Overview

Rite Aid Corporation (NYSE: RAD) is a national drugstore chain operator. As of March 4, 2017, the company operated 4,536 stores in 31 states and the District of Columbia. The company also operates 99 clinics through its wholly-owned subsidiary, RediClinic. Rite Aid was originally incorporated in 1968 and is headquartered in Camp Hill, Pennsylvania.

Operations

Rite Aid has two primary operating segments, Retail Pharmacy and Pharmacy Services:

Retail Pharmacy consists of Rite Aid retail stores, RediClinic, and Health Dialog. The primary source of revenue for retail stores is prescription drugs, while the balance is made up of ‘front-end’ items which include over-the-counter medications, cosmetics, household items, food and beverages, and seasonal items. The company also has a large portfolio of private brand items.

RediClinic is a Houston-based retail clinic operator that was acquired by Rite Aid in April 2014. The clinics are staffed by nurse practitioners and physician assistants who are trained and licensed to treat common conditions and provide preventative services.

Health Dialog is a provider of health coaching and analytics acquired by Rite Aid in April 2014. Health Dialog helps health plans, employers, and physician groups improve healthcare quality while reducing costs.

Pharmacy Services consists of the company’s EnvisionRx subsidiary, a full-service pharmacy benefit management company. In addition to administering prescription drug programs, EnvisionRx offers mail-order and speciality pharmacy services. It also services patients enrolled in Medicare Part D.

Walgreens Merger Update

Traders News Source previously covered the proposed merger with Walgreens on April 26, 2017 (https://tradersnewssource.com/rite-aid/). We discussed the many delays the deal had already experienced, and what was likely to happen next.

On May 8, 2017, Walgreens and Rite Aid certified compliance with the Federal Trade Commission’s (FTC) request for additional information regarding the proposed merger. In short, this move forces the FTC to decide within 60 days whether to allow the transaction to proceed or sue to block it.

There has been plenty of speculation leading up to the July 7, 2017, deadline. Last Friday, The Capitol Forum reported that the staff of the FTC is preparing a recommendation to bring a lawsuit to halt the deal. It seems that the FTC is skeptical that Fred’s will become an effective competitor, even after it acquires the Rite Aid stores Walgreens plans to divest.

The primary concern is that Fred’s, Inc. (FRED), slated to buy hundreds of Rite Aid stores, larger footprint would not be able to replicate Rite Aid’s market presence. Other issues include the fact that Fred’s has struggled to remain profitable, posting a net loss of $36.5 million for the most recent quarter, and the significant debt it would need to incur to finance the store acquisitions.

On June 9th, Fred’s announced it has entered into a second amended and restated commitment letter with a number of banks. The agreement pertains to the company’s debt financing plans as well as the proposed acquisition of 865 stores, certain intellectual property and certain other tangible assets of Rite Aid Corporation RAD, announced in Dec 2016. Fred’s can forge ahead with the $950 million deal only after the proposed merger of Rite Aid and Walgreens Boots Alliance, Inc. materializes.

Past failed divestiture plans in the retail sector may also spur the FTC to action. In multiple instances, companies that agreed to divest assets in order to receive FTC approval later bought them back when the acquirer went bankrupt. These transactions included Hertz/Dollar Thrifty (2012) and Albertsons/Safeway (2015).

The Capitol Forum also reported that the agency has added more staff to the case, and FTC lawyers have deposed executives and collected signed declarations from industry participants.

Fourth-Quarter Earnings Review

Revenue for the 14 weeks ended March 4, 2017, totaled $8.5 billion, a three percent increase from the fourth quarter of 2016. This was driven primarily by the Retail Pharmacy segment which benefitted from an extra week of sales (versus 13 in the prior year). Average weekly revenue decreased to $610.1 million from $636.2 million in 4Q 2016.

Despite the extra week of sales, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) decreased to $264.3 million (or 3.1 percent of revenue) for the 14 weeks ended March 4, 2017, down from $383.0 million (or 4.6 percent of revenue) for the 13 weeks ended February 27, 2016. This decline was attributable to a reduction in prescription reimbursement rates and lower prescription volumes.

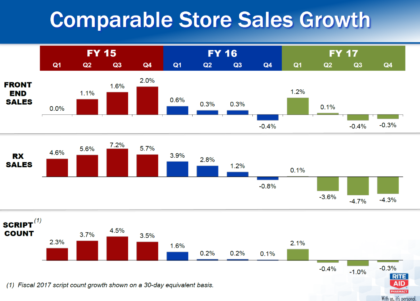

Comparable store sales growth has been negative across all categories for the past two quarters. As shown in the chart below, trends have generally been negative since the beginning of FY 2016.

Rite Aid’s net loss for the quarter was $21.1 million, and $3.2 million on an adjusted basis. The adjusted net loss of $0.00 per share beat the consensus analyst estimate of $0.02 per share.

With respect to the balance sheet, Rite Aid has significant debt obligations. At March 4, 2017, the company’s long-term debt and lease financing obligations (less current maturities) totaled $7.3 billion. Subsequently, the company’s debt-to-EBITDA ratio at March 4, 2017, increased to 6.4, up from 4.9 one year earlier.

Stock Performance

On June 9, 2017, prior to the Capitol Forum report, shares of Rite Aid traded as high as $3.58. The stock subsequently fell to $2.94 before closing at $3.00. Shares were little changed after the weekend and closed at $3.02. Due to growing pessimism regarding the Walgreens merger, the shares have fallen more than 20 percent since we covered Rite Aid in April.

Following are selected analyst ratings and price targets:

| Analyst | Firm | Rating | Price Target | Date |

| Charles Rhyee | Cowen | Outperform | $4.70 | 5/31/2017 |

Analysis

As we noted previously, Rite Aid is no longer trading on fundamentals but rather the likelihood of the Walgreens merger being completed. The recent Capitol Forum report is certainly discouraging, but does not guarantee that the FTC will utlimately sue to block the deal.

If the staff of the FTC recommends litigation (as they appear poised to do), Acting Chairman Maureen Ohlhausen and Commissioner Terrell McSweeny must both vote in favor of a lawsuit. In the event of a tie vote, no action will be taken and the merger will be able to proceed as planned.

It is still unclear how the commissioners intend to vote. Ms. Ohlhausen has previously pledged to make the FTC more business friendly and support President Donald Trump’s promise to reduce government regulation. However, she has also discussed supporting the President’s pledge to combat high drug prices which is a significant anticompetitive concern in the Walgreens deal.

Amazon could make the high drug prices concern a moot point. Last month, in a CNBC report, http://www.cnbc.com/2017/05/16/amazon-selling-drugs-pharamaceuticals.html, it was reported that Amazon was taking steps toward their goal of breaking into the pharmacy market. The CNBC report states:

Each year, Amazon holds an annual meeting to discuss whether it should break into the pharmacy market, said a source familiar. This year, it is getting more serious and Amazon is looking to hire a general manager. Industry experts say this could be a multibillion market opportunity for the e-commerce company. The company recently started selling medical supplies and equipment in the U.S., and is hiring for its “professional health care program” to ensure that the company is meeting regulatory requirements.

In the United States alone, more than 4 billion prescriptions are ordered every year. In 2015, patients, insurance companies and other payers spent an estimated $300 billion on prescription drugs. If competition really does bring products closer to cost; Amazon has the potential to be a disruptive force in the pharmacy industry.

Summary

The negative news regarding the Walgreens merger report sunk Rite Aid’s stock price 15 percent. While it seems that the FTC staff is preparing to recommend a lawsuit to block the transaction, both commissioners must vote against the deal. Otherwise, the waiting period will expire and the companies will be free to combine.

Cowen analyst Charles Rhyee believes that due to the significant potential synergies, Walgreens will pursue the transaction even if the FTC attempts to block it. He calculates the standalone value of Rite Aid to be $2.00 per share.

Should the FTC vote to sue and block the deal, Rite Aid could drop further. Given the current price, the stock could fall to Cowen’s estimated value of $2.00, or perhaps even lower.

Should the merger happen, as we noted in our April report; while there is significant uncertainty surrounding the deal, Walgreens CEO Stefano Pessina is firmly committed to the transaction and working with the FTC. This could push the offer price for Rite Aid shares toward the area of $6.50 per share.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.