Edison Nation, Inc. (NASDAQ: EDNT) Edison Nation is a vertically-integrated, end-to-end, consumer product research and development, manufacturing, sales, and fulfilment company. The Company is the aggregation of five wholly owned subsidiaries whose operations and go-to-market strategy are vertically integrated under the Edison Nation corporate umbrella.

(NASDAQ: EDNT) On May 30th, the company launched a new product line. The newly announced product line includes all-new branded products, such as an Avatar Light Up Wood Sprite and Star Wars Baton and Shield Set, exclusively developed for Disney Parks and Resorts; a Monsters Inc. interactive flashlight for Tokyo Disney; and a Jimmy Fallon microphone for Universal Resorts.

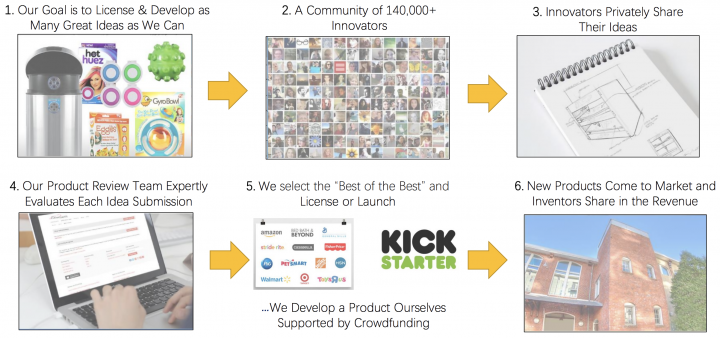

Understanding the business Model:

- Edison Nation’s business model is designed to take advantage and directly benefit from growing online marketplace and crowdfunding momentum for its future growth mitigating new product development risk while allowing for optimized product monetization based on a product’s likelihood to succeed.

- To that end, Edison Nation empowers and enables innovators and entrepreneurs to develop and launch products, gain consumer adoption, and achieve rapid commercial scale efficiently at little to no cost.

- Unlikely Legacy Product Development Model, EDNT’ disruptive model is relatively capital light, Highly flexible, efficient, Turnkey, and investor-friendly with a dedicated focus on growing E-commerce industry.

- All this makes EDNT Uniquely Positioned to Bring Products to Market at Light-Speed with the much lower capital requirement.

Some of EDNT’ Top and Proven Case Studies:

Source: Company’ presentation

Remarkable 2018’ performance reflecting the company’ robust business, market, operational, and financial risk profile:

- 2018 was an exciting building year for Edison Nation. In addition to becoming a public company, the Company has successfully created a vertically integrated, end-to-end consumer product development and a robust omnichannel marketing platform to launch innovative products to market in a rapidly changing consumer environment.

- Coupling its innovative inventor platform and crowdsourcing initiatives, Edison brought exciting new products to market including the Goodie Gusher, 911 Help Now, and MasterSous, all of which have experienced a tremendous acceptance.

- EDNT’ innovative product design platform receives, on average 15 to 20 new product design submissions per day and leverages crowdsourcing, turnkey manufacturing, and distribution to bring products to market at a rapid pace. More than 100,000 submissions across more than 175 countries have provided a deep database background against which it could quickly qualify the prospect of likely commercial success.

First Quarter 2019 performance: Growth continues to be driven by Successful Product Launches and Efficiencies Across Platform

- Edison Nation is expecting Q1 2019 revenues to increase by over 68% to $5.7 million, compared to Q1 2018 revenues of $3.4 million.

- This increase is primarily due to the consolidation of several businesses acquired in the second half of 2018, as well as several successful Q1 2019 products launches.

- To that end, the Company has consolidated all businesses into three operating units, which allows it to leverage each distinct area of focus. These units focus on idea development, product launches, and sales optimization.

- This yet another strong quarter growth clearly highlights the continuous success of product launches and the integration of Edison’ end-to-end product solution into one cohesive platform.

Looking ahead: Edison spent 2018 successfully building the engine, and the management believes that the Company is well positioned to create significant value for its shareholders. Now that there is clear visibility with regard to where the Company is heading, the management anticipates leveraging its unique platform at a much-accelerated pace, which will allow them to bring products to market at light speed and rapidly grow sales across all the channels.

Upcoming presentation: Edison will present at the 9th Annual LD Micro Invitational in Los Angeles, California. The investor conference is being held June 4-5, 2019 at the Luxe Sunset Boulevard Hotel. Edison Nation management will host one-on-one meetings throughout the day on Tuesday, June 4 and Wednesday, June 5, 2019

The key and unique differentiating factor of the Company:

- Edison Nation is a vertically integrated and full-service product development and manufacturing company, providing a risk mitigated platform that connects innovators with companies

- A scalable business model with concept proven out of scale – 25M unit sales representing over $250M in product sales

- High barrier to entry with crucial relationships in the areas of sourcing, manufacturing, marketing, and distribution

- Acquisition of Edison Nation allows for crowdsourced product innovation, creating a strong engine for future growth

- Growth opportunities – Acquisition of promising products / micro-brands from the Edison Nation pipeline using a combination of cash and stock along with continued growth of licensed product manufacturing through Fortune 500 partners such as Disney, Marvel and Universal Studios Experienced leadership team with high insider ownership (47%)

- Completed successful REG A+ offering, raising $6.5M in gross proceeds at $5/share

Visualization of the business Model: Partnering with Innovators To Bring New Products To Market

Robust operational risk profile:

The strong base of enterprise customers:

Compelling and robust Industry perspective:

- Crowdfunding Is Now “Main Stream,” Disrupting Legacy NPD Cycles

- Also, due to the ongoing US/China Trade War, there is an added focus on MADE IN AMERICA.

- E-commerce is driving the brick-and-mortar “retail apocalypse” at internet speed –

- Global e-commerce: 14% CAGR; $4.9 trillion by 2021 –

- US chain store closures have surpassed great recession levels

- Product innovation and immediate or “next day delivery” gratification is driving consumer desire for next-generation products without the need for brand recognition

- The EDNT Business Model Is Designed To Take Advantage Of Online Marketplace And Crowdfunding Momentum For EDNT’ Future Growth.

Recent announcements:

- On May 30, 2019, Edison Nation announced that it had launched a new product line exclusively for its theme park and entertainment customers, which include Disney Parks and Resorts, as well as Universal Studios, among others.

- The newly announced product line includes all-new branded products, such as an Avatar Light Up Wood Sprite and Star Wars Baton and Shield Set, exclusively developed for Disney Parks and Resorts; a Monsters Inc. interactive flashlight for Tokyo Disney; and a Jimmy Fallon microphone for Universal Resorts.

- May 21, 2019, Edison announced plans to expand its ‘Made in America’ and socially responsible product offering across several new product lines.

- Given the encouraging success of its Pirasta ‘Made in America’ product line, EDNT decided to explore how Edison Nation could generate significant revenues while contributing to the US economy and achieving new sustainability goals.

- As per management, this exciting idea of American made, environmentally conscious products with a defined social mission makes a tremendous amount of sense, not only from a brand image perspective, but from a financial perspective as well. This concept resulted in the birth of the company’ Trillion Tree Creations and EcoQuest Products brands, as well as the expansion of its already successful Pirasta brand.

Financial results: Fourth Quarter and Full Year 2018 Financial Results

- Revenue in the fourth quarter of 2018 increased 10.5% to $3.7 million, compared to $3.4 million in the fourth quarter of 2017. Revenue in 2018 increased 10.3% to $16.5 million, compared to $15.0 million in 2017. The increase in revenue was primarily due to the addition of new products and customers in the consumer products segment.

- Pro forma revenue for 2018 was $21.0 million, which includes revenue from Cloud B and Edison Nation LLC, for the full year of 2018. Gross profit increased by 135.7% to $1.4 million in the fourth quarter of 2018, compared to $0.6 million in the fourth quarter of 2017.

- Gross profit increased by 28.8% to $5.1 million in 2018, compared to $3.9 million in 2017. The gross profit margin was 37.6% in the fourth quarter of 2018, compared to 17.6% in the fourth quarter of 2017. The gross profit margin was 30.8% in 2018 compared to 26.4% in the year prior. The increase is primarily a result of the increase in licensing and service revenues.

- Net loss totaled $1.4 million, or ($0.17) per basic and diluted share in the fourth quarter of 2018, compared to net income of $0.1 million, or $0.03 per basic and diluted share in the fourth quarter of 2017. Net loss in 2018 totaled $5.3 million, or ($1.28) per basic and diluted share, compared to net income of $1.5 million, or $0.51 per basic and diluted share in 2017. The increase in net loss is primarily attributable to $4.2 in non-cash expenses.

- Liquidity and financial flexibility: Cash and cash equivalents at December 31, 2018, totaled $2.1 million, as compared to $2.1 million at September 30, 2018. The Company believes it currently has sufficient funds to meet its working capital, debt service, and capital expenditure requirements for at least the next 12 months.

Risk Factors & Stock Influences:

- The company’ ability to maintain liquidity/financial flexibility to support its ongoing and upcoming ventures.

- The overall performance of the economy and the impact of the impact of the US-China trade outlook.

- Company’ performance in several of its key channels in 2019 will set the stage for the next phase of EDNT’ growth in corporate evolution.

- The Company operates in a rapidly changing fast paced industry. Therefore, it must continue to launch, innovate, and enhance products to maintain its substantial market share.

Stock Performance

- On Friday, May 31, 2019, EDNT closed at $3.49 (up by over 0.29 %), with a volume 24,296 shares exchanging hands. Market capitalization is $19.824 million. The current RSI is 44.43

- In the past 52 weeks, shares of EDNT have traded as low as $2.35 and as high as $11.63

- At $3.49, shares of EDNT are trading below its 50-day moving average (MA) at $4.34 and below its 200-day moving average (MA) at $5.41

- The present support and resistance levels for the stock are at $3.16 & $3.66, respectively.

Disclaimer

ALL STOCKS INVOLVE RISKS AND THE POSSIBILITY OF LOSING ALL OF YOUR INVESTMENT. PLEASE CONSIDER ALL RISKS BEFORE INVESTING.

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. TNS LLC has been compensated fifteen thousand dollars cash via bank wire by World Wide Holdings LLC for one week of our coverage and reporting on EDNT. We have not been compensated for the mention of ESCA, YETI and FNKO. TradersNewsSource.com owners, operators and employees do not hold any form of equity in any of the public companies mentioned in this article. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

TNS LLC is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission or FINRA. TNS LLC is not a Broker/Dealer and does not engage in high frequency trading.