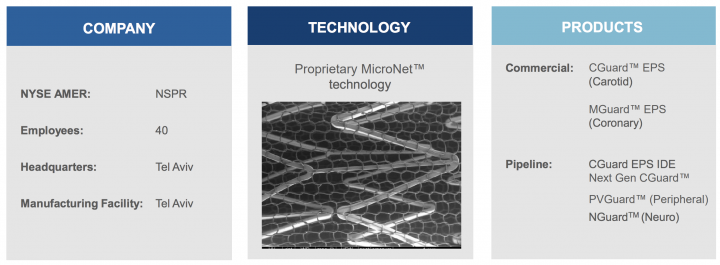

InspireMD, Inc. (NYSE: NSPR) is a biotechnology play that has developed a portfolio of medical device assets using a proprietary technology called MicroNet. It’s an alternative construction of a traditional stent, which removes some of the blockage risk associated with the current standard of care devices in the space.

The company’s business looks extremely promising as it continues to implement the strategy it set out last year. InspireMD continues to grow its sales with its distributors and expanding its distribution network globally. During the fourth quarter, and into 2019, NSPR has continued to add to the body of growing evidence suggesting that its novel best-in-class CGuard Embolic Prevention System which it refers to as CGuard EPS, provides safer and more durable benefits to patients suffering from carotid artery disease.

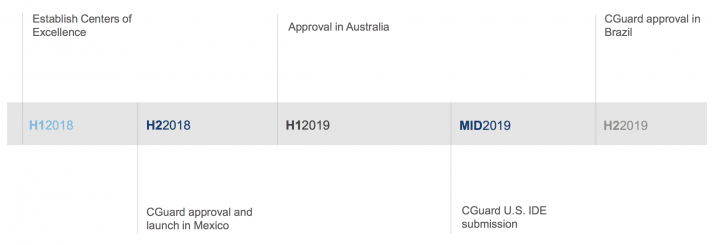

Recent/Upcoming Anticipated Milestones.

- Continued clinical trial/registry results

- Continued market execution and revenue growth

The company recently announced preliminary unaudited sales results for the fourth quarter of 2018.

- CGuard™ EPS featured in the transmission of two successful live cases at Leipzig Interventional Course (LINC) 2019

- Also, at LINC 2019, interim data from the first 50 patients in the investigator-initiated SIBERIA trial that the company presented. Patients treated with CGuard™ EPS had a significantly lower incidence of multiple lesions in the brain (16% vs 44%), large cerebral lesions (24% vs 40%) and major adverse clinical events after 30 days (0% vs 12%) as compared to patients treated with a conventional open-cell carotid stent

- Also, at LINC 2019, Prof. Christian Wissgott presented his findings using CGuard™ EPS with SmartFit™ technology to address a range of carotid artery diameters with a single diameter size device. SmartFit™ readily adapts to different artery diameters even over a range of diameters in the same patients with a single diameter sized device

- Announced the publication of a meta-analysis involving dual-layered and mesh-covered carotid devices in JACC: Cardiovascular Interventions concluding that carotid artery disease (CAD) patients treated with mesh-covered devices experienced a lower 30-day minor stroke rate than rates reported in other widely cited studies, such as CREST and ACT 1, for patients treated with both carotid endarterectomy (CEA) and those treated with conventional carotid stents

- During the 45th Annual Symposium on Vascular and Endovascular Issues, Techniques, Horizons Symposium (VEITHsymposium), updated positive efficacy and safety data from the ongoing PARADIGM-Extend and IRONGUARD 2 studies were presented

- Received regulatory and reimbursement approval of CGuard™ EPS in Australia and Mexico and regulatory approval in South Africa.

- Recently opened the third “Center of Excellence” for vascular surgeons in Rome Italy with Prof. Speziale that included participation by key physicians from Italy, Poland and Slovenia.

- Pre-clinical testing remains on track for U.S. IDE submission mid-2019

- Year-to-date CGuard™ EPS revenue through December 31 was $3.0 million compared to $1.9 million for the comparable period in 2017, an increase of 55%

- $9.4 million of cash as of December 31, 2018

Analysts’ views:

These positive developments in the company business and market profile speaks for itself and prove that “CGuard™ EPS is gaining widespread acceptance among key opinion leaders (KOLs) that treat carotid artery disease. The analyst tracking the stock believes that this growing interest, combined with its specialized distribution network, positions the company for an even stronger sales growth as it supports company’ expansion into the mainstream group of users that include vascular surgeons, interventional cardiologists, interventional radiologists, and interventional neuroradiologists.

Given the safety advantages of the CGuard™ EPS, it has the potential to become the standard of care and to be regarded by physicians as a relatively safer alternative to vascular surgery for patients with carotid artery disease, thereby expanding the addressable market opportunity.

Furthermore, from a market reach perspective, in addition to USA, Europe, NSPR is now establishing an incredibly strong foothold in Asia, evidenced by improving demand trends from India, Hong Kong, Taiwan, Australia, New Zealand, and Vietnam. For these and other reasons, the company is at a critical inflection point as it enters into 2019

The company’s Board of Directors has approved a one-for-fifty reverse stock split of its common stock that is scheduled to become effective after trading closes on March 29, 2019. Beginning on April 1, 2019, the Company’s common stock will trade on the NYSE American on a split adjusted basis.

About the Company: InspireMD seeks to utilize its proprietary MicroNet™ technology to make its products the industry standard for embolic protection and to provide a superior solution to the fundamental clinical issues of current stenting in patients with a high risk of distal embolization, no reflow and major adverse cardiac events.

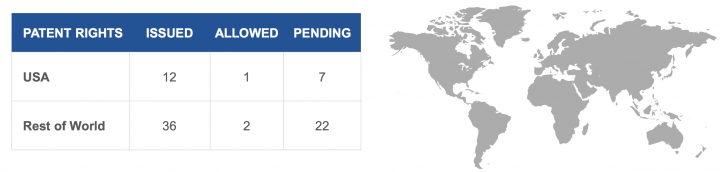

Growing Intellectual Property Portfolio:

- Proprietary platform technology supported by a robust intellectual property portfolio

- Continue to strengthen and broaden patent protection globally to enable future pipeline products

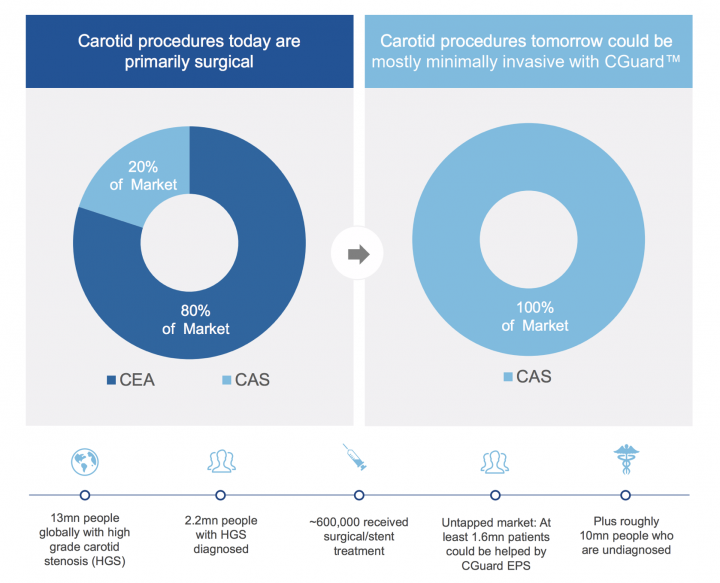

key Demand Drivers and overall market size:

- Focused on the deadly and catastrophic problem of stroke that is estimated to cost the healthcare system more than $34BB annually in the US alone

- A Billion Dollar Market Opportunity – The current addressable market for CGuard TM EPS is estimated to be $1BB with the potential to further expand into the 1.6MM patient population which is diagnosed but not treated

- New commercial strategy beginning to take hold as indicated by sales growth over the last year

- Product pipeline to support continued growth in all geographies, including the United States

- There’s an enormous commercial opportunity for InspireMD in its products which can deliver significant value for its investors and make a substantial improvement in the care of patients.

- 2.2M diagnosed with carotid artery disease

- 2017: ~600,000 patients with high-grade carotid stenosis (HGCS) require interventions for CAD

- At present, ~80% are surgically treated with carotid endarderectomy (CEA)

- At a price of $1,650 per stent, the addressable market is more than $1 billion

Financials:

Revenue: Revenue for the twelve months ended December 31, 2018 was $3,601,000 compared to $2,761,000 for the same period in 2017. The increase was primarily due to an increase in sales of CGuard™ EPS as a result of the company’ transition from its prior exclusive distribution partner for most of Europe to local distributors, continued focus on expanding existing markets such as Germany, Russia, Spain and Italy, and expansion into new geographies such as India.

Profitability:

The Company’s gross profit for the twelve months ended December 31, 2018, was $995,000 compared to $585,000 for the same period in 2017. Gross margin increased to 27.6% in the twelve months ended December 31, 2018, from 21.2% in the same period in 2017, driven mainly by higher volume of sales and more efficient utilization of fixed manufacturing resources.

Net loss for the twelve months ended December 31, 2018, totaled $7,240,000, or $0.33 per basic and diluted share, compared to a net loss of $8,438,000, or $34.98 per basic and diluted share, for the same period in 2017.

Liquidity: As of December 31, 2018, cash and cash equivalents were $9,384,000, compared to $3,710,000 as of December 31, 2017.

Key risk factors and potential stock drivers:

- The long-term results of the company’ New commercial strategy

- The company is still at a nascent stage of operations. The outlook may be revised to ‘Positive’ in case of a sustainable increase in the company’s revenue and profitability along with efficient working capital management, resulting in an improvement in its financial risk profile.

- The company has $9.3 million worth of cash on hand, and if sales do not pick up drastically, the company could dilute over the near to medium term.

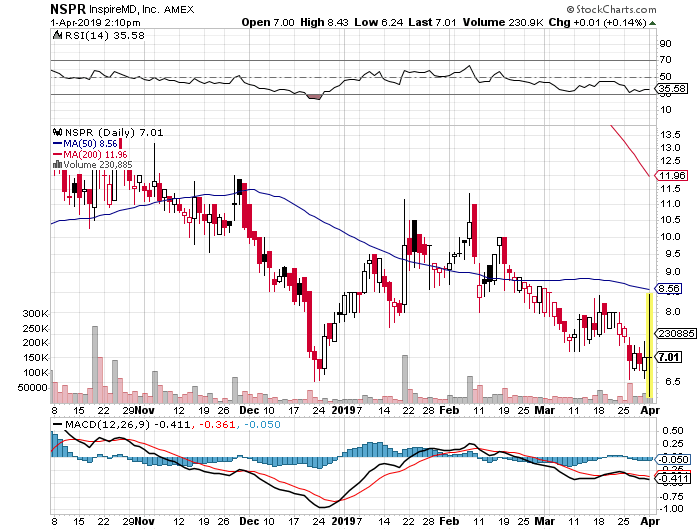

Stock Chart:

Comments:

A recent reverse stock split at rate of 1 for 50 has changed the numbers below-

- On Friday, March 29th, 2019, NSPR closed at $0.14, with an above average trading volume of 1.25M shares exchanging hands. The current RSI is 35.37

- In the past 52 weeks, shares of NSPR have traded as low as $0.13 and as high as $1.64

- At $0.14, shares of NSPR are trading below its 50-day moving average (MA) at $0.17 and below its 200-day moving average (MA) at $0.24

- The present support and resistance levels for the stock are at $0.12 & $0.15 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.