Zynga Inc. (NASDAQ: ZNGA) is a leading developer of the world’s most popular social games that are played by more than 100 million monthly consumers. The Company has created evergreen franchises such as FarmVille, Zynga Casino and Words With Friends. The company is headquartered in San Francisco, Calif., and has additional offices in the U.S., Canada, Finland, U.K., Ireland and India.

During February 2017, Zynga purchased Solitaire mobile game applications from Harpan LLC for approximately $42.5 million in cash. Harpan primarily runs one flagship game, “Solitaire”, which accounts for most its userbase. It is available on both iOS and Android.

Solitaire is already feature among the top-10 card games in the App Store and in the top-20 of the overall games category. The app also commands a place in the top-100 games on the Android download charts. Zynga’s management claims that over a billion people have played its games since 2007. Adding Harpan’s 150 million might further strengthen its business risk profile.

So far as economic synergies are concerned, the game currently displays only banner advertising, and Zynga’s management is sanguine about further monetizing the product by inserting in-game adverts. Therefore, the deal has strengthened Zynga’s leadership spread and could lead to great potential to generate significant future advertising revenue.

Moreover, the recent acquisitions are expected to strengthen the business and financial risk profile of the company and this is expected to drive the stock price as well. Additionally, Zynga has ample downside protection with a relatively reasonable market cap of $2.4 billion and substantial cash and valuable real estate in its books.

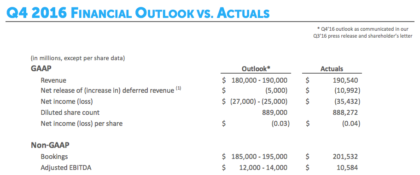

As per the last earnings announcement, the company reported GAAP Revenue of $190.5 million; above the high end of the guidance range, up 3% Y/Y and up 4% Q/Q. The Net Loss was $35.4 million, which is below management guidance range but an improvement of $15.8 million or 31% Y/Y, and $6.3 million or 15% Q/Q.

About the Company: Founded in 2007, Zynga’s mission has been to connect the world through games. To-date, more than 1 billion people have played Zynga’s games across Web and mobile, including FarmVille, Zynga Poker, Words With Friends, Hit it Rich! Slots and CSR Racing.

Major revenue sources: The Company has the following product profile and its contribution to overall topline.

Key highlights of 2016 and key revenue drivers for 2017:

During 2016, ZNGA launched several new games on mobile and web, including Willy Wonka and the Chocolate Factory Slots, Wizard of Oz: Magic Match, CSR Racing 2, FarmVille: Tropic Escape and Dawn of Titans.

During February 2017, Zynga purchased Solitaire mobile game applications from Harpan LLC. The game currently displays only banner advertising, and Zynga’s management is optimistic about further monetizing the product by inserting in-game adverts. Therefore, the deal has strengthened Zynga’s leadership spread and could lead to great potential to generate significant future advertising revenue.

Dawn of Titans and CSR come to the company through the NaturalMotion acquisition. As per management, the Bugatti Chiron launch for CSRS was the top grossing racing game in 37 countries in App store. This is expected to drive revenue during 2017.

The company continues to strengthen its product profile by adding new features and content introduction. In fact, some of the company’s longstanding winners continued to ride on a rapid growth path. Particularly, Words With Friends and Zynga Poker increased bookings by 32% and 20%, respectively. In Q4 Zynga Poker mobile bookings were up 44% Y/Y and ongoing franchises like these, lead to lesser R&D and higher yields over the medium to longer term.

During 2016, Zynga focused on its strategy of growing its existing portfolio of games. i.e. the ones which already have a strong brand recall and have potential to engage players for years as enduring entertainment brands.

Risk Factors & Stock Influences:

- The company had many new games launches in the recent past along with acquisitions as well. The performance of this portfolio expansion would remain a key business driver and potential stock trigger for the company

- Despite having a wide product portfolio, the company’s market share is significantly dependent on its flagship products, and if its top games do not maintain their popularity, results of operations could be harmed.

- The company faces significant competition in all aspects of its business. Therefore, in this competitive landscape, the company’s ability to sustain revenue growth while improving profitability will remain a challenge.

- The company operates in a rapidly changing fast paced industry. Therefore, it must continue to launch, innovate and enhance successful games that players like, and attract and retain a significant number of players to grow revenue and sustain competitive position.

Earnings Review:

Total revenue decreased $23.3 million in 2016 as compared to 2015 due to a decrease in online game revenue, offset by an increase in advertising and other revenue. Bookings increased $54.6 million in 2016 due to increases in both online game and advertising and other bookings resulting from new game launches in 2016.

Profitability:

Adjusted EBITDA, which includes the impact of changes in deferred revenue, was $48.8 million, down $33.0 million or 40% Y/Y with strong operational performance in 2016 more than offset by the swing in deferred revenue Y/Y.

Cash Flow & Balance Sheet:

As of December 31, 2016, ZNGA had cash and cash equivalents of $852.5 million, which consisted of cash, money market funds, corporate debt securities and U.S. government and government agency debt securities. In 2016, the company made capital expenditures of $10.3 million, which included hardware and software to support business operations.

Operating cash flow was $60.0 million, a $104.5 million increase compared to 2015 and the company’s best performance since 2012.

Total current assets were $965.5 million vs. $1.12 billion for the end of 2015. Total liabilities however remain about the same at $325 million

Stock Performance

On Thursday, April 27th, 2017, ZNGA shares increased by 0.71% to $2.84 on an average volume of 7.55 million shares exchanging hands. Market capitalization is $2.43 billion. The current RSI is 56.15

In the past 52 weeks, shares of ZNGA have traded as low as $2.27 and as high as $3.08

At $2.84, shares of ZNGA are trading above their 50-day moving average (MA) at $2.78 and above their 200-day MA at $2.77.

The present support and resistance levels for the stock are at $2.79 & $2.87 respectively.

Analysts expect stability in earnings during current year and believe that better results should drive better return on equity (RoE) and stock price over the near to medium term. With that in mind, a majority of the brokerage firms have retained an outperform rating with a target price up to $4.25/share from its present levels of $2.84/share.

Zynga is scheduled to discuss First Quarter 2017 Financial Results on May 4, 2017. Earnings are expected to hold steady in coming quarters and the company is expected to post revenue of around $197 Million in the current quarter. As per analyst’s expectations, the high and low revenue estimates for the current quarter are $201.7 Million and $184.9 Million, respectively. Zynga reported revenue of $191.21 Million in the same period last year.

About Traders News Source:

Traders News Source recent profiles and track record, 534% in verifiable potential gains for our members on 3 small cap alerts alone!

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

February 6th, 2017- (NASDAQ: SCON) opened at $1.12/share hit a high of $1.80/share within 10 days our member potential gains- 60% – http://finance.yahoo.com/news/superconductor-technologies-potential-revolutionize-smart-130000844.html

March 6th, 2017 (OTC: USRM) opened at .035/share and hit over .17/share within 25 days for gains of 385% for our members- http://finance.yahoo.com/news/traders-news-issues-comprehensive-report-130000743.html

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Limited Time Offer VIP Mobile Alerts

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Traders News Source Mission Statement

We strive to highlight the future potential as well as the inherent risk in each small cap company we cover while remaining neutral as a leading third-party equity research firm.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.