Largo Resources Ltd. (OTCQX: LGORF) is a Toronto-based strategic mineral company focused on the production of vanadium flake, high purity vanadium flake and high purity vanadium powder at the Maracás Menchen Mine located in Bahia State, Brazil. The Company’s common shares are also listed on the Toronto Stock Exchange under the symbol “LGO.”

The fundamental situation for vanadium is rapidly improving, with V2O5 prices continued to edge higher, which puts the company in a good starting position for the third quarter. Management continues to remain very optimistic for the year ahead as the Company begins the construction phase of the Maracás Menchen Mine expansion plan which will see capacity increase at the mine from a total of 800 tonnes produced per month of V2O5 to 1,000.

On July 17th, 2018, the company provided guidance on its expected revenue for the three-month period ending June 30, 2018, anticipating revenue of between CDN$99 million and CDN$107 million, a new quarterly revenue record for the Company.

The Company’ anticipated Q2 2018 revenue would represent an increase of between approximately 176.6% and 198.9% over Q2 2017 if realized. The increase to revenue is expected to be primarily driven by the upward movement in vanadium pentoxide (“V2O5”) pricing and increased production when compared to Q2 2017. The price range of V2O5 for the last week of Q2 2018, as reported by the European Metal Bulletin, was US$17.00/lb V2O5 to US$17.50/lb V2O5 as compared to US$5.35/lb V2O5 to US$6.00/lb V2O5 for the last week of Q2 2017.

Management anticipates that the overall benefit of the increased revenues will be tempered by increases in corresponding royalty expenses and certain mostly non-cash foreign exchange adjustments anticipated to be required as a result of the weakening of the Brazilian Real against the USD given that certain of the Company’s debts in Brazil are denominated in USD. The Company expects the foreign exchange loss in Q2 2018 to exceed the loss recorded in Q2 2017.

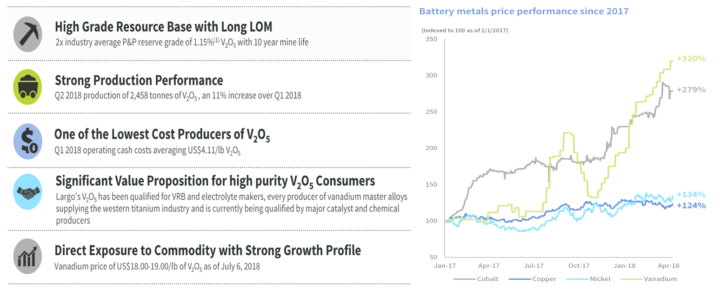

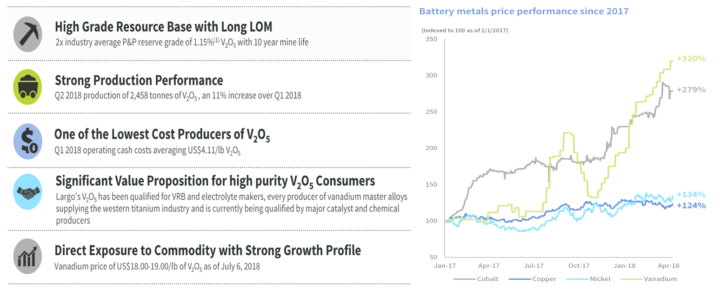

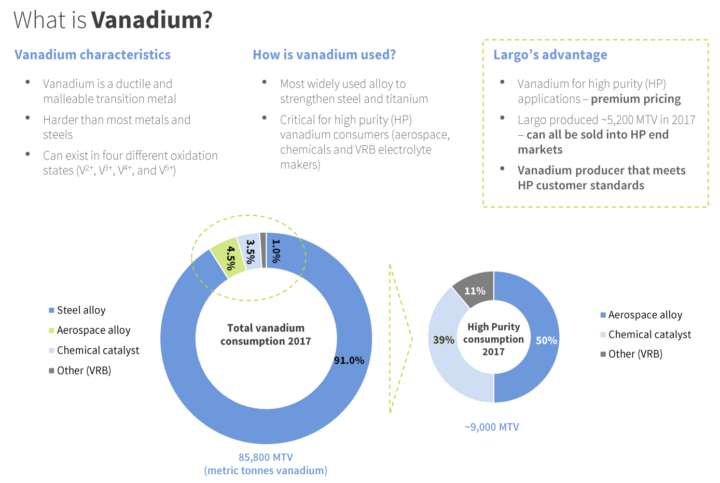

Analysts tracking the stock believes that Largo has up-and-coming prospects, as it is the only pure-play producer of the Vanadium globally. In the recent past, Vanadium has featured as the best performing “battery metal” and has outperformed all other ‘battery metals’ due to its unique characteristics and a deep-seated shift in demand/supply dynamics. Over the years the metal has proven to be a disruptive force of electric vehicles, clean energy storage and fuel efficiency driving ‘battery metal’ fundamentals.

Key and unique differentiating factor of Largos and Vanadium:

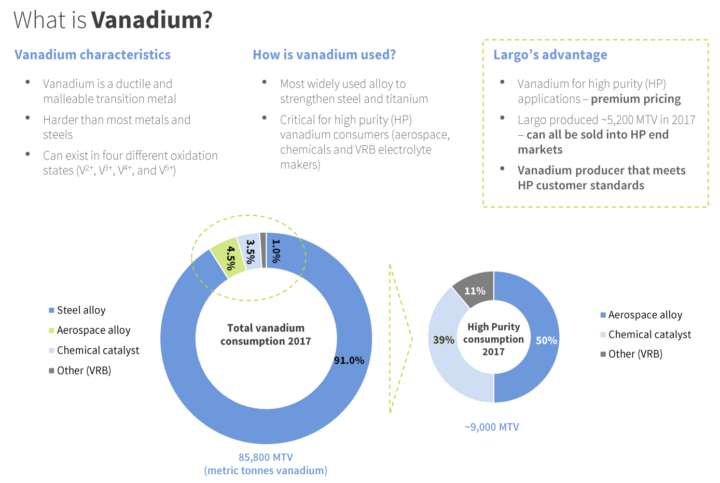

About Vanadium:

Other recent announcement/highlights:

- Closure of secondary Offering: On July 24th, the company announced the closing of the secondary offering of 60,000,000 common shares and an additional 9,000,000 common shares (offering price of $1.40 per share) representing the exercise in full of the over-allotment option which was exercised on closing by the underwriters.

- Credit Facility Repayment Consent: On July 13, 2018, the Brazilian National Economic and Social Development Bank provided its consent for the early repayment of the Company’s credit facility with them. The receipt of this consent is a condition to the release from escrow of the first tranche of the net proceeds from the Company’s recently completed offering of senior secured notes (the “Note Offering”) of approximately US$143 million which have, to date, been held in escrow (the “Escrowed Funds”).

The Company anticipates making a payment using the released portion of the Escrowed Funds of USD$84,138,367 to BNDES on or about July 23, 2018, representing payment in full of amounts owing to BNDES. Once repayment in full of the BNDES has occurred, the remaining Escrowed Funds will be released from escrow and used to repay the Company’s remaining credit facilities held with a syndicate of commercial lenders on or about July 31, 2018.

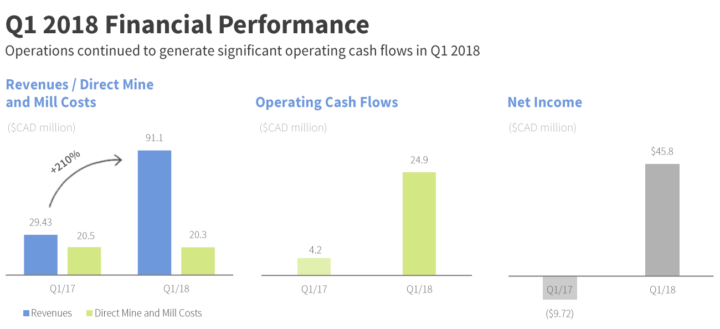

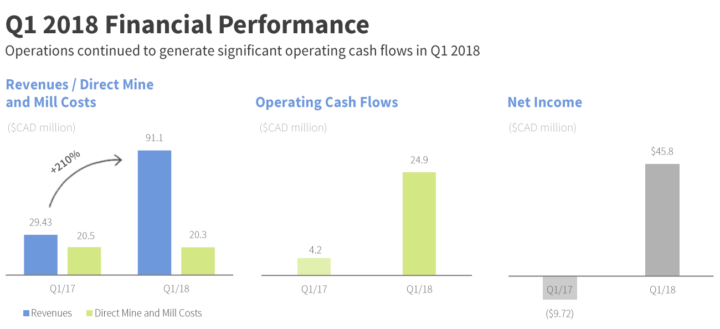

Latest Quarter Financial position:

- Revenues of $91.0 million in Q1 2018, a 210% increase over Q1 2017.

- Profitability: The Company recorded quarterly net income of $45.8MM in Q1 2018 and earnings per share of $0.09 as a result of an increased vanadium price environment.

- Liquidity and financial flexibility: Cash Balance at March 31st, 2018 of $50.2 million and restricted cash of $4.4 million.

2018 Guidance: The management believes that Elevated commodity prices and consistent production rates to drive exceptional operational performance in 2018.

Key risk factors and potential stock drivers:

- Continuing increases in the market price of vanadium could act as a catalyst for company shares.

- The company’ business and operational risk profile are susceptible to fluctuations in metal prices and the end-user industry, and exposure to the risk of product concentration.

- The Company’ Revenue and profitability have strong linkages to the overall economic growth and demand in the end user industry. Fluctuations in Vanadium prices and the downturn in the end-user industry would continue to impinge growth.

Stock Chart:

Comments:

- On Monday, July 30th, 2018, LGORF was at $1.58 on volume of 603K shares exchanging hands. Market capitalization is $798 million. The current RSI is 65.34

- In the past 52 weeks, shares of LGORF have traded as low as $0.38 and as high as $2.05

- At $1.58, shares of LGORF are trading above its 50-day moving average (MA) at $1.37 and above its 200-day moving average (MA) at $1.10

- The present support and resistance levels for the stock are at $1.50 & $1.62 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.