United Natural Foods, Inc. (NASDAQ: UNFI) is North America’s premier food wholesaler delivering the widest variety of products to customer locations throughout North America including natural product superstores, independent retailers, conventional supermarket chains, e-commerce retailers, and foodservice customers. By providing this deeper ‘full-store’ selection and compelling brands for every aisle, UNFI is uniquely positioned to deliver great food, more choices, and fresh thinking to customers everywhere. Combined with SUPERVALU, UNFI is the largest publicly-traded grocery distributor in America with expected annual sales of over $21 billion.

The company closed on the previously announced purchase of SUPERVALU which will accelerate UNFI’s transformation of food distribution throughout North America. As per management, this acquisition was and is all about the creation of value. UNFI is transforming the way in which food is supplied throughout North America through synergy, scale, services, products, and people, providing better food for a better future. The integration of the two companies is well underway, and the company is excited about the long-term creation of value, which they expect to deliver with this combination.

Key accomplishments of first quarter fiscal 2019

- Completed the acquisition of SUPERVALU

- Grew legacy UNFI sales by nearly 8%

- Integration work proceeding as planned

- Affirming cost synergy outlook of more than $185M in year 4.

On Dec. 06, 2018, the Company reported business progress and financial results for the first quarter of fiscal 2019 ended October 27, 2018.

_____________________________________________________________________

Our members have booked up to 800% with our recent well timed (2018) NASDAQ and NYSE small cap reports. We will be initiating coverage on another exciting small cap security within the next ten days (December 11th-20th, 2018). Stop missing out on stocks that run, receive our reports in real time on your cell phone, text the word “Traders” to “25827”

View our recent picks, track record, long term biotech picks and sign up for our real time, low float and breakout mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

_____________________________________________________________________

The results for the current quarter was lower than the company’ expectations, and UNFI also faced multiple headwinds, including:

- The macroeconomic environment of retail continues to be challenging, more and more retailers competing for their share of the consumers’ dollar.

- SUPERVALU’s performance where trends have weakened, causing us to reset near-term expectations.

- Like many distribution companies, United Natural continued to be challenged with higher labor costs and productivity issues related to serving this busy holiday season and the addition of temporary labor where needed.

- Continued supplier out of stocks, which were approximately 80 basis points higher than the first quarter of last year.

Notwithstanding the near-term, industry headwinds which impinged the company’s results, the company’s overall fundamentals continue to remain robust, and the management believes that the company will overcome the near-term sales headwinds. In fact, UNFI has plans in place to mitigate the operating challenges both in short and in the long-term, and it is rapidly progressing in the vision of transforming the North American food supply chain for retail.

UNFI is expected to serve its shareholders over the long-term by becoming the premier wholesaler of products and services throughout North America. This thesis has not changed. As UNFI have begun to integrate, the outlook for the combination is stronger than ever. Analyst tracking the stock is extremely excited about the fact that the combination of UNFI and SUPERVALU will translate into more significant value for shareholders than UNFI as a standalone company over time.

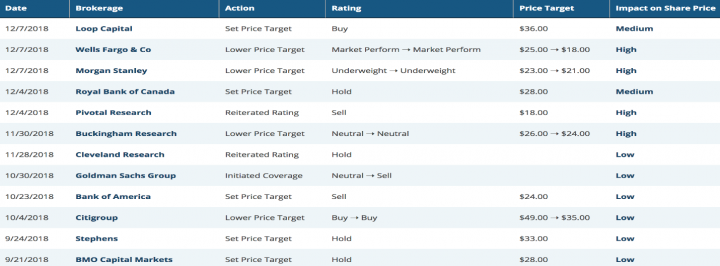

Analyst ratings and target price:

Per www.marketbeat.com, Their average twelve-month price target is $32.69, suggesting that the stock has a possible upside of 119.69%. The high price target for UNFI is $53.00, and the low-price target for UNFI is $18.00. There are currently four sell ratings, 11 hold ratings and 3 buy ratings for the stock, resulting in a consensus rating of “Hold.”

Below are the excerpts of recent analyst rating/Price targets on the company:

Source: www.marketbeat.com

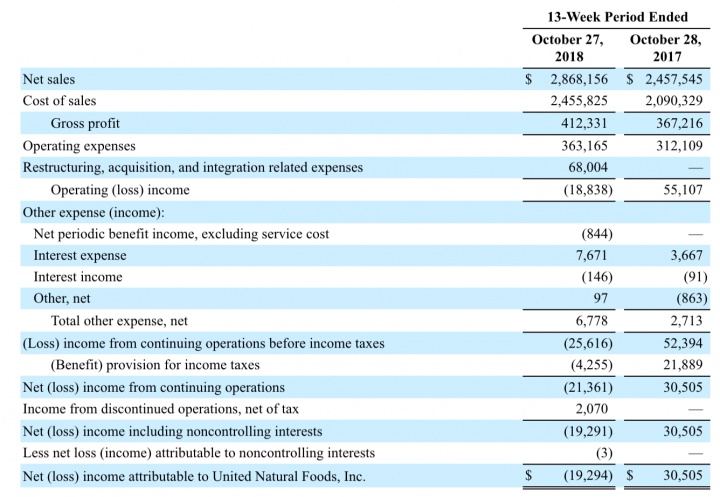

Financial Highlights: (In thousands, except share and per share amounts)

FYE is July 31st

- Net sales increased approximately 16.7%, or $410.6 million, to $2.87 billion for the 13-week period ended October 27, 2018, from $2.46 billion for the 13-week period ended October 28, 2017

- UNFI’ gross profit increased approximately 12.3%, or $45.1 million, to $412.3 million for the 13-week period ended October 27, 2018, from $367.2 million for the 13-week period ended October 28, 2017. UNFI’ gross profit as a percentage of net sales decreased to 14.38% for the 13-week period ended October 27, 2018, compared to 14.94% for the 13-week period ended October 28, 2017.

- The decline in the gross margin rate was driven by a shift in customer mix, including the growth of the supernatural channel, and increased inbound freight expense, partially offset by higher levels of vendor support and greater fuel surcharge income.

- Operating income decreased approximately 134.2%, or $73.9 million, to an operating loss of $18.8 million for the 13-week period ended October 27, 2018, from operating income of $55.1 million for the 13-week period ended October 28, 2017. As a percentage of net sales, operating loss was 0.66% for the13-week period ended October 27, 2018, as compared to 2.24% for the 13-week period ended October 28, 2017.

- The Company had a net loss of $19.3 million, a loss of $0.38 per diluted common share, for the 13-week period ended October 27, 2018, compared to net income of $30.5 million, or$0.60 per diluted common share, for the 13-week period ended October 28, 2017.

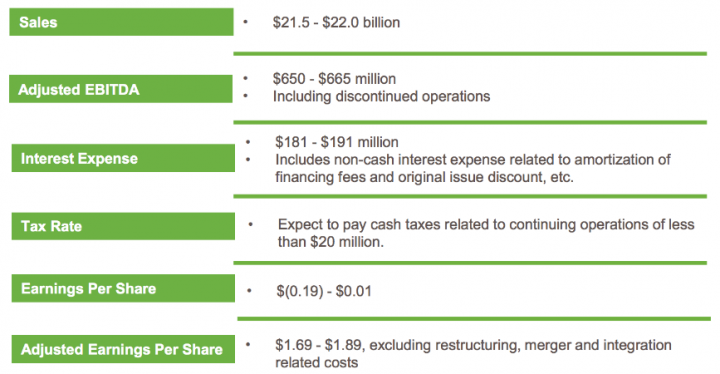

Fiscal 2019 Guidance – 53 weeks: Consolidated UNFI – Assumes existing retail store base operated through Fiscal 2019

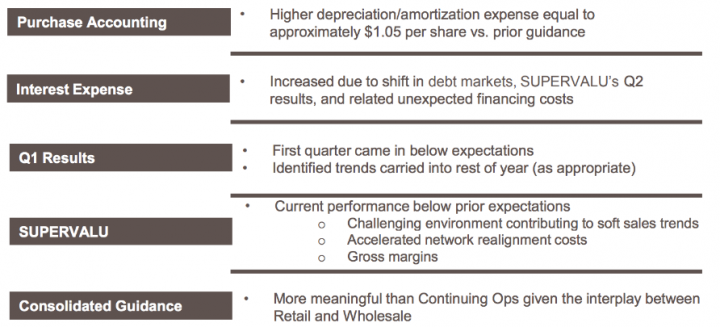

Fiscal 2019 Guidance – What’s Changed: Changes to Adjusted EPS Guidance Driven By

Key risk factors and potential stock drivers:

- The company’ business risk profile is impacted due to the various macro trends, and its ability to withstand these near-term headwinds would continue to remain a key monitorable.

- Company’ ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a challenge for the company.

- Food wholesale business has witnessed intense competition, with deep discounts and pricing competition by several players in the industry. There could be competitors with higher financial resources and greater market reach and UNIF Inability to effectively compete with them could hurt its business profile.

- Failure to identify changing trends and industry preference is an important factor which has a bearing on the company’ performance over the medium to longer term.

Stock Performance

Comments:

- On Friday, Dec 7th, 2018, UNFI closed at $14.88, with an average volume of 1.59 million shares exchanging hands. Market capitalization is $763.533 million. The current RSI is 12.47

- In the past 52 weeks, shares of UNFI have traded as low as $14.15 and as high as $68.05

- At $14.88, shares of UNFI are trading below its 50-day moving average (MA) at $24.41 and below its 200-day moving average (MA) at $36.78

- The present support and resistance levels for the stock are at $12.43 & $18.93 respectively.