SunPower Corporation (NASDAQ: SPWR) provides a diverse group of customers with complete solar solutions and services. Residential customers, businesses, governments, schools, and utilities around the globe rely on SunPower’s more than 30 years of proven experience.

In its first quarter 2018 results, SunPower announced record performance in US Residential Business and the Company exceeded revenue, margin, and adjusted EBITDA Forecasts; SPWR’ strong first quarter performance was driven by solid execution in all markets while prudently managing expenses. Financially, Company’ efforts remain focused on improving cash flow, managing its working capital and executing on its restructuring initiatives. Furthermore, with its asset monetization plans on track and continued cost control, SPWR is well positioned to retire its $300 million converts in June as well as having the resources to fund its growth plans this year.

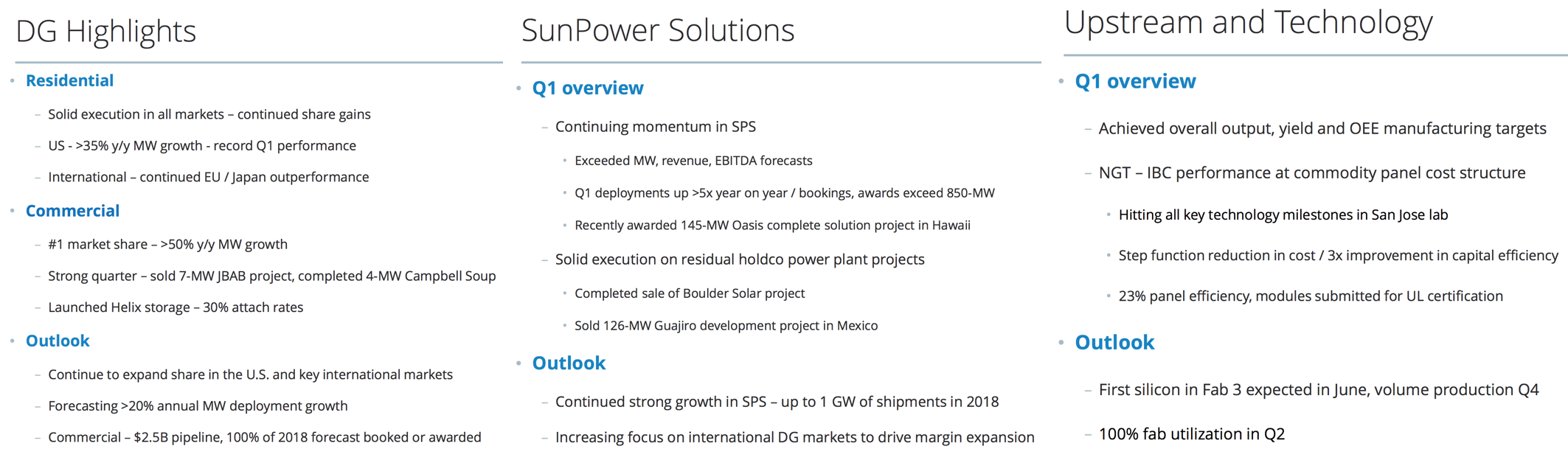

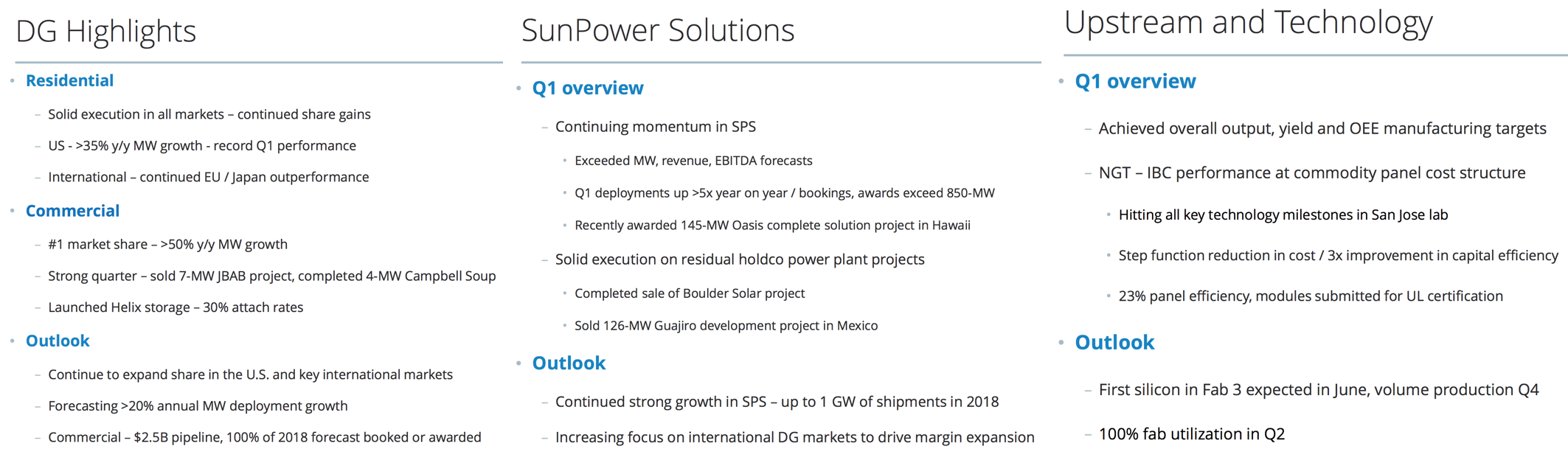

Key highlights for the first quarter 2018:

More recently on June 12th, the company announced a definitive agreement for Enphase Energy to acquire SunPower’s microinverter business for $25 million in cash and 7.5 million shares of Enphase common stock. The transaction is expected to close at the end of the third quarter of 2018. As a result of this strategic partnership, SunPower looks forward to benefitting from Enphase’s expertise, allowing it to continue containing costs, leveraging R&D support and helping streamline the company’s business priorities.

Also, the company is expected to benefit from California’ approval plan to require rooftop solar power for new homes. On May 9th, California became the first U.S. state to require solar panels on nearly all new homes built after Jan. 1, 2020. The solar power industry already provides 16% of California’s electricity, the highest rate in the U.S., and employs more than 86K workers and this move is a boost for the solar industry.

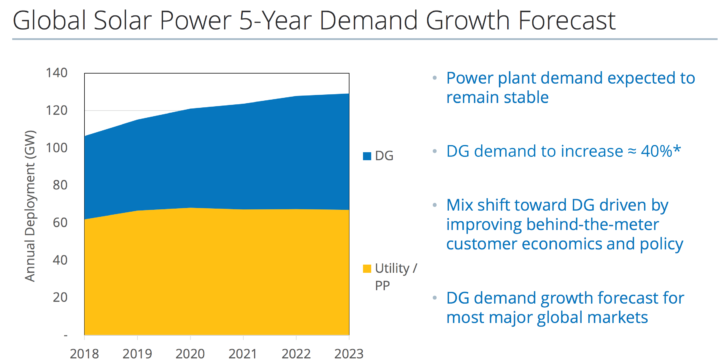

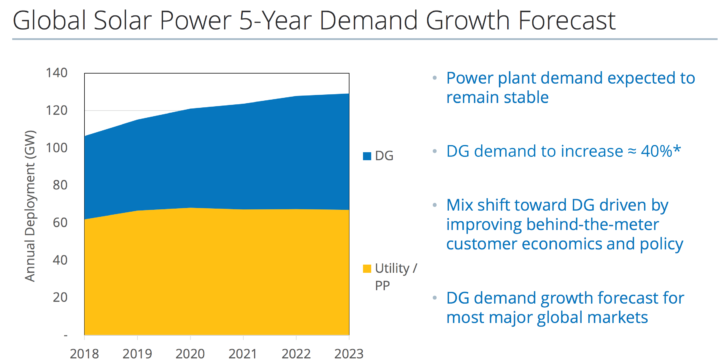

Analysts tracking the stock believes that solar industry is at a critical inflection point and is likely to grow at a significant pace over the medium term. This is expected to produce substantial growth opportunities for players like SunPower. Therefore, led by its robust financial flexibility and improving residential and commercial earnings, SPWR is expected to be one of the major beneficiaries of this upswing in the industry.

Considering all this, the company is in an extremely favorable risk-reward position, and there is enormous potential which we are yet to see in terms of share appreciation of the company.

About the company: As one of the world’s most innovative and sustainable energy companies, SunPower (NASDAQ: SPWR) provides a diverse group of customers with complete solar solutions and services. Residential customers, businesses, governments, schools, and utilities around the globe rely on SunPower’s more than 30 years of proven experience. From the first flip of the switch, SunPower delivers maximum value and superb performance throughout the long life of every solar system. Headquartered in Silicon Valley, SunPower has dedicated, customer-focused employees in Africa, Asia, Australia, Europe, and North and South America.

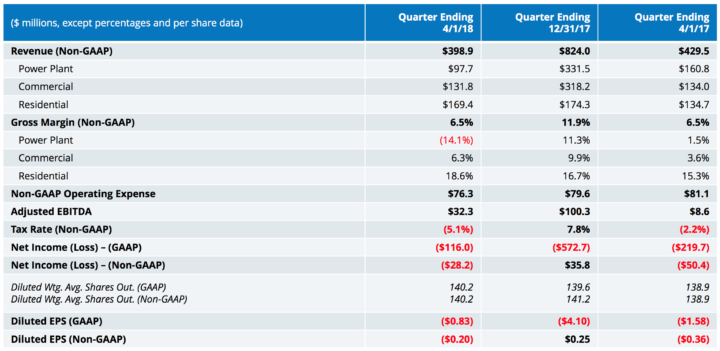

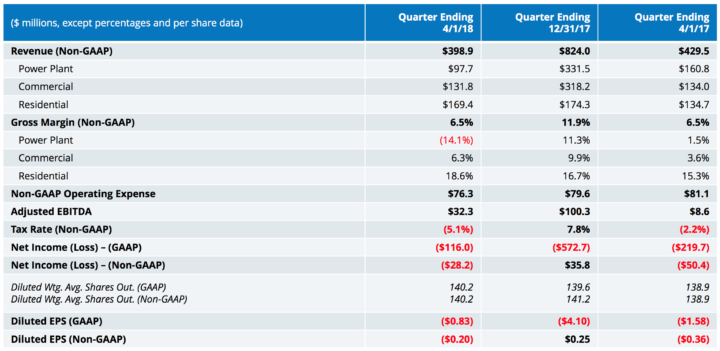

First Quarter 2018 Results:

Revenue: SPWR’ total revenue increased by 19% during the three months ended April 1, 2018 as compared to the three months ended April 2, 2017 , primarily due to an increase in the proportion of capital leases placed in service relative to total leases placed in service under its residential leasing program within the United States, as well as stronger sales of solar power systems and components to customers in its Residential Segment in North America; stronger sales of solar power projects in its Commercial Segment in North America, and stronger sales of solar power component and systems in Power Plant Segment in Europe.

Profitability: Net loss decreased by $89.3 million in the three months ended April 1, 2018, as compared to the three months ended April 2, 2017. The decrease in net loss was primarily driven by an increase in gross margin of $55.8 million, primarily as a result of decreased product costs driven by cost savings initiatives that the company implemented.

Liquidity: As of April 1, 2018, SPWR had unrestricted cash and cash equivalents of $260.7 million as compared to $435.1 million as of December 31, 2017.

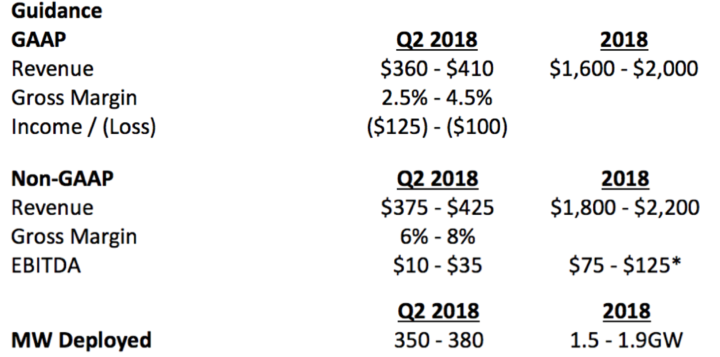

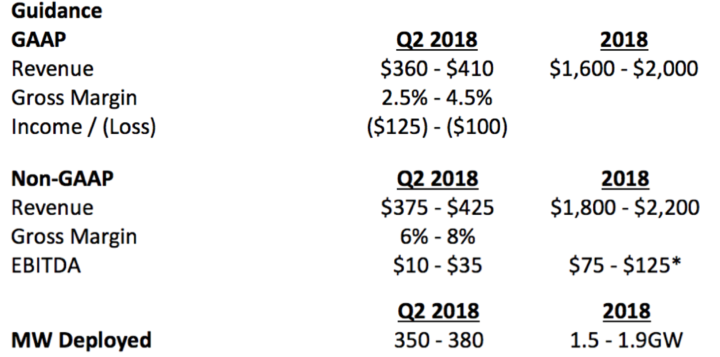

Guidance for the near term:

Key risk factors and potential stock drivers:

- Uncertainty concerning U.S. residential solar market, which has slowed the overall demand situation in some of the states.

- Offtake from prospective solar homeowners & easy availability of solar-plus-generator financing for the consumers.

- Progress on growing EBITDA, improving liquidity and timely debt repayments.

- Impact of new capital raise & potential dilution in its equity shares and its effect on stock prices.

- The global Solar industry is highly competitive and still at a nascent stage. SPWR currently faces competition from other sources of power and players explicitly operating in the solar industry.

- Another key risk is related to government regulations, SPWR’s business is subject to extensive government regulation.

Stock Chart:

Comments:

- On Monday, June 18th, 2018, SPWR was at $7.74, on volume of 509K shares exchanging hands. Market capitalization is $1.1 billion. The current RSI is at 42.91

- In the past 52 weeks, shares of SPWR have traded as low as $6.46 and as high as $11.70

- At $7.74, shares of SPWR are trading below its 50-day moving average (MA) at $8.50 and below its 200-day moving average (MA) at $8.05

- The present support and resistance levels for the stock are at $7.29 & $8.17 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.