Adamis Pharmaceuticals Corporation (NASDAQ: ADMP) is a specialty biopharmaceutical company primarily focused on developing and commercializing products in various therapeutic areas, including respiratory disease and allergy.

On Aug 10th, 2018, the company reported financial results and recent corporate highlights for the second quarter ended June 30, 2018.

The company announced several significant achievements during the second quarter of 2018, including the management’ expectation that the FDA will approve a lower dose formulation of emergency allergy med Symjepi (epinephrine) Injection 0.15 mg. Expected FDA action on NDA by 9/27/18. ADMP has selected Novartis unit Sandoz to launch the product in the U.S. (the FDA approved the 0.30 mg version in November 2017).

As per management, the Sandoz partnership for the commercialization and distribution of Symjepi™ in the U.S. will likely prove to be the most transformative for the Company. Under the agreement, Sandoz will take responsibility for sales and marketing. The company believes that the financial terms of the agreement could provide for a meaningful recurring revenue to Adamis. ADMP has also expanded its pipeline with its sublingual tadalafil (Cialis®) product candidate, which is in development.

So far liquidity and financial flexibility are concerned, the successful underwritten public offering of common stock has provided the necessary resources to advance the company’ pipeline. We were fortunate to have had multiple fundamental health care funds lead that offering. These recent advancements have put Adamis in a strong position for growth.

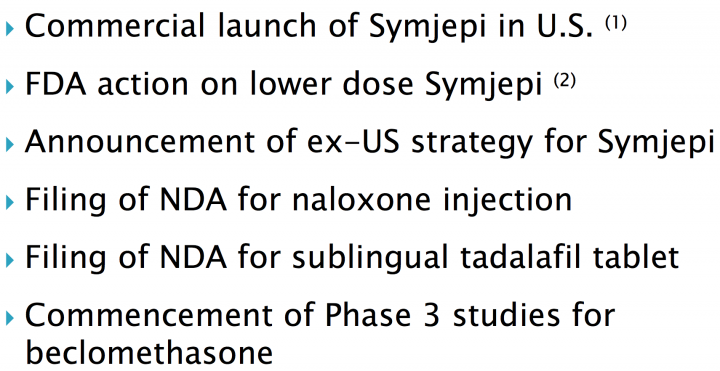

Near-term target milestones:

- Footnotes:

1.The timing of launch and commercial strategy at Sandoz’s sole discretion

- FDA PDUFA date 9/27/18

Recent Highlights in details: Some of the company’s product updates and accomplishments since the beginning of the second quarter of 2018 include the following:

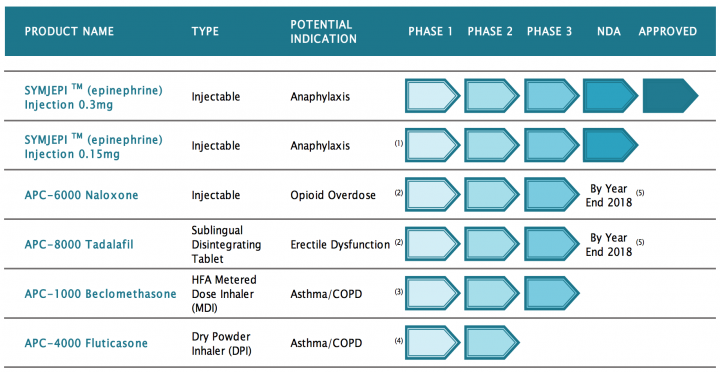

- Symjepi (epinephrine) Injection 0.30mg – The company entered into a commercialization and distribution agreement with Sandoz, a division of Novartis, to market and sell Symjepi in the U.S. Key terms include: Sandoz to pay a supply price to Adamis for product, Adamis 50% profit split and Sandoz right of first negotiation for territories outside the U.S.;

- APC-8000 (sublingual tadalafil) – The company is developing a new fast-dissolving sublingual tablet containing tadalafil (Cialis®) and intends to submit an Investigational New Drug (IND) application to the U.S. Food and Drug Administration (FDA) with the goal of filing a New Drug Application (NDA) before year-end;

- APC-6000 (naloxone) – ADMP continues to advance its naloxone product candidate for opioid overdose, and plan to file an NDA with the FDA before year-end. This is the company second product using its FDA-approved injection device;

- APC-1000 (beclomethasone) – The FDA cleared Adamis to begin Phase 3 pivotal studies with its beclomethasone metered dose inhaler and the company is planning to begin patient recruitment in Q4;

- APC-4000 (fluticasone) – Fluticasone will be the company’ first product candidate using its patented dry powder inhaler device platform purchased from 3M. Adamis continue to work on proof of concept studies with the objective of demonstrating proper dosing of the steroid;

- Balance sheet – The company has strengthened its cash position with an underwritten equity offering that raised net proceeds of approximately $37.6 million.

Analysts tracking the stock believes that with all of the reported shortages of epinephrine products, there is an excellent opportunity for a simple, easy-to-use device like Symjepi within the anaphylaxis market. With several upcoming milestones in its pipeline, a strengthened cash position, and a solid commercialization partner for Symjepi, Adamis is well poised for substantial growth for the foreseeable future.

As per www.marketbeat.com, The average twelve-month price target for the company is $8.6250, suggesting that the stock has a possible upside of 146.43%. The high price target for ADMP is $13.00, and the low-price target for ADMP is $7.00. There are currently four buy ratings for the stock, resulting in a consensus rating of “Buy.

Below are the excerpts of recent analyst rating on the scrip:

source: www.marketbeat.com

About the company:

Adamis Pharmaceuticals Corporation is a specialty biopharmaceutical company primarily focused on developing and commercializing products in various therapeutic areas, including respiratory disease and allergy. The company’s Symjepi (epinephrine) Injection 0.3mg, was approved for use in the emergency treatment of acute allergic reactions, including anaphylaxis, and its Symjepi (epinephrine) Injection 0.15mg product is undergoing FDA review.

Adamis recently announced a distribution and commercialization agreement with Sandoz, a division of Novartis Group, to market Symjepi in the U.S. Adamis is developing a sublingual tadalafil product candidate as well as additional product candidates, using its approved injection device, a metered dose inhaler, and dry powder inhaler devices. The company’s subsidiary, U.S. Compounding, Inc., compounds sterile prescription drugs, and certain nonsterile drugs for human and veterinary use, to patients, physician clinics, hospitals, surgery centers and other clients throughout most of the United States.

Products and Pipeline:

1.Expected FDA action on sNDA by 9/27/18

2.Anticipate pharmacokinetics study will be sufficient to support NDA 3 Phase

3.study expected to commence by YE 2018

- Expect to continue proof of concept development during 2018

5.Target milestone

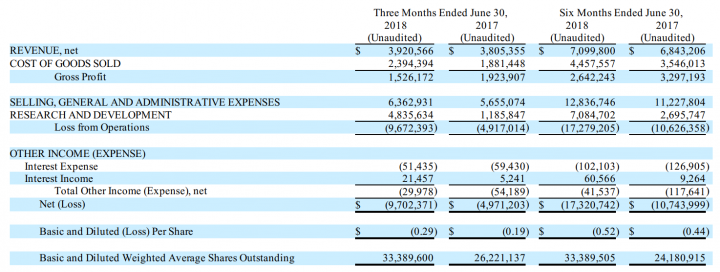

Financial Results:

- Revenues: Revenues were approximately $3.9 million and $3.8 million for the three months ended June 30, 2018, and 2017, respectively. The increase in revenues for the three months ended June 30, 2018 compared to the comparable period of 2017 reflected an increase in sales of USC’s compounded and non-compounded pharmaceutical formulations resulting in part from price increases and marketing personnel efforts.

- Profitability: Net loss from operations for the three months ending June 30, 2018 and 2017, respectively, was approximately $9.7 million and $4.9 million. The increase in net loss primarily resulted from an increase in both selling, general and administrative (“SG&A”) expenses and research and development (“R&D”) expenses.

- Liquidity and financial flexibility: At June 30, 2018, the Company had cash and cash equivalents of $4.4 million. On August 6, 2018, the Company announced the closing of an underwritten public offering resulting in net proceeds of approximately $37.6 million.

Key risk factors and potential stock drivers:

- Any adversities related to the future guidance might adversely impact the overall investor sentiments.

- The company expects the FDA to approve its lower dose formulation of emergency allergy med Symjepi (epinephrine) Injection 0.15 mg. Expected FDA action on sNDA by 9/27/18.

- The Future key milestones for the company include the filing of U.S. marketing applications for sublingual tadalafil (Cialis) and naloxone injection, along with the launch of Phase 3 studies of beclomethasone.

- Any time/cost overruns and or suspensions or delays in the completion of clinical testing could result in increased costs and delay or prevent its or certain of its subsidiaries’ ability to complete development of that product or generate product revenues.

- Extensive industry regulation has had and will continue to have, an impact on ADMP’ business in the area of cost of goods, especially its product development, manufacturing, and distribution capabilities.

Stock Chart:

Comments:

- On Tuesday, September 25th, 2018, ADMP was at $3.75, on volume of ~ 1.3 million shares exchanging hands. Market capitalization is $165.52 million. The current RSI is at 70.01

- In the past 52 weeks, shares of ADMP shave traded as low as $2.20 and as high as $5.85

- At $3.75, shares of ADMP are trading above its 50-day moving average (MA) at $3.18 and above its 200-day moving average (MA) at $3.70

- The present support and resistance levels for the stock are at $3.13 & $3.73 respectively.