| Good morning and welcome to all of our new members,

We alerted you to a our new bounce play (NASDAQ: EVFM) this morning and we saw an opening price of .34/share, now sitting at .39/share up over 14% and moving.

This stock is so oversold I would not be surprised to see good double digit gains today. We are planning and updated report for Sunday and a full report early next week. If you have not already, take the time to look at the report below and check out the just released investor presentation.

The Team

This mornings report below

_____________________

Evofem Biosciences (EVFM) Oversold, Small Float, FDA Approved Product with Revenues and Another in Phase III Trials

Oversold, Residual Strength Index (RSI 14) is Sitting at 14.07

Good morning everyone,

Evofem Biosciences, Inc. (NASDAQ: EVFM) is developing products to address unmet needs in women’s sexual and reproductive health.

Current price $.3466/share (as of market close 6-1-22)

EVFM looks like a hidden jewel, and I expect a fast and hard swing could be right around the corner.

EVFM is a rapidly growing biopharma company and sales of its lead product Phexxi® have been growing by triple digits QoQ with Q122 revenues reaching $4.3M. FDA-approved, Phexxi® (lactic acid, citric acid, and potassium bitartrate), is a hormone-free, on-demand prescription contraceptive vaginal gel. It comes in a box of twelve pre-filled applicators and is applied 0-60 minutes before each act of sex.

There is a lot happening at EVFM that may result in 2022 being their breakout year. Contraception for women is a huge market and EVFM has an effective hormone free product. A recent cash raise has created a rare value opportunity and l we are looking to exploit that.

EVFM shares took a hit on May 19, 2022 (see chart below) as the company announced its intent to sell common shares, warrants for common shares, and pre-funded warrants for common shares. You can read the details of the public offering here. As often happens, the company value fell in response to the announced dilution.

In a just released company presentation, filled with valuable information about EVFM and Phexxi, the company states their post cash raise outstanding share count (as of May 25) is at 42.2M. My estimate is that EVFM receives $18.8M in net proceeds from the offering so there should not be any additional dilution near-term.

Let’s put the current numbers in perspective (subject to further verification by the company). EVFM would have a current market cap of $14.6M and a cash position of $18-20M. On a pro-forma basis, given that Phexxi sales were $4.3M in Q1, and assuming they will stay at that level or more likely gain, FYE22 revenues could be $17-20M (the company has guided a higher revenue level for FYE22).

Those numbers result in a cash position of $.45/share and a price to sales ratio of .75X, both favorable investment statistics. EVFM CEO Saundra Pelletier just bought (last week) 141,000 shares at market, more than doubling her stake in the company. Maybe she knows those numbers are too hard to resist.

Look at the recent QoQ revenue growth:

Q121 $1.1M

Q221 $1.8M

Q321 $1.7M

Q421 $3.5M

Q122 $4.3M

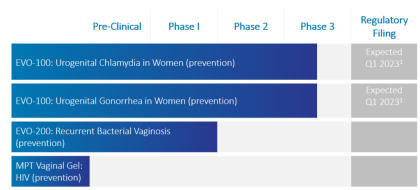

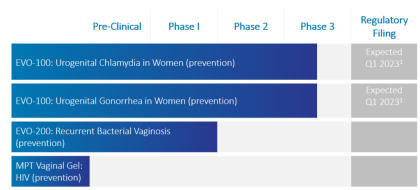

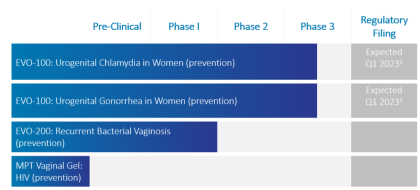

Phexxi (EVO100) is also in development for two potential new indications, chlamydia, and gonorrhea in women. In March 2022, EVFM completed enrollment in EVOGUARD, the confirmatory Phase 3 clinical trial to evaluate the safety and efficacy of Phexxi, with a supplemental NDA (sNDA) filing expected in 1H23.

Top-line results from the Phase III trial are expected in the second half of 2022. EVO100 (Phexxi) has been granted Fast Track Designation for the prevention of chlamydia in women and the prevention of gonorrhea in women and is designated a Qualified Infectious Disease Product for both indications by the FDA.

In news the company released Thursday, the FDA has formally extended the shelf life of Phexxi® from three to four years. “As we continue our long-term strategy to reduce operating expenses, this shelf-life extension provides a significant and valuable operational efficiency”, said CEO Saundra Pelletier.

In December 2021, the Health Resources & Services Administration, part of the U.S. Department HHS, updated guidelines regarding patient access to contraceptive products, essentially mandating payer coverage for all FDA-approved pregnancy prevention contraceptives, including Phexxi, at zero copay under the Affordable Care Act.

This HHS mandate is a huge benefit to contraceptive manufacturers.

On May 10th, EVFM announced it selected Bora Pharmaceuticals Services Inc. Canada as Evofem’s new contract manufacturing organization. Bora will eventually manufacture Phexxi® for markets worldwide. Bora is expected to begin manufacturing Phexxi in the fourth quarter of 2022.

“Evofem expects to realize a 45 percent reduction in the cost of goods related to the manufacturing, packaging, and testing of Phexxi as part of the company’s overall efforts to reduce spend and continue to improve gross margin,” said Saundra Pelletier, CEO.

EVFM statistics:

FYE is December 31.

Outstanding shares 42.2M

Shares in float (YF) 12.6M

Revenues (ttm) $11.3M

Revenues (Q122) $4.3M

EVFM has too much going for it to remain at its current levels. Looking for a near term swing.

We have a lot more coming on EVFM over the next couple trading days.

The Traders News Group |