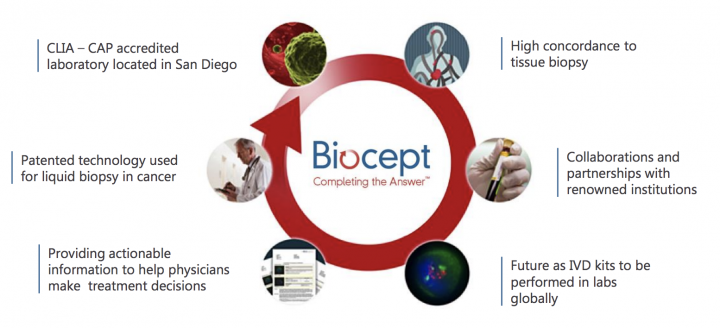

Biocept, Inc. (NASDAQ: BIOC) is a molecular diagnostics company with commercialized assays for lung, breast, gastric, colorectal and prostate cancers, and melanoma. The Company uses its proprietary liquid biopsy technology to provide physicians with information for treating and monitoring patients diagnosed with cancer.

Recent announcements/Catalysts:

- The launch of Biopsy Kit: On Jan 28th, Biocept Launches Liquid Biopsy Kits Intended to Broaden Use of its Proprietary Technology Platform for High Sensitivity Detection of Circulating Tumor DNA. Target Selector™ kits are research-use-only (RUO) and designed to enable laboratories around the world to leverage Biocept’s patented assay technology to perform cutting-edge liquid biopsy testing.

- Capital Raise/Financial Closure: On Jan 18th, the company announced it has entered into a securities purchase agreement with certain accredited institutional investors to purchase approximately $2.2 million of its common stock in a registered direct offering. The purchase price for one share of common stock will be $2.25.

- Introduction of Artificial Intelligence: On Dec 18th, the company announced that Biocept and Prognos Entered into Partnership to Apply Artificial Intelligence in Order to Help Pharmaceutical and Life Sciences Companies Optimize Commercialization of Biomarker-Targeted Therapies in Oncology. The partnership enables Biocept’s data monetization strategy and enhances Prognos’ repository of more than 20 billion laboratory records to predict disease earlier.

Anticipated Near-Term Milestones:

- Increase market penetration into emerging liquid biopsy segment

- Enter into strategic commercial and technology partnerships – Global and U.S.

- Validate Oncomine™ NGS Panel; Become Thermo Fisher Liquid Biopsy Center of Excellence Grow sales of blood collection tubes under VWR marketing and distribution agreement

- Sign new third-party health plan agreements and expand the relationship with BCBS

- Publish clinical case studies

- Develop and launch ex-US kit strategy

- Launch additional oncology biomarker assays

- Monetize data through Artificial Intelligence (AI) from over 16,000 patients tested

The company is in an expansionary phase, as evident from its recent financial closure and robust partnerships. BIOC’s liquid biopsy tests are expected to supplement or even replace tissue biopsies in the multi-billion molecular oncology testing market, leading the company towards full-fledged commercialization stage.

Analysts tracking the stock believes that Biocept is an emerging player in the liquid biopsy space and the key for Biocept is to continue to raise awareness about its technology platform. Furthermore, 2019 is expected to be a remarkable year for biotech space and oncology/cancer segment will likely continue to dominate the industry.

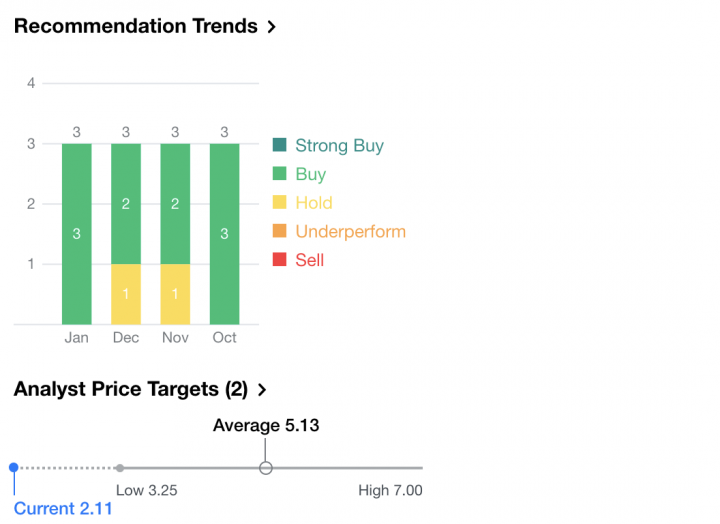

Analyst rating/price targets:

Several brokerage firms have initiated coverage on the company, and the stock currently has an average rating of “Buy” and a consensus price target of $5.13. Per Yahoo.com, 3 out of 3 analysts, recommends buying. Considering present valuation, the company is in a favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains exceptionally favorable.

Source: Yahoo.com

Description & about the Company:

Biocept is a cancer diagnostics company, which develops and commercializes proprietary circulating tumor cell (CTC) and circulating tumor DNA assays utilizing a standard blood sample. Traditional Biopsies, are invasive, can be painful, and difficult to carry out in many instances. On the flip side, Biocept’ detect circulating cells and the DNA fragments in blood, as opposed to from a direct tumor sample. The tests are called liquid biopsies.

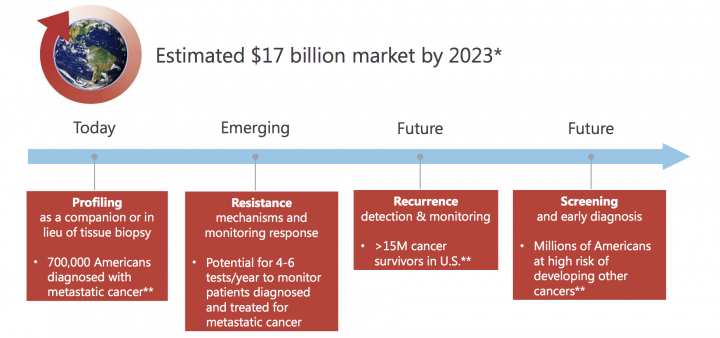

Industry potential:

- Biocept focuses on patients with lung, breast, prostate, & colorectal cancers (>45% of all metastatic cancers)

- Liquid Biopsy Market Forecast to Reach in the Billions

- The commercial organization, improving cancer patient outcomes

- Advantages of a simple blood test vs. tissue biopsy (high sensitivity, actionable, rapid results, non-invasive, cost-effective)

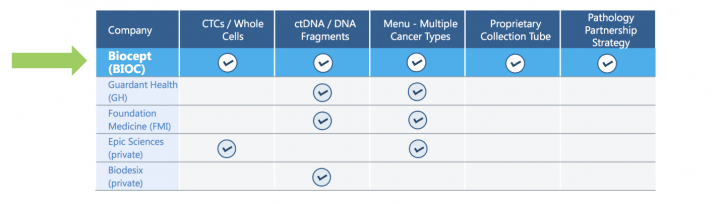

Unique differentiating factors of Biocept:

Collaborations:

Q-3 Financial Results:

Revenue: Revenues for the third quarter of 2018 were $762,000, compared with $1.1 million for the third quarter of 2017.

Profitability: The net loss for the third quarter of 2018 was $6.0 million, or $2.42 per share on 2.8 million weighted-average shares outstanding. This compares with a net loss for the third quarter of 2017 of $5.8 million, or $5.90 per share on 987,000 weighted-average shares outstanding.

Liquidity and financial flexibility: Cash and cash equivalents as of September 30, 2018, were $9.0 million, compared with $2.1 million as of December 31, 2017.

Key Stock Influences:

- Successful completion of the upcoming catalysts would lead future direction for the company. Any adversities related to these upcoming milestones might adversely impact the overall investor sentiments.

- BIOC is still an early stage entity and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it.

- BIOC has a history of operating losses. Therefore, any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor.

Stock Chart:

- On Tuesday, Jan 29th, 2019, BIOC was at $2.02 on volume of 1.2 million shares exchanging hands. Market capitalization is $8.57 million. The current RSI is 56.57

- In the past 52 weeks, shares of BIOC have traded as low as $0.66 and as high as $12.30

- At $2.02, shares of BIOC are trading above its 50-day moving average (MA) at $1.30 and below its 200-day MA at $3.83

- The present support and resistance levels for the stock are at $1.80 & $2.66 respectively.

About Traders News Source

Over 75% in realistic bookable gains so far in 2019

Any trader in any market would fall all over themselves to book gains like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in class. We know with a large following comes a large responsibility as we have everyone from the institutional investor to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

View our track record, currently featured reports and updates here- https://tradersnewssource.com/traders-news-source-new-members/

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP SMS/text alert service for free, simply text the word “Traders” to the phone number 25827 from your cell phone.

Pay attention, if you’re just joining us you are about to see why everyone wants to be like us. There are a lot of imitators but only one Traders News Group.

The Traders News Team

_________________________________________________________________

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.