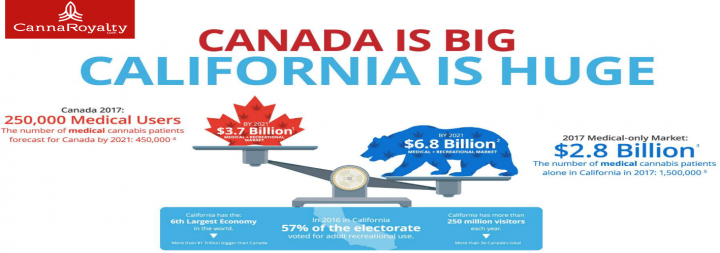

CannaRoyalty Corp. (OTCQX: CNNRF) is a North American cannabis consumer product company currently focused on building a leading distribution business in California, the world’s largest regulated cannabis market. By building a world-class logistics platform and supporting contract manufacturing assets, the Company intends to support the growth of new and established cannabis brands.

Canada is set to implement their legalization of recreational cannabis use on October 17th. In the U.S., 30 states have some form of legal medical cannabis use and 9 states have approved recreational cannabis use along with many municipalities. In November voters will decide on ballot proposals for recreational cannabis use in Michigan and N. Dakota. Utah and Missouri voters will be deciding if they want a medical marijuana law on their books.

Q2 marked a turning point for CannaRoyalty, and its shareholders as the team translated strategy and execution into record financial performance. The Company generated earnings per share of $0.18 primarily by delivering on its stated objective of rationalizing early passive investments. The Company also generated a record adjusted EBITDA result for a Canadian-listed cannabis company.

As per management, Q2 is just the beginning of a multi-quarter parabolic step change in revenue, powered by sequential acquisitions and organic growth. CannaRoyalty generated a record $3.5 million in revenue in Q2-2018, a 446% increase from Q1 and more than the Company generated in all of 2017. These results reflect the successful initiation of the Company’s strategic focus on building its Californian distribution and brands platform.

This growth is expected to continue in Q3 and Q4 as FloraCal and RVR are added to the Company’s financials and as the company’ team continues to grow market share and expand the Company’s supporting manufacturing and value-add services footprint. Both RVR and FloraCal are performing above expectations, and the company is actively executing its plans to increase the revenue generating capacity of both companies.

______________________________________________________________________

Our members have booked up to 800% with our recent (2018) NASDAQ and NYSE small cap alerts. We will be initiating coverage on another exciting small cap security mid-week this week (10/14/18). View our recent picks, track record and sign up for our real time mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

______________________________________________________________________

Strategic Sale/deals in the recent past and profit: As CannaRoyalty continues to grow and build a solid presence in California as a cannabis brands company and a major third-party distributor, the company’ focus has been concentrated on realizing value from assets that are non-core to the business.

- On October 3rd, the company announced a definitive agreement with Australis Capital Inc. whereby Australis will purchase 2,200,000 common shares in the capital of Wagner Dimas Inc. from Cannroy Delaware Inc., a wholly-owned subsidiary of CannaRoyalty. The approximately 182% return on investment from the sale of an equity stake in Wagner Dimas reinforces CNNRF’ commitment to generate significant returns for shareholders and fund accretive growth in the key markets in North America

- On August 27th, the company announced that it has entered into a binding letter of intent with Tidal Royalty Corp., a leading provider of royalty financing to licensed U.S. cannabis operators, whereby Tidal Royalty will acquire the Company’s equity stake and royalty entitlement in Alternative Medical Enterprises LLC (“AltMed”) for a consideration of $8 million, representing approx. 168% return on investment for CannaRoyalty’s shareholders. CannaRoyalty will maintain the right to license MÜV products in California, Nevada, Canada, and other select markets.

- Before this, the company sold its stake in Anandia Labs, as well as its exclusive Canadian license to Wagner Dimas’s pre-roll technology to Aurora Cannabis for a combined value of $26 million. These transactions represent a combined return of approx. 500% on the investments and will enable the company to continue to execute its growth plans while repurchasing shares.

The outlook for 2018 & 2019: The company is expected to exit 2018 at a significantly higher quarterly revenue run rate than CannaRoyalty’s record rate of Q2. Thus, the market is extremely bullish about the upcoming Q3 and Q4 results to see the revenue generating power of this business moving into 2019.

Analyst tracking the stock and the industry believes that the cannabis market is positioned for strong growth pending further market legalization and California, home to some of the world’s most discerning consumers and a nexus of information and trends, will be the point of inception for the global cannabis brands of the future.

The Company’s leadership and staff combine passion and a hands-on understanding of the cannabis industry, with proven financial and legal expertise. Considering all this, the company is in an extremely favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains exceptionally favorable.

About the Company: CannaRoyalty is a North American cannabis consumer product company currently focused on building a leading distribution business in California, the world’s largest regulated cannabis market. By building a world-class logistics platform and supporting contract manufacturing assets, the Company intends to support the growth of new and established cannabis brands. CannaRoyalty’s shares trade on the Canadian Stock Exchange (CSE) under the symbol CRZ and in the US on the OTCQX under the symbol CNNRF.

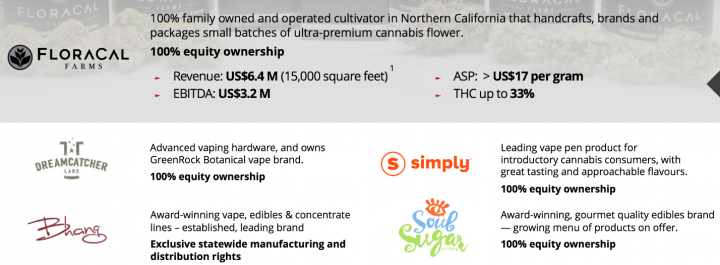

Portfolio: CannaRoyalty has developed a diversified portfolio of assets within the cannabis sector, including research, infrastructure, and intellectual property to support its existing brands, partner products, and distribution networks.

Brands in Distribution – California

Owned & Licensed Brands in California

Other recent announcements:

- CannaRoyalty to Present at U.S. Cannabis Symposium in Toronto on October 18, 2018. The one-day event will feature company presentations and one-on-one meetings with industry leaders who will discuss the opportunities and challenges of the U.S. cannabis market

- Trichome Financial Corp. Announces Proposed Qualifying Transaction with 22 Capital Corp.

- The company has signed a binding term sheet to acquire 100% of investee 180 Smoke and its affiliates for total consideration of $25 million, as well as an additional $15 million upon the completion of certain milestones.

- 420 Wellness, a subsidiary of investee 180 Smoke, has been approved by the City of Calgary to open its first cannabis dispensary in the city, pending approval from the Alberta Gaming and Liquor Commission.

Industry Potential:

- As per a research by Genesis Market Insights, the worldwide cannabis industry was valued at USD 17.18 Billion in 2017 and is likely to surpass USD 58 Billion by 2023. This is primarily led by increasing legalization of medical and recreational and cannabis.

Second Quarter 2018 Financial Results – All comparisons below are to June 30, 2017, unless otherwise noted

- Revenues were $3.5 million as compared to $960,157, an increase of 266%;

- Gross margin was $820,935 as compared $421,681, an increase of 95%;

- Net income of $9.3 million as compared to a net loss of $2.0 million;

- Net income per basic share of $0.18 as compared to a net loss per basic share of $0.05;

- Cash was $15.7 million as compared to $4.5 million an increase of 248%;

- Total assets of $94.8 million as compared to $46.1 million, an increase of 105%;

- Current assets of $23.5 million as compared to $7.9 million, an increase of 196%;

- Current liabilities of $5.9 million as compared to $2.1 million, an increase of 178%; and

- Long-term debt of $290,457 as compared to $2.3 million, a decrease of 87%.

Key risk factors and potential stock drivers:

- CNNRF is on the verge of seeing meaningful results from their current investments. Analysts remain hopeful that these payoffs will take shape quite soon and remain bullish about the stock price.

- CNNRF is still an early stage company and is yet to demonstrate a stable track record of growing revenue and profitability. Therefore, its ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a challenge for the company.

- Continuing growth in the cannabis sector could act as a catalyst for the company shares.

- Notwithstanding recent positive developments, Marijuana remains illegal under federal law. It is a Schedule I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized at the state level, its prescription is a violation of federal law.

Stock Performance

Comments:

- On Monday, October 15th, 2018, CNNRF was at $5.80, on volume of 172K shares exchanging hands. Market capitalization is $333.24 million. The current RSI is 60.28

- In the past 52 weeks, shares of CNNRF have traded as low as $1.83 and as high as $23.36

- At $5.80, shares of CNNRF are trading above its 50-day moving average (MA) at $4.75 and above its 200-day moving average (MA) at $3.82

- The present support and resistance levels for the stock are at $5.3846 & $5.7646 respectively.