Traders News Source has an Exciting New Technology Report Coming Monday October 17th, 2022

Summary

- CSI Communications recently completed a triangular reverse merger with HEC, E-Gear, and Pineapple Energy.

- A challenging capital structure and little to no public data has left the surviving company, Pineapple Energy, with a freefalling stock price.

- The current price is offering investors willing to dig a little deeper an opportunity to invest in a fast growing, micro-cap, solar energy company with a number of upcoming catalysts.

Eloi_Omella/E+ via Getty Images

CSI Communications (“JCS”), founded in 1969 in Minnesota, was originally a local telecommunications company. After expanding their product offerings and becoming a more nationally recognized brand, the company went public in 1981. Most recently, the company has been involved in two main segments – Electronics and Software (“E&S”) and Services and Support (“S&S”).

However, like many companies during the Covid-19 pandemic, JCS struggled. And, over the past couple years (after losing a major client), the company shifted gears and began winding down its operations in favor of selling off core real estate holdings and operating divisions. Then, in March of 2021, the company announced a merger with Pineapple Energy.

The terms of the deal stated that any existing JCS shareholder would be entitled to a CVR that would act as a vehicle to distribute the proceeds of any real estate and JCS legacy assets and earnouts upon consummation of the merger. For me, the risk-reward was compelling enough to initiate a sizeable position before the merger was approved and sell-out after the CVR record date was determined. And, that is what I did. However, now that the stock (henceforth referred to as “PEGY”) has cratered following the merger, the company is worth another look. So, let’s take a look at Pineapple Energy.

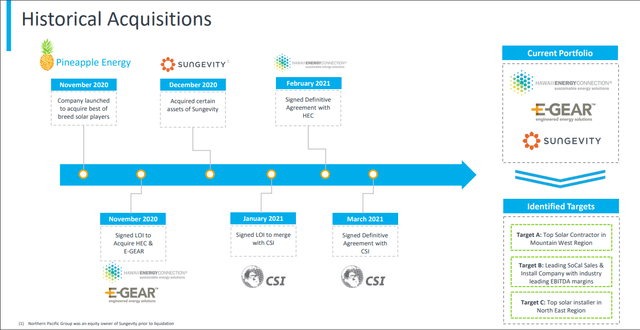

Founded in November 2020, PEGY was created by industry experts as a vehicle to acquire, expand, and refine solar companies across the nation. Over the course of the proceeding two years, PEGY acquired certain Sungevity assets, HEC, and E-Gear. Now, with the closing of the reverse merger, they have their eyes set on a number of strong solar companies with industry leading EBITDA margins across Southern California, the Mountain West Region, and the North East.

Pineapple History (Proxy Statement)

(Source: Company Presentation)

Lead by Kyle Udseth, a McKinsey, Netflix, and Sunrun alumnus, PEGY will look to bridge the gap between lead generation, best-of-breed technology, and traditional solar. As they expand, they will look to provide a full suite of end-to-end customer engagement via installation, servicing, and financing.

As a deep value oriented special situations investor, I initially became interested in JCS as a liquidation play, however looking underneath the hood, it seems PEGY is an extremely compelling growth story with a heads I win, tails I probably don’t lose much setup.

The Math

Prior to the merger, after conducting a reverse stock split, JCS had 2,429,341 shares outstanding. As part of the merger agreement, the company issued 5,006,245 shares to the various unit holders of Pineapple Energy. Therefore, following the merger, the newly formed company – PEGY – had 7,435,586 shares outstanding.

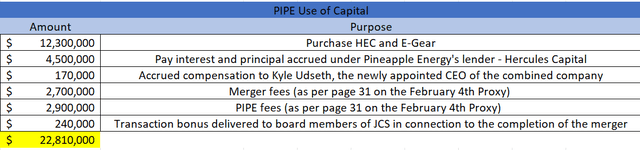

Concurrently with the JCS merger, Pineapple Energy raised $32MM via a PIPE offering and completed an acquisition of substantially all of the assets of Hawaii Energy Connection (“HEC”) and E-Gear – two Hawaii-based solar companies. $12.3MM of the $32MM PIPE were used for the HEC and E-Gear acquisition. Additionally, 6,250,000 class B units were issued to the HEC and E-GEAR owners (Chris DeBone & Steven Goodmere) and investment bankers in exchange for all assets of the growing Hawaii-based solar companies. These units were transferred 1-for-1 for shares of PEGY once the JCS merger completed.

The PIPE investors, in exchange for the $32MM capital infusion, received 32,000 Series A Convertible Preferred Stock, which are initially convertible into 2,352,936 shares of common stock at $13.60/share, and 5-year warrants to purchase an additional 2,352,936 shares at an initial exercise price of $13.60/share.

The usage of the PIPE money can be found in the below table:

PIPE Investment (Author Compiled from Various Filings)

(Source: Author compiled information from various filings)

Valuation

As of writing this article, PESY trades for roughly $3 a share. With 7,435,586 common shares outstanding, the total market cap for the company stands at $22,306,758. Including the cash remaining from the PIPE and the $3,000,000 Hercules loan outstanding, PESY’s Enterprise Value stands at $16,116,758. But, the question is, how much is this company really worth?

Well, let’s start with HEC and E-Gear.

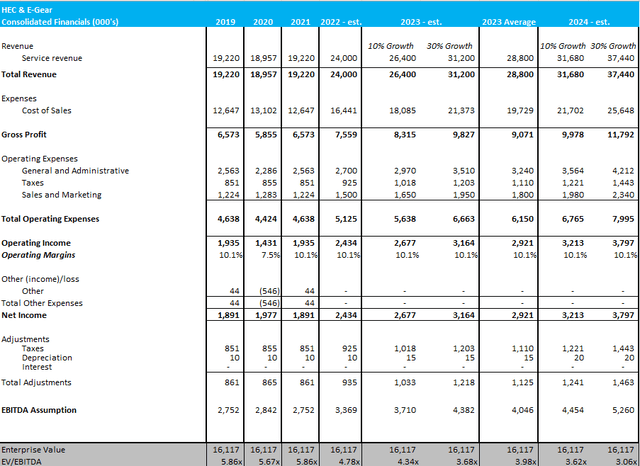

HEC and E-Gear

As per data provided by the recent press release, HEC and E-Gear are expected to generate $19.1MM – $19.3MM in annual 2021 revenue. They expect that figure to grow roughly 20% to 30% in 2022 to a range of $23MM – $25MM. Although depreciation, EBITDA margins, and long-form growth projections weren’t provided, below I summarize my best-guess assumptions as to where these two businesses could be headed over the next 1 – 2 years.

HEC and E-Gear Financials ((Source: 2019 / 2020 data provided on page 23 of the February 3rd Proxy Statement. 2021 / 2022 revenue provided by the press release linked above))

(Source: 2019 / 2020 data provided on page 23 of the February 3rd Proxy Statement. 2021 / 2022 revenue provided by the press release linked above)

Based on my estimates, PEGY trades at a 4.78x EV/EBITDA multiple on just HEC and E-Gear alone. If the 20% – 30% growth continues, at $3/share, the stock trades at a 3.06x EV/ 2023 EBITDA.

However, it gets better!

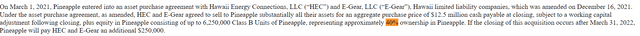

As per page 196 of the February Proxy statement, HEC and E-Gear only represent less than half of the combined company. The statement notes that in exchange for purchasing all assets of HEC and E-Gear (and assuming all liabilities), Pineapple Energy also issued “6,250,000 Class B units of Pineapple, representing approximately 40% ownership in Pineapple.” See excerpt below:

Excerpt ((Source: Page 196, February Proxy))

(Source: Page 196, February Proxy)

Knowing that HEC and E-Gear make up 40% of the value of PEGY, we can extrapolate the potential value of the entire entity.

If HEC/E-Gear Estimated 2022 EBITDA is $3.369MM, the entire entity would have EBITDA of $8.42MM

If HEC/E-Gear Estimated 2023 EBITDA is $3.710MM, the entire entity would have EBITDA of $9.275MM

If HEC/E-Gear Estimated 2024 EBITDA is $4.454MM, the entire entity would have EBITDA of $11.14MM

However, it is important to note, that unlike HEC and E-Gear, Pineapple is not an established company. While the 2023 and 2024 EBITDA figures could be accurate, 2022 figures are likely not. It is unlikely Pineapple will have significant cash flow – if any – immediately as they begin their ramp-up phase in late 2022 and early 2023.

So, where does this leave us?

For just an implied $16MM enterprise value, the market is valuing HEC and E-Gear at a 4.78x EV/EBITDA figure based on my estimate of 2022 figures. However, when you factor in the entire company, which consists of the newly branded Pineapple Energy name (which consists of 115,000 untapped Sungevity and Horizon leads and an all star team of industry experts), the market is valuing the enterprise at a whopping 1.75x EV/ 2023 EBITDA ($16.117 2022 EV /$9.275MM 2023 EBITDA).

And, after diving through the Proxy, valuation firm, Craig Hallum, came to a similar conclusion – albeit even more aggressive.

See below table:

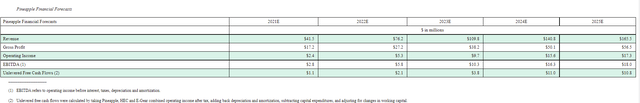

Pineapple Projections ((Source: February Proxy, Page 92))

(Source: February Proxy, Page 92)

Based on company estimates, Craig Hallum believes PEGY will earn $10.3MM in 2023 EBITDA – not far off from my $9.275MM estimate. They also estimate that by 2024, the run-rate EBITDA will be over 100% of today’s implied enterprise value!

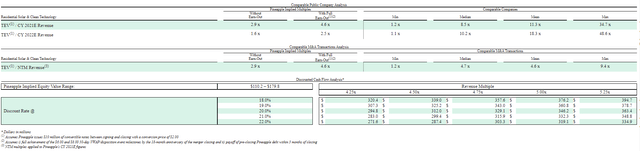

Based on their estimates, they believe the implied equity value of the combined company is likely somewhere between $110MM and $170MM – more than 5x greater than the current market cap. See below table:

Pineapple Valuation ((Source: February Proxy, Page 89).)

(Source: February Proxy, Page 89).

But, what about the equity dilution? Let’s dig deeper.

Dilution

As mentioned above, the PIPE investors currently hold preferred shares and warrants convertible into common shares. However, those shares are deeply out of the money. With zero liquidation preference, the preferred shares can only convert into common at a price of $13.60 – 4x higher than the price today. Similarly, the warrants can only convert at $13.60. Essentially, as an equity investor today, because the warrants and preferred shares are so deeply out of the money, you get access to the $32MM PIPE and the growth potential of Pineapple, HEC, and E-Gear, all for a massive 75% discount!

Additionally, their are a series of earnouts eligible to legacy Pineapple owners. The following is taken from the March 2nd press release.

In addition to the base consideration, Members of Pineapple may receive additional shares pursuant to an earnout. Additional shares of common stock will be issued to Members of Pineapple upon the occurrence of the following milestones:

- If Pineapple discharges its Permitted Indebtedness of $22.5 million within three months of closing, then the Members of Pineapple will be entitled to an additional 3.0 million shares.

- If, within two years of closing, the CSI common stock achieves a 30-day VWAP (volume weighted average price) of at least $6.00 per share, the Members of Pineapple will be entitled to receive up to 0 million shares of common stock (to be increased to 5.0 million if CSI consummates the “Dispositions,” (as defined below) by the 18-month anniversary of the closing).

- If, within two years of closing, the CSI common stock achieves a 30-day VWAP of at least $8.00 per share, the Members of Pineapple will be entitled to receive up to an additional 0 million shares of common stock (to be increased to 5.0 million if CSI consummates the “Dispositions” by the 18-month anniversary of the closing).

(Source: March 2nd press release)

As of now, all three of the earnout criteria are up in the air. As far as I know, Pineapple hasn’t secured additional convertible debt funding concurrent with the merger closing. Although they are entitled to raise additional funds (and they will likely do so given that they have their eye on a handful of potential targets), it is hard to determine how much they will raise and what that’ll look like from a dilution standpoint. If Pineapple absolves their right to financing, members of Pineapple will be entitled to an additional 3MM shares.

At this point, the other two bullet points detailing the earnout possibilities can be completely disregarded for PEGY investors today. Why? Because the press release references a hurdle price of $6 and $8 – both of which are prices before the stock reverse split. Now, the stock is trading at $3 and would need to hit $24 and $32, respectively, in order to trigger the additional shares. An investor today would gain nearly 8x his/her money before suffering any dilution from an earnout.

Conclusion

I believe a speculative position in PEGY at today’s price is a prudent investment decision (read: not financial advice). PEGY is an unproven solar origination and battery installation company run by industry experts that are looking to rollup attractive opportunities. No one seems to care about the company because it used to be JCS and the opportunity to arbitrage the CVRs has ended. Now, what’s left is a company that has been left for dead and forced sold by most investors that simply do not, nor care to, own a solar-related company. At today’s price, an investor is buying a fast growing company in an expanding industry that quite literally might earn its entire market cap in EBITDA in 2-3 years. Not only that, but insiders own a substantial portion of the equity and are highly incentivized to increase the equity value by at least 500% to make their investment worthwhile.

Risks

This is an illiquid, micro-cap, stock in an industry that is highly saturated. The team has not proven itself and thus has a large amount of execution risk. On top of that, if PEGY does not grow quick enough, it will be forced to raise debt and equity to further its growth and stop the bleeding. Position accordingly and always do your own due diligence.

Traders News

***The owners and operators of this website have NOT been compensated in any way for conducting or distributing this article/interview. Furthermore, we do not hold any form of equity in the publicly traded company/companies or cryptocurrency mentioned above***