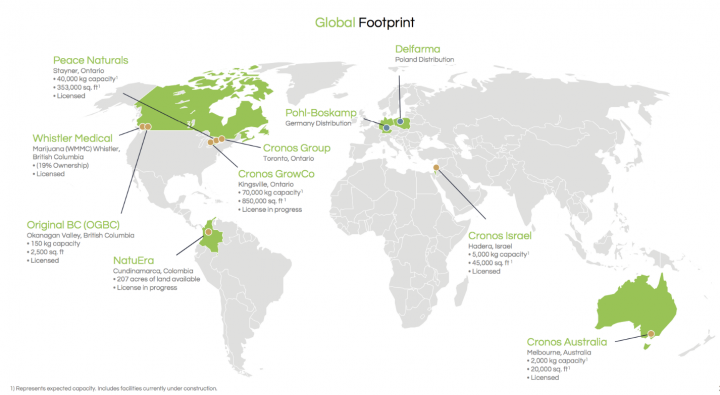

Cronos Group Inc. (NASDAQ: CRON) is a globally diversified and vertically integrated cannabis company with a presence across five continents. Cronos Group operates two wholly-owned Canadian license holders: Peace Naturals Project Inc., which was the first non-incumbent medical cannabis license granted by Health Canada, and Original BC Ltd., which is based in the Okanagan Valley, British Columbia.

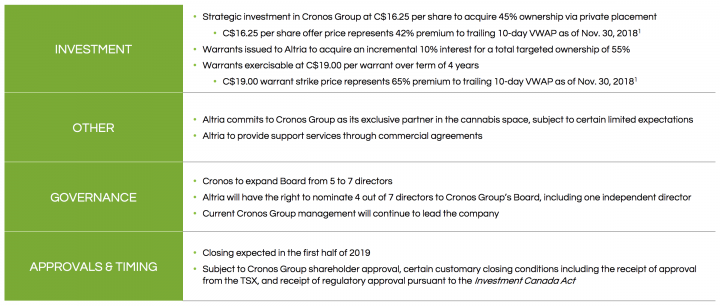

On December 7, 2018, Cronos announced that it has entered into a subscription agreement with Altria Group, Inc, pursuant to which Altria has agreed to make an approximately C$2.4 billion equity investment in Cronos Group on a private placement basis in exchange for common shares in the capital of the Company. Altria will also receive Warrants of Cronos Group, that if fully exercised, would provide the Company with an additional approximately C$1.4 billion of proceeds.

Transaction overview:

Management Commentary:

“Altria is the ideal partner for Cronos Group, providing the resources and expertise we need to accelerate our strategic growth meaningfully,” said Cronos Group’s Mike Gorenstein, Chairman, President, and Chief Executive Officer. “The proceeds from Altria’s investment will enable us to more quickly expand our global infrastructure and distribution footprint, while also increasing investments in R&D and brands that resonate with our consumers.

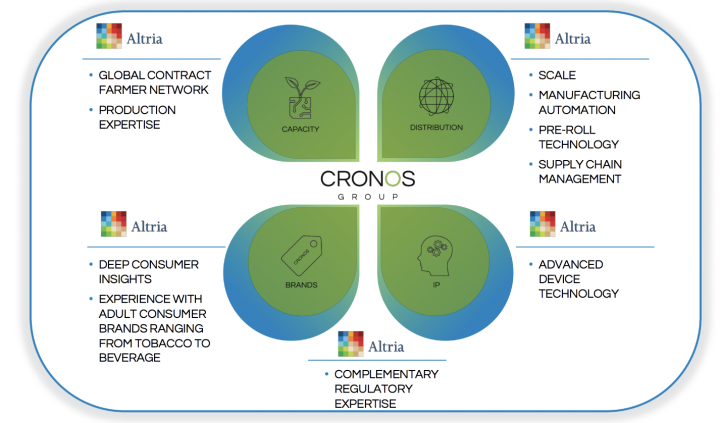

About Altria and expected synergies/value unlocking:

_______________________________________________________________________

Traders News Source recent coverage (NASDAQ: TSRI) 20-35% in bookable gains within 3 days of our coverage! Buyout higher than the current PPS rejected in November 2018, under 1M shares in the float, 64M annual revenues, zero debt, Net cash flow. Prime buyout candidate. Recently announced seeking acquisitions. Full must see report – https://mailchi.mp/tradersnewssource/do-not-miss-our-1st-breakout-report-of-2019-tomorrow-10-am-est-646825?e=[UNIQID]

__________________________________________________________________________

Financial update:

CRON recently announced financial results for the third quarter ended September 30, 2018. For Third quarter 2018, the company reported revenues of $3.8 million, as compared to $1.3 million for the third quarter of 2017, representing an increase of $2.4 million, or 186%.

As per the company, the strategic initiatives launched in 2017 and early 2018 are coming to fruition. The most recent results of the third quarter, reflect the meaningful progress CRON is making on its strategic initiatives. In the quarter, the company announced many landmark partnerships to expand its reach beyond the flower and beyond Canada and launched its second differentiated recreational cannabis brand (refer recent business and operating highlights below).

Industry Perspective: From an industry perspective, the recent legalization of cannabis sales for adult recreational use in Canada was a watershed moment for the entire industry and the Company.

On October 17, 2018, Canada became the first G7 country and the second country in the world to legalize cannabis sales for adult recreational use. The Company is actively engaged in this distribution channel and is currently selling dried cannabis, pre-rolls and cannabis oils to Ontario, British Columbia, Nova Scotia, and Prince Edward Island, which collectively represent over 50% of the Canadian population. The Company expects to secure additional provincial listings as more of its production capacity comes online, which will allow the Company to service additional provincial markets adequately.

Furthermore, the opportunities for the Company extend across the globe as regulations evolve and markets open. The recent initiatives it launched with Gingko Bioworks and Technion are great examples of how CRON intend to use innovation and its growing intellectual property portfolio to develop new applications for cannabinoids across a range of categories.

In conclusion, in the recent past, Cronos Group made clear strides on each of its strategic pillars and is energized by the progress and the phenomenal opportunities ahead. The company is at the outset of its potential, and presently focussing on executing its strategic plan to continue its growth and create value for its stakeholders. Analysts expect that revenue and earnings will be the critical catalyst for CRON over the near to medium term and the company is expected to grow significantly, mainly as a result of their operations within Canada.

Taking all that into consideration, analysts tracking the stock believes that CRON is now well positioned to trade higher. Furthermore, driven by the accelerated interest of the market, CRON has become an attractive play in the legalization of recreational cannabis.

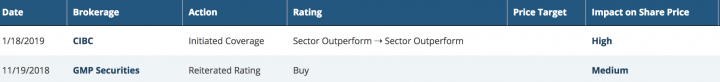

Below are the excerpts of recent analyst rating/Price targets on the company/industry:

Source: marketbeat.com

Other Business and Operational Highlights:

- Research agreement with the Technion: In October 2018, the Company announced sponsored research agreement with the Technion Research and Development Foundation of the Technion – Israel Institute of Technology (“Technion”) to explore the use of cannabinoids and their role in regulating skin health and skin disorders. The preclinical studies will be conducted by Technion over a three-year period and will focus on three skin conditions: acne, psoriasis and wound healing.

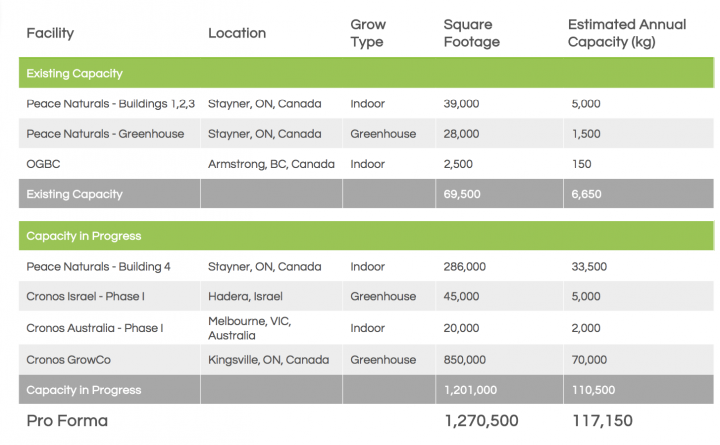

- Construction of Building 4, a 286,000 sq. ft. Purpose-Built indoor production facility built to GMP standards is complete. Building 4 is expected to become fully operational in phases. The facility commenced cannabis cultivation after receiving its license on August 31, 2018. The first harvest from Building 4 is expected by year end 2018.

- Partnership with Ginkgo Bioworks, Inc: Cronos Group and Ginkgo Bioworks, Inc. (“Ginkgo”) announced a landmark partnership to produce cultured cannabinoids through fermentation that are identical to those extracted from the cannabis plant.

- 50/50 strategic joint venture with an affiliate of Agroidea SAS: In August 2018, the Company announced a 50/50 strategic joint venture with an affiliate of Agroidea SAS (“AGI”) This partnership establishes a newly formed entity, NatuEra S.à r.l. (“NatuEra”), in Colombia that will develop, cultivate, manufacture and export cannabis-based medical and consumer products for the Latin American and global markets. This license has an effective term of five years from August 31, 2018. NatuEra is awaiting the grant of licenses to cultivate psychoactive cannabis and manufacture derivative products. Commencement of operations at the facility will be subject to obtaining the remaining appropriate licenses under applicable law.

- The launch of brand Spinach™: Cronos Group launched its mainstream recreational brand Spinach™. A fun, lighthearted and playful brand, Spinach™ is focused on offering Farm-To-Bowl™ products that bring friends together and make experiences more enjoyable. This brand has High Expectations™ and is geared towards a wide range of consumers that don’t take life too seriously and are looking for entertaining, fun ways to enhance activities.

- Strategic joint venture for Cronos Growing Company Inc: In July 2018, Cronos Group announced a 50/50 strategic joint venture with a group of investors led by Bert Mucci, a leading Canadian large-scale greenhouse operator. The entity created by this new partnership, Cronos Growing Company Inc. (“Cronos GrowCo”), expects to construct an 850,000 square foot, purpose-built, a GMP-standard greenhouse on approximately 100 acres of land to be acquired by Cronos GrowCo in Kingsville, Ontario. Once fully operational, the greenhouse is expected to produce up to 70,000 kilograms of cannabis annually. Construction of the greenhouse has commenced and is expected to be complete in the second half of 2019.

- Supply agreement with Cura Cannabis Solutions: Cronos Group entered into a supply agreement with one of the largest cannabis companies in the world by revenues in the first quarter of 2018, Cura Cannabis Solutions (“Cura”). Cura signed a five year take-or-pay supply agreement to purchase a minimum of 20,000 kilograms of cannabis per annum from Cronos GrowCo after Cura receives all necessary licenses from Health Canada. Cura also expects to build its proprietary, state-of-the-art extraction facility on a parcel of land owned by Cronos Group in the heart of Okanagan Valley, British Columbia.

About the Company: Cronos Group is a globally diversified and vertically integrated cannabis company with a presence across five continents. Cronos Group operates two wholly-owned Canadian licensed producers: Peace Naturals Project Inc., which was the first non-incumbent medical cannabis license granted by Health Canada, and Original BC Ltd., which is based in the Okanagan Valley, British Columbia. Cronos Group has multiple international production and distribution platforms across five continents. Cronos Group intends to continue to rapidly expand its global footprint as it focuses on building an international iconic brand portfolio and developing disruptive intellectual property. Cronos Group is committed to building industry-leading companies that transform the perception of cannabis and responsibly elevate the consumer experience.

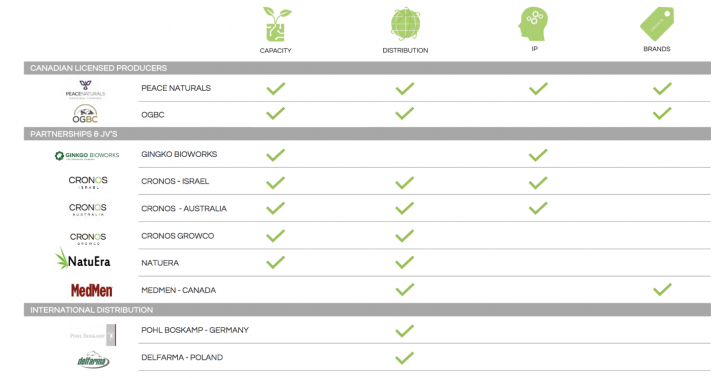

Operational bandwidth/Capacity:

Company’ product profile and strategy execution:

Widespread Global footprint:

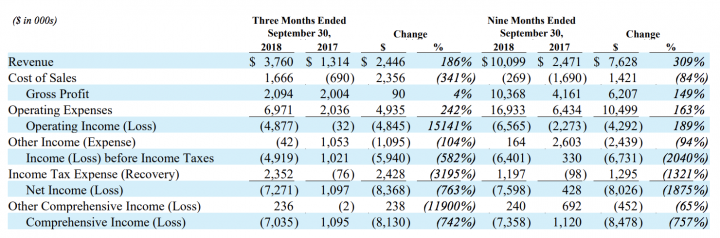

Selected Financial Results

- Revenues: Revenue increased 186% and kilograms sold increased 213% in Q3 2018 as compared to Q3 2017 Revenue increased by $2.4 million, or 186%, from $1.3 million in Q3 2017 to $3.8 million in Q3 2018, while kilograms sold increased by 350 kilograms, or 213%, from 164 kilograms in Q3 2017 to 514 kilograms in Q3 2018. On a sequential quarter basis, revenue and kilograms sold in Q3 2018 increased 11% and 8%, respectively, over those in Q2 2018. The Q3 2018 increases in revenue and kilograms sold over the comparable prior year period were due to increased production capacity and increased volumes sold through the domestic medical and international channels, as well as initial shipments into the domestic adult-use recreational market. The Company continues to see strong growth in cannabis oil sales, which represented 29% of total revenue in Q3 2018.

- Profitability: For the third quarter the company reported a comprehensive loss of $7 million as compared to income of $1.1 million for Q3, 2017 representing a decrease of $8.1 million during the period.

- Liquidity: The company is well-capitalized, having raised approximately US$430 million to date, and partners with innovative industry leaders who are building disruptive technology for the future. As of September 30, 2018, total liquidity amounted to $72.5 million, comprised of $43.8 million in cash and $28.7 million of additional borrowings available under the Construction Loan.

Key risk factors and potential stock drivers:

- Notwithstanding CRON’ unique and differentiating factors, the company is still exposed to risk related to competition and peer pressure. There are other highly diversified cannabis companies in the industry. Additionally, there’s a cannabis ETF that recently launched for even more diversification.

- Company’ ability to grow revenue while significantly improving its profitability will continue to remain a critical price sensitivity for the company

- Company’s ability to maintain its liquidity and financial flexibility to fund its incremental capital requirements. Since cannabis is still illegal at the federal level, it is not easy for CRON to access capital on agreeable terms.

- Company’s ability to continue the growth momentum would be an essential factor. Moreover, given the sector it operates in, it is necessary for the company to keep innovating or acquire other entities in a bid to grow and consolidate its overall resources.

- The cannabis industry is, in many respects, still in the early stages of its development and only time would differentiate between real winners and laggards. As far as choosing an option with a relative advantage is concerned, CRON is preferred choice with upside potential.

Stock Chart:

Comments:

- On Tuesday, January 22nd, 2019, CRON was trading at $15.13, on an average volume of 16.56M shares exchanging hands. Market capitalization is $2.703 billion. The current RSI is 76.63

- In the past 52 weeks, shares of CRON have traded as low as $5.12 and as high as $16.05

- At $15.13, shares of CRON are trading above its 50-day moving average (MA) at $10.81 and above its 200-day moving average (MA) at $8.61

- The present support and resistance levels for the stock are at $13.43 & $15.93 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.