AVEO Pharmaceuticals, Inc. (NASDAQ: AVEO) is a biopharmaceutical company, develops and commercializes a portfolio of targeted medicines for oncology and other areas of unmet medical need. It markets its lead candidate, tivozanib, an oral, once-daily, vascular endothelial growth factor receptor tyrosine kinase inhibitor, which is used for the treatment of renal cell carcinoma (RCC).

________________________________

Receive our breakout reports in real time text the word TRADERS to 25827 – Traders News Source recent picks, track record and about us – https://tradersnewssource.com/traders-news-source-new-members/

________________________________

On April 3rd, 2019, the company announced it has commenced an underwritten public offering of its shares of common stock, together with warrants to purchase shares of common stock.

The proposed offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

The Company intends to use the net proceeds from the offering for ongoing clinical and preclinical development of its product candidates, as well as for working capital and other general corporate purposes.

On April 1st, the company along with partner Biodesix, Inc. announced positive results from phase Ib expansion cohort of ficlatuzumab in combination with cytarabine in patients with relapsed and refractory acute myeloid leukemia (AML).

The phase Ib study was designed to assess the safety, tolerability and preliminary efficacy of ficlatuzumab combined with cytarabine in AML patients who are refractory to first-line therapy (7+3) or have relapsed within one year of induction, a population known to have poor outcomes.

Last November, AVEO announced that it will earn a $2-million milestone fee from EUSA Pharma, triggered by the commercial launch and reimbursement of Fotivda in Germany.

Products

About

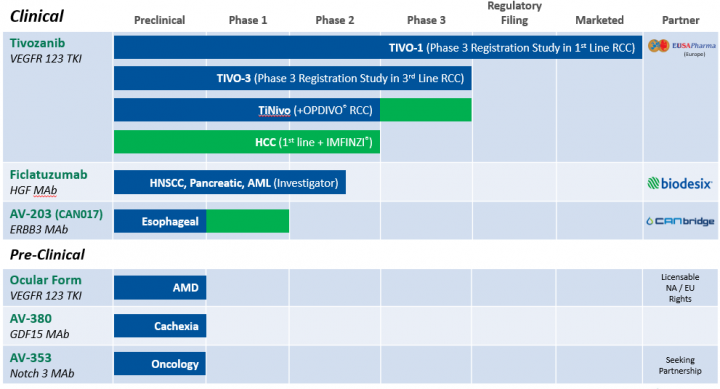

AVEO Pharmaceuticals, Inc., a biopharmaceutical company, develops and commercializes a portfolio of targeted medicines for oncology and other areas of unmet medical need. It markets its lead candidate, tivozanib, an oral, once-daily, vascular endothelial growth factor receptor tyrosine kinase inhibitor, which is used for the treatment of renal cell carcinoma (RCC). The company has also completed a Phase 3 TIVO-3 trial of tivozanib for the treatment of RCC; and initiated enrollment in a phase Ib/II clinical trial of tivozanib in combination with Opdivo (nivolumab), an immune checkpoint (PD-1) inhibitor, for the treatment of RCC. In addition, it is developing Ficlatuzumab, a potent hepatocyte growth factor inhibitory antibody for the treatment of squamous cell carcinoma of the head and neck, metastatic pancreatic ductal cancer, and acute myeloid leukemia; and AV-203, a potent anti-ErbB3 specific monoclonal antibody, which has completed Phase I clinical trial for treating esophageal cancer. The company’s preclinical stage products include AV-380, a potent humanized IgG1 inhibitory monoclonal antibody for the treatment or prevention of cachexia; and AV-353 for the treatment of pulmonary arterial hypertension. It has strategic partnerships with CANbridge Life Sciences Ltd.; EUSA Pharma (UK) Limited; Novartis International Pharmaceutical Ltd.; Biodesix, Inc.; St. Vincent’s Hospital Sydney Limited; Biogen Idec; and Kyowa Hakko Kirin Co., Ltd. AVEO Pharmaceuticals, Inc. has a clinical collaboration with AstraZeneca PLC to evaluate IMFINZI (durvalumab), a human monoclonal antibody directed against programmed death-ligand 1 (PD-L1). The company was formerly known as GenPath Pharmaceuticals, Inc. and changed its name to AVEO Pharmaceuticals, Inc. in March 2005. AVEO Pharmaceuticals, Inc. was incorporated in 2001 and is based in Cambridge, Massachusetts.

Recent Highlights

Presented Topline Results from TIVO-3 During an Oral Presentation at the 2019 ASCO Genitourinary Cancers Symposium. In February 2019, AVEO presented topline results from the TIVO-3 trial, AVEO’s Phase 3 randomized, controlled, multi-center, open-label study to compare tivozanib to sorafenib in 350 subjects with refractory advanced or metastatic renal cell carcinoma (RCC) at the 2019 American Society of Clinical Oncology (ASCO) Genitourinary (GU) Cancers Symposium held February 14-16, 2019 in San Francisco. The results were presented during an oral presentation titled “TIVO-3: A Phase 3, Randomized, Controlled, Multi-Center, Open-Label Study to Compare Tivozanib to Sorafenib in Subjects with Refractory Advanced Renal Cell Carcinoma (RCC).” A copy of the presentation is currently available in the Publications & Presentation section of AVEO’s website.

The presentation noted that the TIVO-3 trial met its primary endpoint of demonstrating a statistically significant benefit in median progression-free survival (PFS). Median PFS for tivozanib was also longer than sorafenib both in patients who received prior PD-1 therapy and those who received two prior VEGF TKI therapies. The secondary endpoint of overall response rate also demonstrated a statistically significant improvement for patients receiving tivozanib compared to sorafenib.

The analysis of the secondary endpoint of overall survival (OS) was not mature at the time of the final PFS analysis. As presented, the preliminary OS analysis conducted at an October 4, 2018 data cutoff date, which included additional patients previously lost to follow-up, showed a non-statistically significant difference in OS favoring sorafenib (hazard ratio: 1.12, p-value: 0.44).

Tivozanib was generally well-tolerated relative to sorafenib, with reported grade 3 or higher adverse events consistent with those observed in previous tivozanib trials. The improved tolerability of tivozanib was evident in the lower rates of dose reductions and interruptions for toxicity in patients receiving tivozanib compared to those receiving sorafenib. The most common adverse event in patients receiving tivozanib was hypertension, an adverse event known to reflect effective VEGF pathway inhibition.

Announced NDA Timing Update. In January 2019, the U.S. Food and Drug Administration (FDA) recommended that AVEO not submit a New Drug Application (NDA) for tivozanib at this time using the preliminary OS results from the TIVO-3 trial. The FDA indicated that these preliminary OS results do not allay their concerns about the potential detriment in OS outlined in the Complete Response Letter dated June 6, 2013. AVEO now plans to make an NDA filing decision following the availability of more mature OS results. AVEO intends to conduct an additional interim OS analysis in August 2019, the results of which are expected to be reported in the fourth quarter of 2019.

Data from Phase 1b Expansion Cohort of Ficlatuzumab and Cytarabine in Relapsed and Refractory AML to be Presented at 2019 AACR Annual Meeting. Data from the investigator-sponsored Phase 1b expansion cohort evaluating the safety and tolerability of ficlatuzumab, AVEO’s potent hepatocyte growth factor (HGF) inhibitory antibody, in combination with cytarabine in patients with relapsed and refractory acute myeloid leukemia (AML) will be presented during a poster session at the 2019 American Association for Cancer Research (AACR) Annual Meeting. The presentation, titled, “Cyfi: Results from a Phase 1b expansion cohort of anti-hepatocyte growth factor and cytarabine in relapsed and refractory AML” (abstract CT078 / 2) will be featured during a poster session (Session PO.CT03) on Monday, April 1, 2019 from 1:00-5:00pm Eastern Time.

Entered Immuno-Oncology Clinical Supply Agreement with AstraZeneca. In December 2018, AVEO entered into a clinical supply agreement with AstraZeneca to evaluate the safety and efficacy of AstraZeneca’s IMFINZI® (durvalumab), a human monoclonal antibody directed against programmed death-ligand 1 (PD-L1), in combination with tivozanib in first-line hepatocellular carcinoma, or liver cancer, in a Phase 1/2 study. AVEO will serve as the study sponsor; each party will contribute the clinical supply of its study drug and study costs will be otherwise shared equally. The Phase 1 portion of the study is expected to commence this year.

Earned $2 Million Milestone Payment from EUSA Pharma. In November 2018, AVEO announced the triggering of a $2 million milestone payment from EUSA Pharma related to the reimbursement in Germany for FOTIVDA® as a first line treatment of adult patients with advanced RCC.

Extended Debt Facility Interest-Only Period. In December 2018, AVEO announced a six-month extension to the interest-only period under its existing amended and restated loan and security agreement with Hercules Capital, Inc. The extension was granted as a result of achieving certain predefined requirements under the agreement, including successfully meeting the primary endpoint of the TIVO-3 trial.

Raised $7.5 Million Under the Sales Agreement with SVB Leerink, Extending Financial Runway. In February 2019, AVEO raised $7.5 million through its sales agreement with SVB Leerink. Approximately $32 million of shares remain available for future issuance and sale pursuant to the sales agreement, which was originally entered into in February 2018. AVEO believes that the proceeds generated in February 2019 through the sales agreement, together with its available cash, cash equivalents, and marketable securities at December 31, 2018, and together with the extension of the interest-only period under the Hercules loan agreement, which results in deferment of principal payments, will allow it to fund planned operations into the first quarter of 2020.

Analysts

6 Wall Street analysts have issued ratings and price targets for AVEO Pharmaceuticals in the last 12 months. Their average twelve-month price target is $2.20, suggesting that the stock has a possible upside of 103.70%. The high price target for AVEO is $3.00 and the low-price target for AVEO is $1.00. There are currently 1 sell rating, 2 hold ratings and 3 buy ratings for the stock, resulting in a consensus rating of “Hold.”

Date Brokerage Action Rating Price Target

3/28/2019 National Securities Initiated Coverage Sell

3/18/2019 HC Wainwright Reiterated Rating Hold $1.00

2/4/2019 B. Riley Reiterated Rating Buy-Neutral $5.00 ➝ $1.00

1/31/2019 Piper Jaffray Companies Reiterated Rating Overweight $5.00 ➝ $3.00

1/3/2019 Robert W. Baird Initiated Coverage Outperform $3.00

12/20/2018 FBR & Co Set Price Target Buy $3.00

10/6/2017 Seaport Global Reiterated Rating Buy

Source: marketbeat.com

Financial review

Full Year 2018 Financial Highlights

AVEO ended 2018 with $24.4 million in cash, cash equivalents and marketable securities as compared with $33.5 million at December 31, 2017.

Total revenue for 2018 was approximately $5.4 million compared with $7.6 million for 2017.

Research and development expense for 2018 was $20.7 million compared with $25.2 million for 2017.

General and administrative expense for 2018 was $10.8 million compared with $9.1 million for 2017.

Net loss for 2018 was $5.3 million, or a loss of $0.04 and $0.19 per basic and diluted share, respectively, compared with a net loss of $65.0 million for 2017, or a loss of $0.61 per basic and diluted share.

The 2018 net loss was partially offset by an approximate $19.9 million non-cash gain attributable to the decrease in the fair value of the 2016 private placement warrant liability that principally resulted from the decrease in the stock price that occurred within the fiscal year. In 2017, the non-cash loss attributable to the increase in the fair value of such warrant liability was $33.7 million.

Financial Guidance

AVEO believes that its $24.4 million in cash, cash equivalents, and marketable securities at the end of 2018, together with the additional $7.5 million raised from sales under its sales agreement with SVB Leerink in February 2019 and together with the extension of the interest-only period under the Hercules loan agreement, which results in deferment of principal payments, would allow it to fund planned operations into the first quarter of 2020.

Stock influences and risk factors

Continuing positive results from clinical trials could act as a catalyst for company shares.

They will require substantial additional funding, and a failure to obtain this necessary capital when needed would force us to delay, limit, reduce or terminate research, product development or commercialization efforts.

In the near term, they are substantially dependent on the success of tivozanib.

Their preclinical or clinical trials of any product candidates that they or their collaborators may develop could fail to demonstrate satisfactory safety and efficacy to the FDA and other regulators.

Stock chart

On Friday, April 5, 2019, AVEO shares closed at $1.08 on traded volume of 18.6 million shares. The current RSI (14) is 56.91

At $1.08, AVEO shares are trading above their 50 DMA of $.76 and below their 200 DMA of $1.94

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Mark Roberts. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.