Monster Digital (NASDAQ: MSDI) develops, markets, and distributes Monster-branded products for use in high-performance consumer electronics, mobile products, and computing applications.

On October 19, 2017, the Company received a letter from the NASDAQ indicating that the Company’s non-compliance with the $2.5 million stockholders’ equity requirement will serve as a basis for delisting the Company’s common stock unless the Company timely requests a hearing before the Nasdaq Hearings Panel.

MSDI plans to timely request a hearing before the Panel. At the hearing, Monster Digital will present its plan to evidence compliance with the bid price and stockholders’ equity requirements and request an extension of time within which to do so. The Panel has the discretion to grant the Company an extension through no later than April 17, 2018.

The Company’s common stock will continue to trade on Nasdaq under the symbol “MSDI” at least pending the ultimate conclusion of the hearing process. Monster Digital intends to provide a further update when additional relevant information becomes available.

Previously, on July 3, 2017, Monster Digital and Innovate Pharma entered into a merger agreement under which Monster Digital and Innovate will combine in a stock-for-stock transaction. Monster Digital’s wholly owned subsidiary, Monster Merger Sub, Inc., will merge into Innovate with Innovate becoming a wholly-owned subsidiary of Monster. Innovate’s reverse merger with Monster Digital is expected to close later this year, according to an announcement from both companies. The combined company will be called Innovate Biopharmaceuticals Inc., the companies stated, and will be led by Innovate’s management team. It’s board is expected to be made up of seven members from Innovate.

The combined company will advance a late-stage drug for celiac disease into expected Phase 3 clinical trials. Innovate believes celiac disease is a significant unmet medical need as a gluten-free diet is the only current therapy. In celiac disease, ingestion of gluten supposedly causes disruption or opening of the tight junctions. In prior trials, Innovate has been able to confirm that INN-202 can act as a strict junction regulator, which helps restore leaky or open junctions to a normal state.

Topline data is expected to hit press early 2019, meaning new entity could have an asset at-market within 18 months in the US. That’s a significant opportunity for Innovate and with this merger Monster shareholders are part of this exposure as well. In fact, for Monster shareholders, a 9% exposure in a late stage development biotechnology company like Innovate is an extremely positive development. On the other hand, the merger gives Innovate a quick and easy access to public capital.

From an industry perspective, there are over 3 million Celiac patients, each in the US and Europe with another 15 million in the rest of the world. If approved, it will be the only asset on the market in the US in this indication. No other drug has come up with something like this before, and it’s a huge market with significant offtake potential.

There’s also another asset targeting ulcerative colitis (UC) for which phase II trials should begin in 2018. This one’s relatively behind the 202 assets, but it still has upcoming catalysts and therefore upside potential for the combined entity. Which is why, the analysts covering MSDI believes that combined entity is relatively much more valuable than the 100% of standalone MSDI. The company currently has an average rating of “Buy” and an average near-term price target of $2.40.

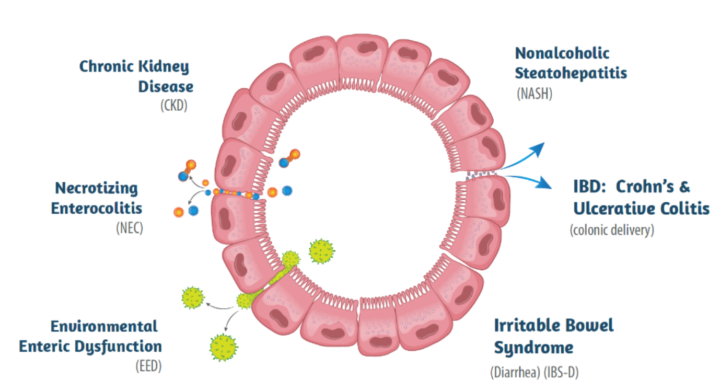

About Innovate: Innovate is a clinical-stage biotechnology company focused on developing novel medicines for autoimmune and inflammatory disorders.

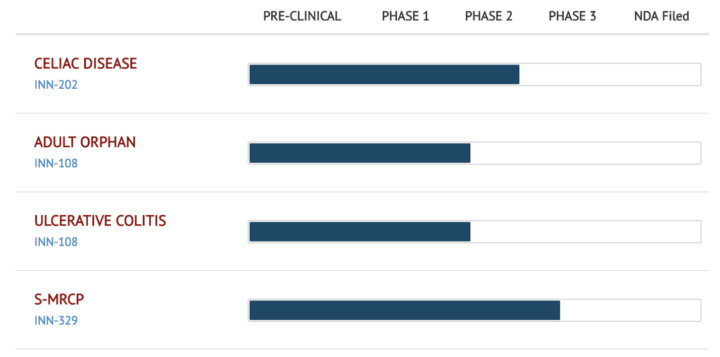

Pipeline overview and present stage:

INN-202: Larazotide Acetate or INN-202 is Innovate’s leading drug candidate for Celiac Disease (CeD) entering phase 3 clinical trials.

- Market Opportunity: Celiac Disease remains an unmet need with no drugs approved. There are more than 3 million Celiac patients in the US and a similar number in Europe with another 15 million in the rest of the world. Larazotide would be the first drug ever approved for Celiac Disease by 2018.

- Regulatory Status: Larazotide is the only late-stage drug entering phase 3 trials with a path forward agreed upon with the FDA. After several clinical trials involving more than 800 patients and a phase 2b trial with 342 patients, Larazotide has been shown to be safe and effective in a “real world setting” for Celiac patients. Phase 3 trials are expected to begin later in 2017.

INN-108: is a novel oral small molecule therapeutic for Ulcerative Colitis (UC). Ulcerative Colitis is one of the two type of Inflammatory Bowel Diseases (IBD) which plagues up to 1.4 million individuals in the US alone. More than 80% of patients present with the mild to moderate form of Ulcerative Colitis.

- Market Opportunity: For primary treatment of mild to moderate Ulcerative Colitis various formulations of 5-ASA/mesalamine are used. Currently approved treatments include various brands such as Lialda® by Shire Pharmaceuticals and Asachol HD® by Allergan. Sales of 5-ASAs add up to about $2 billion in the US alone.

- Regulatory Status INN-108 has successfully completed a phase 1 trial in the US in 24 subjects. INN-108 is in process of entering phase 2 trials for mild to moderate UC and an adult orphan indication.

Secretin stimulated MRCP (S-MRCP): is a non-invasive, ionizing, radiation-free assessment of the pancreaticobiliary system. The current secretin formulation is not labeled for MRCP.

- Market Opportunity: The approximately 100,000 diagnostic ERCPs and 400,000 abdominal MRIs performed annually in the United States are a large addressable market for INN-329 as an add-on for image enhancement and cost savings.

- Regulatory status: The recently published phase III study of S-MRCP vs. MRCP alone vs. Endoscopic Retrograde Cholangiopancreatography (ERCP) elucidates the clinical advantages of using secretin in combination with MRCP.

Key Currently Anticipated Milestones for Innovate:

- Q4’17/Q1’18 – commence enrollment in expected Phase 3 clinical trials of larazotide acetate (INN-202) for celiac disease.

- Late 2017 – advance R&D collaborations and applications of larazotide in in vitro and pre-clinical models including other autoimmune/inflammatory diseases.

- 1H’18 – commence Phase 2 clinical trials for INN-108 for mild to moderate ulcerative colitis.

- First half 2019 – expected collection of pivotal data from expected Phase 3 clinical trials of larazotide acetate in celiac disease.

Merger fine prints: Under the terms of the Merger Agreement, pending shareholder approval of the transaction, Innovate shareholders will receive newly issued shares of Monster in exchange for Innovate stock. The exchange ratio is based on a pre-transaction valuation of $60 million for Innovate’s business and $6 million for Monster’s business. As a result, current Monster shareholders will collectively own approximately 9% and Innovate stockholders will collectively own approximately 91% of the combined company on a pro-forma basis.

MSDI’s second-quarter results:

Net sales for the three months ended June 30, 2017, decreased approximately to $187,000 from $1683,000 for the three months ended June 30, 2016.

The net loss was approximately $1.6 million, or $(0.19) per basic and diluted share, compared to a net loss of approximately $1.2 million, or $(0.33) per basic and diluted share, for the three months ended June 30, 2016.

Key risk factors and potential stock drivers:

- There’s plenty of upside on the back of upcoming catalysts. The positive outcome of the same could be a medium to longer term driver for the company.

- The cash burn is expected to rise for the combined entity. Therefore, financial flexibility is critical for the operations to continue in the planned manner.

- Also, there is a high likelihood of company needing incremental funding. With this, there’s always the potential for dilution, and this could translate into near-term weakness if and when it happens.

- Biotech space in itself is a high-risk sector due to uncertainties associated with the novel drug development. Therefore, favorable outcome of the upcoming catalyst is necessary for the stock to retain its momentum. Any adversities related with the same could impinge the stock performance significantly.

Stock Chart:

On Monday, November 6, 2017, 2017, MDSI is trading at $0.66 (+3.53%) on volume of 381K shares exchanging hands. Market capitalization is $5.20 million. The current RSI is 54.77

- In the past 52 weeks, shares of MDSI have traded as low as $0.40 and as high as $3.51

- At $0.66, shares of MSDI are trading below its 50-day moving average (MA) at 0.70 and below its 200-day MA at $0.91

- The present support and resistance levels for the stock are at $0.53 & 0.58 respectively.

Welcome to Traders News Source

Our track record speaks for itself…

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 small cap alerts alone! These are just three examples from over two dozen winners this year.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletter. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

Big Opportunities Trading Small Cap Stocks

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.