Laredo Petroleum, Inc. (NYSE: LPI) operates as an independent energy company in the United States. It operates through two segments, Exploration and Production; and Midstream and Marketing. The company engages in the acquisition, exploration, and development of oil and natural gas properties; and the transportation of oil and natural gas primarily in the Permian Basin in West Texas, as well as rig fuel, natural gas lift, and water delivery and takeaway services.

Approximately 85% of the Company’s gross operated volumes are gathered directly on pipe by Laredo Midstream Services, LLC (“LMS”)-owned crude oil gathering system or on Medallion-owned gathering, substantially eliminating the need for trucking the Company’s crude production. The small portion of crude that is trucked is delivered into either Laredo or Medallion-owned truck stations, shortening the average trip from tank battery to delivery to approximately 20 miles.

In the second quarter of 2018, Laredo contracted firm transportation to the Gulf Coast on the Gray Oak crude oil pipeline, which is expected to begin transporting crude oil in the fourth quarter of 2019. The agreement allows the Company to transport 25,000 gross barrels of oil per day (“BOPD”) in the first year of operation and 35,000 gross BOPD in the remaining six years of the contract. Laredo currently transports 10,000 gross BOPD to the Gulf Coast on the Bridgetex crude oil pipeline and, when combined with the Gray Oak volumes, a substantial portion of the Company’s gross production will be priced in the Gulf Coast when the Gray Oak pipeline begins service.

Operations

Laredo’s Permian activities are centered on the east side of the basin approximately 35 miles east of Midland, Texas in primarily Glasscock and Reagan Counties. Today, Laredo has over 140,000 gross acres (with a majority of it being contiguous) and of which 85% is HBP.

The principal focus of Laredo’s horizontal drilling activities is an oil play (that also includes a liquids-rich natural gas component) that involves both the Wolfcamp (Upper, Middle, and Lower) and the Cline formations. Secondary targets include the Spraberry, Canyon, Strawn and ABW intervals. In total, over 12 viable landing points have been identified throughout the stratigraphic section (~ 4,500 ft. thick) as being prospective for development.

About

Laredo Petroleum, Inc. operates as an independent energy company in the United States. It operates through two segments, Exploration and Production; and Midstream and Marketing. The company engages in the acquisition, exploration, and development of oil and natural gas properties; and the transportation of oil and natural gas primarily in the Permian Basin in West Texas, as well as rig fuel, natural gas lift, and water delivery and takeaway services. As of December 31, 2017, it had assembled 124,843 net acres in the Permian Basin; and had total proved reserves of 215,883 thousand barrels of oil equivalent. The company was formerly known as Laredo Petroleum Holdings, Inc. and changed its name to Laredo Petroleum, Inc. in December 2013. Laredo Petroleum, Inc. was founded in 2006 and is headquartered in Tulsa, Oklahoma.

Analysts

17 Wall Street analysts have issued ratings and price targets for Laredo Petroleum in the last 12 months. Their average twelve-month price target is $12.1667, suggesting that the stock has a possible upside of 56.59%. The high price target for LPI is $15.00 and the low-price target for LPI is $9.50. There are currently 2 sell ratings, 11 hold ratings and 4 buy ratings for the stock, resulting in a consensus rating of “Hold.”

Date Brokerage Rating Price Target

8/21/2018 Williams Capital Hold $10.00

8/5/2018 Piper Jaffray Companies Buy $14.00

8/2/2018 Bank of America Underperform $12.00 ➝ $11.00

Source: marketbeat.com

Guidance

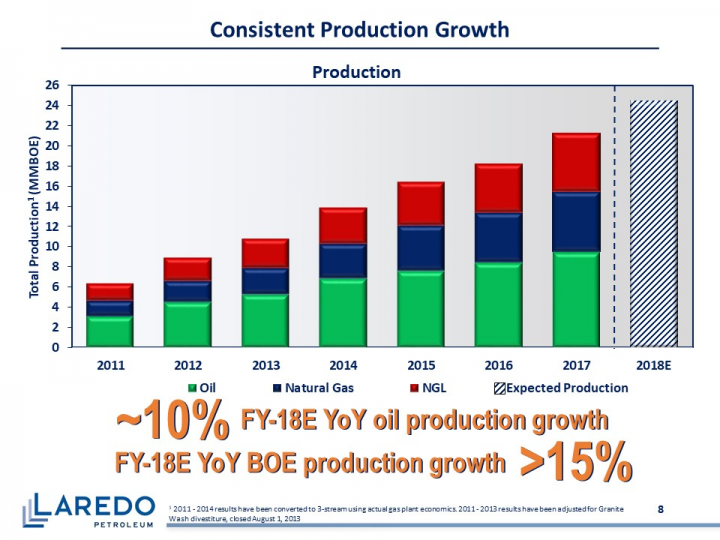

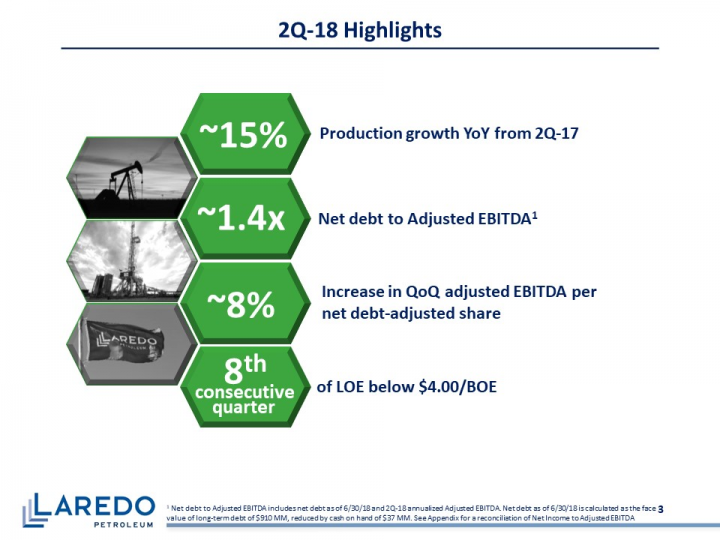

The Company is increasing its anticipated full-year 2018 total production growth guidance to greater than 15% and reiterating previously issued oil production growth guidance of greater than 10% as compared to 2017. The table below reflects the Company’s guidance for the third quarter of 2018.

Total production (MBOE/d) 71.0

Oil production (MBO/d) 29.1

Price Realizations (pre-hedge):

Crude oil (% of WTI) 86%

Natural gas liquids (% of WTI) 33%

Natural gas (% of Henry Hub) 47%

Operating Costs & Expenses:

Lease operating exp ($/BOE) $3.65

Midstream expenses ($/BOE) $0.15

Transport and marketing ($/BOE) $0.80

Production and ad valorem taxes 6.25%

General and administrative expenses:

Cash ($/BOE) $2.60

Stock-based comp ($/BOE) $1.55

Depletion, dep and amort ($/BOE) $8.30

Financial review

Laredo reported second-quarter net income of $33.5 million.

The company said it had net income of 14 cents per share. Earnings, adjusted for non-recurring costs, came to 25 cents per share.

The company posted revenue of $351 million in the period.

Q2 expenses were $256 million.

The company reported $36.6 million in cask at the end of the quarter.

Stock influences and risk factors

Strong oil and natural gas prices may act as a continuing catalyst for the company shares.

Oil, NGL and natural gas prices are volatile. The continuing and extended volatility in oil, NGL and natural gas prices has affected, and may adversely affect, the business.

To the extent they are unable to obtain future hedges at attractive prices or derivative activities are not effective, cash flows and their financial condition may be adversely impacted.

Federal and state legislation and regulatory initiatives relating to hydraulic fracturing and water disposal wells could prohibit projects or result in materially increased costs and additional operating restrictions or delays because of the significance of hydraulic fracturing and water disposal wells in their business.

Stock chart

On Friday, September 7, 2018, LPI shares were at $7.77 on traded volume of 2.7 million shares. The current RSI (14) is 33.95

At $7.77 per share, LPI is trading below its 50 DMA and its 200 DMA of $8.89 and $9.36 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.