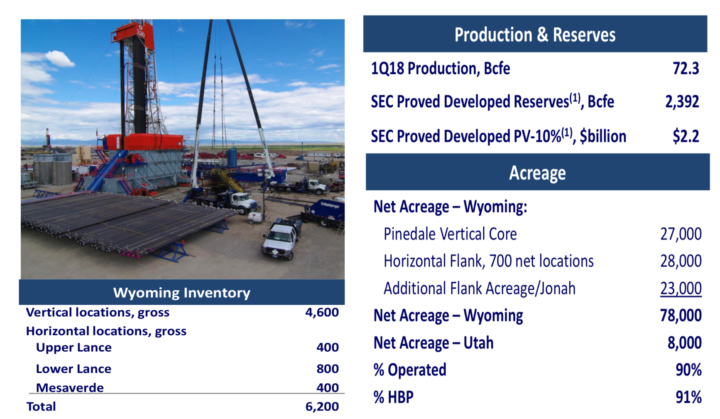

Ultra-Petroleum Corp. (NASDAQ: UPL), is an independent exploration and production company focused on developing its long-life natural gas reserves in the Green River Basin of Wyoming – the Pinedale and Jonah Fields. In addition, Ultra Petroleum currently has an oil development project underway in the Uinta Basin, Three Rivers area in Utah.

On May 10th, the company announced its financial and operating results for the quarter ended March 31, 2018. During the first quarter of 2018, total revenues increased 2% to $225.4 million as compared to $221.0 million during the first quarter of 2017. The Company’s production of natural gas and oil was 72.3 billion cubic feet equivalent (Bcfe), an increase of 13% over the first quarter of 2017, with 68.2 billion cubic feet (Bcf) of natural gas and 677.8 thousand barrels (MBbls) of oil and condensate.

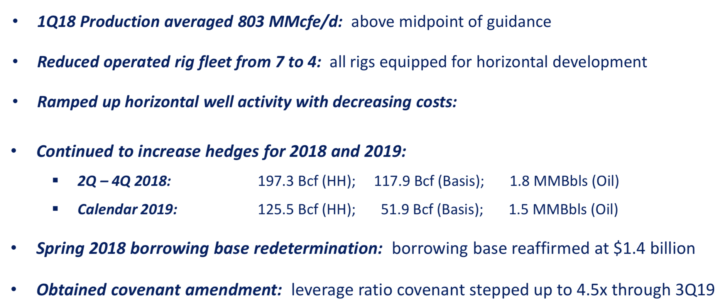

Year to date highlights:

Based on encouraging early results, UPL has significantly ramped up its horizontal well development and now plan to drill 25-30 horizontal wells this year while maintaining its $400 million capital expenditure guidance. Management believes, on average, the horizontal program can provide strong economic returns at, or even materially below, current strip pricing.

Essential economics of Horizontal well:

- Horizontal wells can deliver compelling returns at prices materially lower than current strip

- Laterals with lower net pay counts require fewer completion stages and result in lower costs

- Smaller wells with lower well costs have compelling returns, even at stress pricing

In 2018, the Company is focused on capital efficiency, cash flow visibility and accelerating the horizontal program, while producing free cash flow.

Over the past few quarters, the management is setting a new course for Ultra with emphasis on capital efficiency, discipline growth, visibility to cash flow and the pursuit of higher returns in order to drive long-term shareholder value. UPL is rapidly transitioning and is focused on maximizing the value of one of the largest oil and gas fields in the U.S., the Pinedale Anticline in Western Wyoming.

On the financial front, UPL has significantly improved its cash flow visibility for both 2018 and ’19, with ongoing increases to its hedge book. Furthermore, the company has over $400 million of liquidity, and inside maturity is four years out. The management is confident that based upon its production forecast and increased hedging in ’18 and ’19; the company will have no debt covenant issues.

The market is hugely excited about the successful first quarter in 2018. Moreover, from a forward-looking perspective, the company’ guidance continues to project a decrease in unit cost as the volumes grow with the ramp-up of its horizontal well program. Also, the company plans to drill up to 30 horizontal wells this year. Overall sentiment is favorable about the company’ ability to meet or exceed expectations with respect to both horizontal well performance and cost. Moreover, ultra has also raised production guidance for the year by 5 Bcfe without any increase to CapEx.

About the company: Ultra Petroleum Corp. is an independent energy company engaged in domestic natural gas and oil exploration, development and production. The Company is listed on NASDAQ and trades under the ticker symbol “UPL.”

Company snapshot:

The 2017 Year End Financial Highlights:

During the first quarter of 2018, total revenues increased 2% to $225.4 million as compared to $221.0 million during the first quarter of 2017. The Company’s production of natural gas and oil was 72.3 billion cubic feet equivalent (Bcfe), an increase of 13% over the first quarter of 2017, with 68.2 billion cubic feet (Bcf) of natural gas and 677.8 thousand barrels (MBbls) of oil and condensate.

Ultra-Petroleum’s reported net income was $47.5 million, or $0.24 per diluted share. Ultra-reported adjusted net income (2) of $55.3 million, or $0.28 per diluted share for the quarter ended March 31, 2018.

Forward-looking statements:

In 2018, the Company is focused on capital efficiency, cash flow visibility and accelerating the horizontal program, while producing free cash flow.

Production: Ultra is increasing its 2018 annual production guidance to 285-295 Bcfe. In the second quarter, the average daily production rate is expected to range between 780-800 MMcfe/d and includes the production of 1.1 Bcfe from the Utah assets. With less capital allocated to vertical drilling than originally planned, second quarter volumes are forecasted to decline slightly, with production from horizontal wells providing growth later in the year.

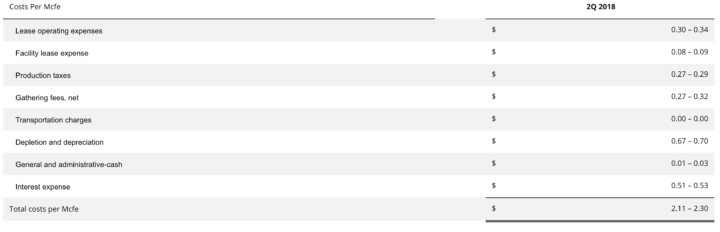

Expenses: The following table presents the Company’s expected per unit of production expenses for the second quarter of 2018. Production tax guidance assumes a $2.75 per MMBtu Henry Hub natural gas price and a $68.00 per Bbl NYMEX crude oil price:

Key risk factors and potential stock drivers:

- The company’ business risk profile is exposed to significant industry and regulatory risk. The oil and natural gas industry are affected by many factors. Government regulations, particularly in the areas of taxation, energy, climate change and the environment, can have a significant impact on operations and profitability.

- Global energy prices have been under pressure since their mid-2014 highs. Crude oil, saw its price plummet from $99 per barrel (dated Brent) in 2014 to just $34 per barrel in January 2016. Crude oil prices are expected to move upward but remain at sub-$70/bbl in fiscal 2019, and their medium-term price outlook remains stable. Going forward, the focus will continue to be on oil and natural gas prices.

- The company’ operational risk profile is significantly dependent on prices and export of natural gas if natural gas prices outperform over the next few quarters. This will substantially benefit Ultra and its investors.

- The company has had faced financial issues and restructuring in the past. The overall leverage was uncomfortably high, leaving the company’ financial flexibility vulnerable to a downturn in oil/gas prices. Therefore, with revenue growth estimated over the medium term, the incremental capital requirements will be high and controlled management of these requirements will remain critical.

- The company’s operational and market risk profile is exposed to risk related to competitive forces. The oil and natural gas industry are intensely competitive, and UPL competes with numerous other oil and natural gas exploration and production companies. Some of these companies have substantially greater operational and financial resources than UPL.

Stock Chart:

Comments:

- On Tuesday, June 12, 2018, UPL was at $2.00, on volume of 1M shares exchanging hands. Market capitalization is $374 million. The current RSI is at 46.42

- In the past 52 weeks, shares of UPL have traded as low as $1.64 and as high as $12.39

- At $2.00, shares of UPL are trading below its 50-day moving average (MA) at $2.58 and below its 200-day moving average (MA) at $6.23