factors and potential stock drivers:

- Successful completion of the upcoming milestones would lead future direction for the company. Any adversities might adversely impact the overall investor sentiments.

- NVAX has a history of operating losses. Therefore, any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor.

- Notwithstanding the expected improvement in the business and financial risk profile of the company, NAVX is still a loss-making entity. Therefore, the company’s ability to achieve successful commercialization will continue to remain a long-term stock sensitivity factor.

Stock Performance

Comments:

- On Friday, Oct 12th, 2018, NVAX closed at $1.97, with an average volume of 4.1 million shares exchanging hands. Market capitalization is $753.706 million. The current RSI is 62.05

- In the past 52 weeks, shares of NVAX have traded as low as $0.96 and as high as $2.75

- At $1.97, shares of NVAX are trading above its 50-day moving average (MA) at $1.56 and above its 200-day moving average (MA) at $1.71

- The present support and resistance levels for the stock are at $1.86 & $2.04 respectively.

The Traders News Group

See our recent reports and track record