Company Overview

Sirius XM Holdings Inc. (NASDAQ: SIRI) is a satellite radio company with approximately 31.6 million subscribers. The company transmits music, sports, entertainment, comedy, talk, news, traffic, and weather channels in the United States using a subscription model. Although customers primarily use satellite radios installed in automobiles, subscribers may access content using mobile devices, home devices, and other consumer electronic equipment. Sirius also provides a variety of safety and security services for satellite-connected vehicles.

In addition to its U.S. operations, the company holds an approximate 37 percent equity interest and a 25 percent voting interest in Sirius XM Canada Holdings, which offers satellite radio services in Canada. As of March 31, 2017, Liberty Media Corporation owned approximately 68 percent of the outstanding shares of Sirius.

Products and Services

Sirius has agreements with every major automaker for installation of satellite radios in their vehicles. The company also has a variety of marketing partnerships with rental car agencies (which carry satellite-enabled vehicles), airlines (for in-flight entertainment), and companies that provide commercial-free music for businesses.

The company’s primary source of revenue is subscription fees, with most customers subscribing to annual, semi-annual, quarterly, or monthly plans. Sirius also derives revenue from activation and other fees, the sale of advertising on select non-music channels, direct sale of satellite radios and accessories, and various ancillary services.

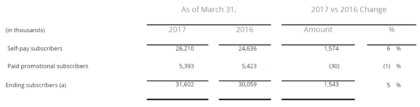

As of March 31, 2017, the company reported a subscriber base of 31.6 million, which is further detailed in the table below:

Self-pay subscribers are generally defined as subscribers who are paying for their own subscription on a regular basis.

Paid promotional subscribers generally consist of customers on a prepaid subscription included in the sale or lease of a new or previously owned vehicle. Paid promotional subscriptions typically run between three and 12 months.

Recent Developments

- On May 2, 2017, Sirius announced it would offer the first-ever Beatles-backed radio channel, which will feature a variety of programming related to the band’s music and history. The Beatles Channel was created in collaboration Apple Corps Ltd., which manages The Beatles’ intellectual property. The channel will launch on May 18, 2017.

- On April 27, 2017, the company announced that it had acquired Automatic Labs Inc. Automatic’s primary offering is an adapter for passenger vehicles that relays data to the user’s smartphone. The adapter plugs into the car’s standard diagnostics (OBD-II) port, and is compatible with most vehicles manufactured after 1996. Mobile applications allow the users to track a variety of metrics including engine efficiency and fuel consumption. On the most recent earnings call, Sirius CEO James Meyer noted that Automatic’s analytics platform could be leveraged into a very successful asset, but ultimately would not have a material impact (positive or negative) on the company’s full-year guidance for 2017.

- In May 2016, the company announced it would increase its ownership of Sirius XM Canada to a 70 percent equity interest and a 33 percent voting interest in exchange for 35 million shares of Sirius. The transaction is expected to be completed this month.

First Quarter Earnings Review

Revenue for the first quarter ended March 31, 2017, totaled $1.3 billion, climbing eight percent from the same period a year earlier, helped by a net increase in self-pay subscribers of 259,000 in the quarter. Operating expenses increased six percent to $900 million. First quarter net income was $207 million, 20 percent higher than the first quarter a year ago, yielding a profit of $0.04 per share.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), which primarily removes the effect of share-based compensation and purchase price accounting from the original merger of Sirius and XM, was a record-high $502 million in the first quarter of 2017. The company’s EBITDA margin increased 200 basis points from the first quarter of 2016 to 38.7 percent.

The company’s free cash flow (cash from operations less capital expenditures) decreased 15 percent from the first quarter of 2016 to $249 million, primarily due to the timing shift of certain interest payments and payments for satellites. At March 31, 2017, Sirius had a cash balance of $230 million and a net working capital deficit of $1.9 billion, mainly attributable to a large current deferred revenue balance. Long-term debt totaled approximately $6.0 billion.

In the first quarter of 2017, Sirius spent $300 million to repurchase 62 million shares of common stock and paid a dividend of $0.01 per share.

Full-Year Earnings Guidance

Sirius issued the following guidance for the 2017 fiscal year in January:

- Revenue of $5.3 billion;

- Adjusted EBITDA of $2.025 billion;

- Free cash flow of $1.5 billion; and

- Net self-pay subscriber growth of 1.3 million.

On the first quarter earnings call, Sirius executives confirmed the previous guidance and remained confident in their ability to hit those targets, despite first quarter figures for subscriber growth and free cash flow slightly below that pace. It will be important to monitor these figures in the second quarter and beyond.

Auto sales, an important revenue driver for the company, are expected to remain stable. Weaker trends throughout the year could have an impact on subscriber growth, and lead the company to review its guidance. Other figures to watch in the coming quarters include paid promotional subscriber conversion rates (to self-pay subscribers), subscriber deactivations, and subscriber acquisition costs.

Outlook

Overall, Sirius has solid fundamentals, including strong EBITDA and margins. Furthermore, the company is returning cash to shareholders through repurchases and dividends. However, Barclays analyst Kannan Venkateshwar notes that free cash flow has been helped in recent years by past net operating losses (NOLs) which have reduced taxes payable. As these NOLs expire in the next two years, free cash flow growth could drop off considerably. Sirius already commands a premium growth multiple, and it is possible that it could contract as the company enters a later stage in its growth cycle.

Still, the acquisition of Automatic Labs suggests that the company is looking to expand beyond its current markets. If Sirius can make significant strides in the connected vehicle space, the company could return to a high-growth track.

Stock Influences

- Subscriber turnover and conversion metrics;

- Changes in the seasonally adjusted annual rate (SAAR) for vehicles;

- M&A in the connected vehicle space; and

- Agreements with marketing and hardware partners.

Risk Factors

- The company faces substantial competition from online streaming services;

- The company’s ability to attract and retain customers is uncertain;

- The company is highly dependent on the auto industry; and

- The company is effectively controlled by Liberty Media, whose interests may differ from those of other common shareholders.

Stock Performance

As of May 2, 2017, shares of Sirius closed at $4.84, down nearly 2.5 percent on the day, yielding a market capitalization of $22.6 billion. In the past year, the stock is up more than 22 percent after trading as low as $3.74 in June 2016. Shares have traded as high as $5.53 as recently as mid-March, but have since retreated. Short interest has generally increased over the past 12 months, and sat at 266 million shares at April 13, 2017, or approximately 13.7 days of trading volume.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Kannan Venkateshwar | Barclays | Equal Weight | $4.50 | April 28, 2017 |

| Bryan Kraft | Deutsche Bank | Hold | $5.00 | April 27, 2017 |

| Stan Meyers | Piper Jaffray | Overweight | $5.25 | April 27, 2017 |

Summary

Sirius has strong fundamentals and will likely continue to grow EBITDA. However, it appears that much of this growth is already priced in. Although the company may make significant gains in the connected vehicle space in the future, there is no clear indication of when this will happen. Accordingly, the midpoint price target of $5.00 seems most appropriate.

Welcome to Traders News Source Small Cap Research (see our track record below)

Expect 3-4 small cap profiles per month consisting of two emails per week. We do not spam or send emails daily, we understand that is annoying! Our reports are only sent when we see an actionable situation and potential for near term gains.

About Traders News Source:

Traders News Source recent profiles and track record, 534% in verifiable potential gains for our members on 3 small cap alerts alone!

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

February 6th, 2017- (NASDAQ: SCON) opened at $1.12/share hit a high of $1.80/share within 10 days our member potential gains- 60% – http://finance.yahoo.com/news/superconductor-technologies-potential-revolutionize-smart-130000844.html

March 6th, 2017 (OTC: USRM) opened at .035/share and hit over .17/share within 25 days for gains of 385% for our members- http://finance.yahoo.com/news/traders-news-issues-comprehensive-report-130000743.html

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Limited Time Offer VIP Mobile Alerts

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer and Privacy Policy

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.