Tetraphase Pharmaceuticals, Inc. (NASDAQ: TTPH) is a biopharmaceutical company using its proprietary chemistry technology to create novel antibiotics for serious and life-threatening bacterial infections, including those caused by many of the MDR bacteria highlighted as urgent public health threats by the Centers for Disease Control and Prevention.

2018 is off to an excellent start at TTPH. The company reported positive data on eravacycline and has entered into an exclusive licensing agreement with Everest Medicines Limited to develop and commercialize eravacycline in mainland China and other Asian territories, advancing its goal to deliver new treatment options for serious, often life-threatening infections, to patients on a global level. The management is excited to move forward with commercial preparations to bring eravacycline to market as a treatment for cIAI in the second half of 2018, pending U.S. regulatory approval following their PDUFA date of August 28.

Key near term milestones for 2018

- Potential approval of eravacycline in cIAI in the U.S. – Q3 2018

- Potential approval of eravacycline in cIAI in Europe – 2H 2018

- The potential commercial launch of eravacycline in cIAI in the U.S. – Q4 2018

- Complete phase 1 multiple ascending dose studies for TP-271 and TP-6076 – 2H 2018

Recent announcements:

Data from pooled analysis of IGNITE1 and IGNITE4 studies of eravacycline & TP-6076: On June 11th, the Company reported positive data on eravacycline, which is currently under review by the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for the treatment of complicated intra-abdominal infections (cIAI), as well as data for TP-6076, its second-generation candidate targeting MDR Gram-negative bacteria, which is currently in phase 1 clinical testing. These data were presented at the American Society for Microbiology (ASM) Microbe 2018 in Atlanta, GA.

For patients with cIAI caused by Enterobacteriaceae, the overall favorable clinical and microbiological response rates among pooled eravacycline-treated subjects were 88.2% and 86.3%, respectively. Notably, in patients with infections due to ESBL-producing Enterobacteriaceae, eravacycline demonstrated a favorable microbiologic response rate of 88.9%. For patients with cIAI caused by A. baumannii, of which most strains were MDR, the overall favorable clinical and microbiological response rate among pooled eravacycline-treated subjects was 100%. Also, for TP-6076, data demonstrated that it retained potency against several emergent resistance types and support the company’ belief that it is a promising candidate for the treatment of MDR Gram-negative pathogens.

Submission of Investigational New Drug (IND) application to China’sFood and Drug Administration (CFDA): On June 4th, the company announced that Everest Medicines Limited (“Everest”), a C-Bridge Capital-backed biopharmaceutical company based in China which has the exclusive license to develop and commercialize eravacycline in China, Taiwan, Hong Kong, Macau, South Korea and Singapore (the “Territories”), has submitted an Investigational New Drug (IND) application to China’sFood and Drug Administration (CFDA) for a phase 3 clinical trial of eravacycline in complicated intra-abdominal infections (cIAI).

Everest’s IND submission to the CFDA ahead of schedule marks an important milestone in our strategy to make eravacycline available as a new antibiotic treatment option for serious, MDR infections,” said Guy Macdonald, President, and CEO of Tetraphase. We are delighted with Everest’s rapid progress, which speaks to its development expertise and our highly collaborative working relationship, and we look forward to providing future updates as the process continues.

As a result of the IND submission, Tetraphase will receive a milestone payment of $2.5 million. Under the terms of the agreement, Tetraphase may receive future clinical and regulatory milestones of up to $14 million as well as sales milestones of up to $20 million. Tetraphase is also eligible to receive double-digit tiered royalties on net sales of eravacycline in the Territories. Everest is solely responsible for the development and commercialization of eravacycline in the Territories.

As per management, this remains an exciting time for Tetraphase and the potential of eravacycline in cIAI, with a New Drug Application under review by the U.S. Food and Drug Administration and a Marketing Authorization Application under review by the European Medicines Agency. Now, with Everest’s IND submitted, they are one step closer to bringing eravacycline to patients in need on a global level.

On the liquidity front, As of March 31, 2018, Tetraphase had cash and cash equivalents of $117.7 million and 51.6 million shares outstanding. The Company expects that its cash and cash equivalents, as well as expected revenue from its U.S. government awards, will be sufficient to fund operations through the first half of 2019. According to the company, it believes that it has enough financial flexibility to sustain operations until Q2 of 2019.

Notwithstanding, Company’ announcement of failure in a different indication, TTHP’ scrip continues to be on the rapid growth trajectory, supported by expected catalysts and comfortable liquidity position. The company is positive about getting its first FDA approval, eravacycline for cIAI, by August 28, 2018.

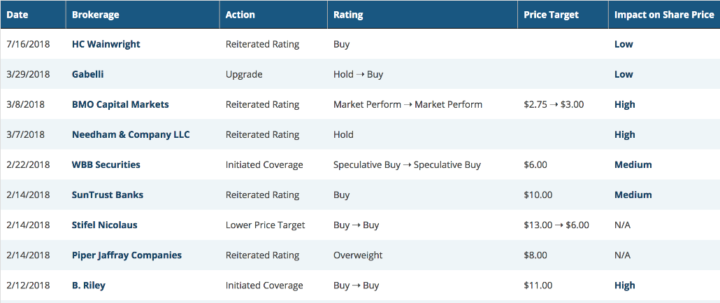

The market believes that the Disappointing clinical data doesn’t adversely impact the other promising opportunities for the company and in fact, the current subdued price creates a favorable buying opportunity to the investors as well as momentum players trading the stock. Several brokerage firms have initiated coverage on the company, and the stock currently has a consensus rating of “Buy” and a consensus price target of $7.14.

Below are the details of most recent ratings from brokerage:

source: www.marketbeat.com

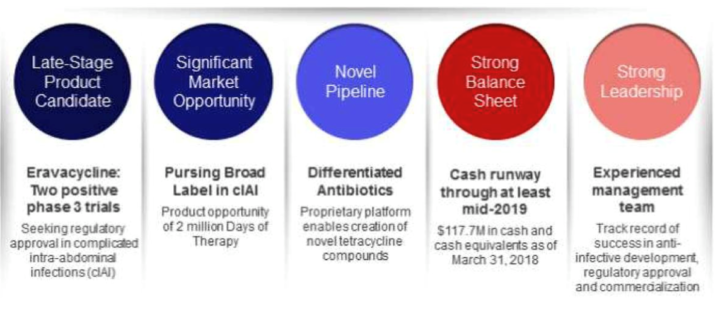

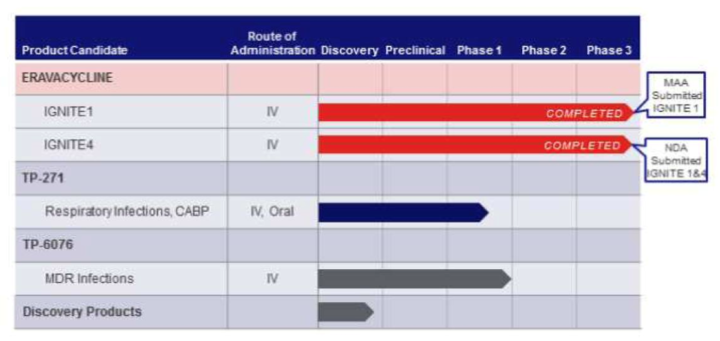

About the company: Tetraphase is a biopharmaceutical company using its proprietary chemistry technology to create novel antibiotics for serious and life-threatening bacterial infections, including those caused by many of the MDR bacteria highlighted as urgent public health threats by the CDC. The Company has created more than 3,000 novel tetracycline compounds using its proprietary technology platform. Tetraphase’s pipeline includes three antibiotic clinical candidates: eravacycline, which has completed phase 3 clinical trials and is under review for potential approval in complicated intra-abdominal infections by the FDA and the EMA, and TP-271 and TP-6076, which are in phase 1 clinical trials.

About Eravacycline: Eravacycline is a novel, fully-synthetic fluorocycline antibiotic being developed for the treatment of cIAI and other serious infections, including those caused by MDR pathogens that have been highlighted as urgent public health threats by both the World Health Organization and the CDC.

Unique differentiating factors of the company:

Pipeline and milestones:

First Quarter 2018 Results (In thousands):

Revenues: Revenues during the first quarter of 2018 were $1.9 million compared to $1.5 million for the same period in 2017. Revenues for each period consisted of contract and grant revenue under the Company’s U.S. government awards for the development of Tetraphase compounds for the treatment of diseases caused by bacterial biothreat pathogens and for certain infections caused by life-threatening multidrug-resistant bacteria. The increase was primarily due to the initiation of the CARB-X grant in the second half of 2017.

R&D Expenses: Research and development (R&D) expenses for the first quarter of 2018 were $18.1 million compared to $25.9 million for the same period in 2017. The decrease in R&D expenses was primarily due to the completion of our IGNITE phase 3 clinical studies for eravacycline.

Profitability: For the first quarter of 2018, Tetraphase reported a net loss of $21.6 million, or ($0.42) per share, compared to a net loss of $29.5 million, or ($0.79) per share, for the same period in 2017.

Liquidity and financial flexibility: As of March 31, 2018, Tetraphase had cash and cash equivalents of $117.7 million and 51.6 million shares outstanding. The Company expects that its cash and cash equivalents, as well as expected revenue from its U.S. government awards, will be sufficient to fund operations through the first half of 2019.

Key risk factors and potential stock drivers:

If one or more of their current drug candidates receive regulatory approval or gets commercialized, it would be a significant catalyst;

TTPH is a clinical-stage company and expects to incur substantial operating losses during the next stages of corporate development.

The biotech space is a high-risk sector due to uncertainties associated with the novel drug development. Any adversities related with the same could upset the stock performance significantly.

Stock Chart:

Comments:

- On Friday, July 20th, 2018, TTPH closed at $3.04, on an average volume of 657,644 shares exchanging hands. Market capitalization is $156.955 million. The current RSI is steady at 29.84

- In the past 52 weeks, shares of TTPH have traded as low as $2.05 and as high as $8.75

- At $3.04, shares of TTPH are trading below its 50-day moving average (MA) at $3.73 and below its 200-day moving average (MA) at $4.66

- The present support and resistance levels for the stock are at $2.95 & $3.12 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.