Company Overview

Izea, Inc. (NASDAQ: IZEA) operates an online marketplace that matches marketers (brands, advertising agencies, and publishers) with creators of influential digital content. These ‘influencers’ distribute text, videos, and photos on behalf of marketers through various social media channels. The company’s platform brings these groups together, and facilitates large-scale transactions by managing content workflow, targeting, bidding, analytics, and payment processing.

Izea’s primary customers are marketers who wish to gain access to the company’s network of content creators. The company’s two primary approaches consist of influencer marketing, the engagement of various online figures to create lead marketing campaigns, and custom content, the creation of stand-alone content through client-owned channels.

The company was formed in 2006 under the name PayPerPost, Inc., and became a public company in May 2011. Izea is headquartered in Winter Park, Florida.

Products and Services

As noted above, Izea has two main product offerings:

Influencer Marketing: The company works with marketers to facilitate influencer campaigns at scale. Included in this category is Sponsored Social, which compensates bloggers and Twitter users for sharing sponsored content with their followers. Izea considers itself a pioneer in the marketplace for sponsorship on social media, and will continue to scale its product offerings in this space.

Custom Content: Izea also offers marketers the option to augment or replace existing content development efforts. The company’s platform connects customers to creators (such as journalists, subject matter experts, bloggers, and other digital content producers) in order to generate editorial and marketing content (ranging from complex white papers to simple product descriptions). Many customers use this service to update and maintain corporate blogs.

In order to connect its customers to its talent pool, Izea operates three distinct platforms:

IZEA.com and the Izea Exchange (IZEAx) was designed to provide a unified ecosystem for multiple types of custom content, including blog posts, status updates, videos, and photos shared through social channels such as Twitter, Facebook, Instagram, and Tumblr. The system is available to customers and partners using a self-serve portal.

Ebyline, which was acquired by the company in 2015, is a content marketplace that was originally designed to replace the editorial newsrooms of traditional newspapers. The primary focus of this platform is producing content for brands, in addition to the self-service functionality used by newspapers.

ZenContent, which was acquired by the company in 2016, is a platform that includes content creation workflow management and a database of creators, which enables scalable production of content for e-commerce entities and brand marketers. Whereas Ebyline uses expert-grade content producers, ZenContent relies on a wider array of creators to meet customer requirements for quality, speed, and price.

The company’s various platforms and product offerings are designed to meet the needs of different customers, ranging from start-ups to Fortune 500 companies. According to a recent presentation, Izea’s clients include the following well-known brands:

Source: Company Presentation

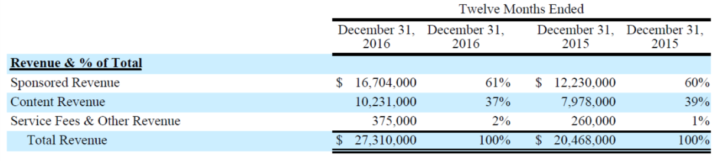

As of December 31, 2016, the IZEAx database was comprised of 810,000 user connections, with an aggregate reach of 4.7 billion non-unique fans and followers. Since inception, the company has completed more than 3.6 million social sponsorship transactions. A summary of Izea’s 2016 revenue is shown below:

Source: Company Filing

Market Overview

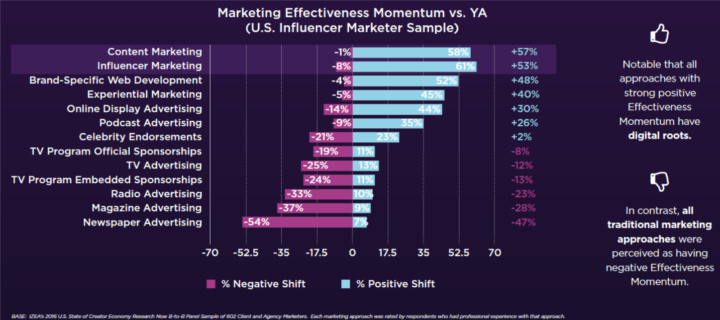

Studies performed by the company indicate that web-based marketing has gained significant momentum in the past year:

Source: Company Presentation

Conversely, traditional advertising channels such as television and print are increasingly seen as ineffective. The company also notes that more companies are creating large, dedicated budgets for influencer and content marketing, and it hopes to capture a greater share of this market going forward.

Third Quarter Earnings Review

Total revenue for the quarter ended September 30, 2017, increased nine percent year-over-year to $8.2 million. This improvement was attributable to organic growth of managed services revenue. Gross profit increased 23 percent as the company’s product mix shifted away from lower margin self-service content revenue.

Although total operating expenses were flat year-over-year, the company’s cash based operating expenses fell five percent to $4.2 million. Accordingly, Izea’s net loss for the third quarter was $0.6 million ($0.10 per share), as compared to a net loss of $1.5 million ($0.28 per share) in the third quarter of 2016. However, the company did record positive adjusted earnings before interest, taxes, depreciation, and amortization (of $0.2 million) for the first time since becoming a public company.

Net cash used in operations for the nine months ended September 30, 2017, declined 23 percent year-over-year to $3.2 million. At September 30, 2017, the company listed a cash balance of $3.4 million, with no long-term debt.

Izea subsequently updated its full-year outlook for 2017. The company expects revenue between $29 million and $30 million, compared to $27.3 million in 2016. Gross margin guidance increased by 200 basis points, and is likely to fall between 50 and 51 percent. Guidance for adjusted EBITDA improved by $1.0 million to a full-year total of negative $3 million.

Stock Influences

- Shifts away from print and television advertising towards digital solutions;

- Changes in the company’s revenue mix and improved profitability;

- Significant new customers and bookings; and

- M&A activity.

Risk Factors

- The social sponsorship landscape is subject to numerous changes that could cause the company’s revenue to decline;

- The company relies on third-party social platforms to deliver its marketing content, and changes in platform terms and costs could have a negative impact on the business;

- The company could be impacted by changes to net neutrality; and

- The company’s social sponsorship is subject to government regulation related to advertisers.

Stock Performance

On Monday, November 13th, 2017, shares of Izea were at $4.16, yielding a market capitalization of $25 million. The stock hit a one-year high of $7.85 in early October, but lost more than 50 percent throughout the rest of the month. The recent earnings announcement helped push the stock north of $4.00.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Jon Hickman | Ladenburg | Buy | $10.00 | 11/8/2017 |

| Mike Malouf | Craig Hallum | Buy | $7.00 | 11/8/2017 |

Summary

Overall, Izea’s third quarter results were positive – growing revenue in high margin areas and improved profitability. Although the company reported a net loss, adjusted EBITDA was slightly positive. Izea’s operating cash flows remain negative however, and the company may need to raise additional cash within the next year. Still, the company boasts an impressive client roster, and the company’s platform is capable of servicing a variety of marketing needs. Accordingly, Izea appears well-positioned to participate in the growth of this nascent industry.

Welcome to Traders News Source

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.