The Green Organic Dutchman Holdings Ltd. (OTCQX: TGODF) is a research & development company licensed under the Access to Cannabis for Medical Purposes Regulations (“ACMPR”) to cultivate medical cannabis. The Company carries out its principal activities producing cannabis from its facilities in Ancaster, Ont., pursuant to the provisions of the ACMPR and the Controlled Drugs and Substances Act (Canada) and its regulations.

The company has achieved significant accomplishments in a very short span of time and is moving forward at a rapid pace on its aggressive, de-risked business plan and continues to expand all aspects of its business significantly. Most recently, on August 21st, the company announced it signed an agreement to acquire 100% of the issued and outstanding shares of privately-held HemPoland for $7.75M cash and 1,968,323 restricted TGODF shares currently worth $7.75M, which will be escrowed for a term of three years from closing.

Transaction Highlights:

- Acquisition cost of US$7.75 million in cash and 1,968,323 restricted TGODF shares currently worth US$7.75 million (~CAD$20.4 million combined) with an additional US$10.3 million (CAD$13.5 million) cash investment for rapid European expansion

- Additional performance-based incentives of up to US$12 million (CAD$15.8 million) for delivery of US$32 million (CAD$42.1 millions) of EBITDA in fiscal 2021

- European gateway with distribution channels to over 750 million people and sales in over 700 locations across 13 countries

- Premier selling CBD oil brand “Cannabigold,” a recognized leader in the EU and 32,000 kgs of dried flower production from 1,250 acres of cultivation

- Leading innovative organic brand with diverse, novel product offerings and unique IP

As per management, HemPoland is a key component to a number of strategic acquisitions and planned partnerships focused on expanding its global distribution network. This acquisition will significantly add to the Company’s top and bottom line. Gaining market share with CBD products now, in the EU, with over 700 locations allows TGODF to establish immediate brand awareness across all verticals including infused beverages. This is an accretive acquisition and gateway to Europe’s 750 million people accelerating the company’ plan of becoming the world’s largest organic cannabis brand.

Before this on August 15th, the company announced its financial and operational results for the second quarter of fiscal 2018, ended June 30th, 2018. The company reported that the overall construction in Ancaster, Ontario and Valleyfield, Quebec remains on schedule with cultivation expected to commence in the first half of 2019. As per management, Construction is on-going without any time or cost overruns across all jurisdictions and TGODF’ is aggressively building its medical and adult-use brands. The company is investing heavily in consumer research, R&D and simultaneously building both the capability and systems needed to scale as it prepares for the adult-use market rapidly.

From a liquidity and financial flexibility perspective, TGODF continues to maintain a strong balance sheet with cash and cash equivalents of $261,816,000 and continues to execute on management’s vision of becoming the largest organic cannabis brand in the world.

The company is focussed on making strategic additions across all divisions of the Company to execute on its expansion plans. TGODF’s business plan calls for operations in 12 countries on three continents by the end of 2018 with a focus on Europe and Latin America.

The company share price has been on a constant climb in the recent past and has reported an increase in the volumes backed by these announcements laying the strong foundation for revenue visibility and business growth. Considering all these, we remain bullish about the stock.

Description & about the Company:

The Company grows high quality, organic cannabis with sustainable, all-natural principles. TGODF’s products are laboratory tested to ensure patients have access to a standardized, safe and consistent product. TGODF has a funded capacity of 170,000 kg and is building 1,382,000 sq. Ft. of cultivation facilities in Ontario, Quebec, and Jamaica.

The Company has developed a strategic partnership with Aurora Cannabis Inc. (TSX: ACB) whereby Aurora has invested approximately C$78.1 million for an approximate 17.5% stake in TGODF. In addition, the Company has raised approximately C$350 million and had over 20,000 shareholders.

Synergies between Aurora and TGODF:

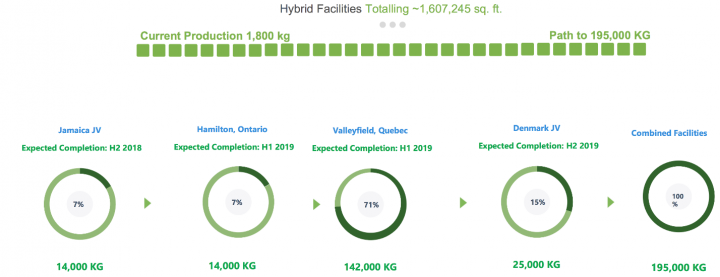

Buildout Timeline of various facilities:

Other Key highlights/achievements of 2018:

- Continued to make steady progress on the construction of its facilities in Ancaster, Ontario and Valleyfield, Quebec, spending a total of $20,734,000 on those initiatives

- Received organic certification from ECOCERT Canada.

- Successfully completed the record-breaking Initial Public Offering on the Toronto Stock Exchange, raising gross proceeds of $132,264,000

- Expanded its shareholder base from 4,000 to over 20,000

- Announced a strategic partnership agreement with Epican Medicinals Limited, a vertically integrated Jamaican cannabis company

- Completed a letter of intent with Denmark’s Queen Genetics/Knud Jepsen A/S, which, if completed will increase TGODF’s total organic-funded capacity to 195,000 kgs

- Announced several strategic licensing agreements with top US brands including Stillwater Brands, Evolabs, and CBx Sciences

- Completed a $25,024,000 bought deal financing which closed on June 26th, 2018

Other Recent Announcements – On September 4th, the company announced that it has agreed with Aurora Cannabis Inc. (“Aurora”) (TSX: ACB) to extend Aurora’s exercise deadline of its first milestone option (the “Milestone Option”) under the TGODF Aurora Investor Rights Agreement by 6 weeks to October 12, 2018. The first Milestone Option entitles Aurora to acquire an additional 8% of the common shares of the Company.

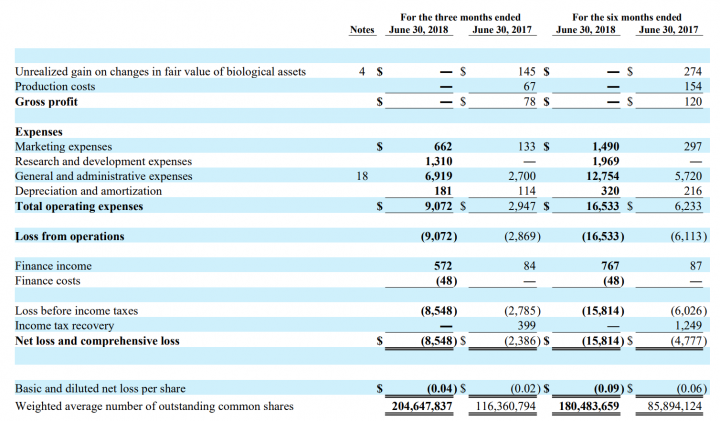

Earnings Review:

Liquidity: The Company maintained a strong balance sheet with cash and cash equivalents of $261,816,000. Cash used in operating activities equated to $7,196,000 for the three months ended June 30, 2018. This spends included strategic initiatives in consumer market research, marketing and brand building in anticipation of the Company’s launch into the recreational market.

Key Stock Influences: Some key influences that might govern future stock price performance include:

- The company operation is still at a pre-commercialisation stage. Therefore, its ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain an extremely critical challenge for the company.

- The company’s business is exposed to regulatory risk and its adverse impact on the overall business risk profile.

- The company’ business is exposed to risk related to competitive pressure, and its revenues may suffer from better products sold by competitors.

- Notwithstanding the recent boom, this is still a very nascent stage space and only time would differentiate between real winners and laggards. As far as choosing an option with a relative advantage is concerned, TGODF is the preferred choice with upside potential.

Stock Performance

- On Friday, September 7th, 2018, TGODF shares closed at $4.90 on an average volume of 571K shares exchanging hands. The current RSI is 58.5

- At $4.7117, shares of TGODF are trading above their 50-day moving average (MA) at $4.36

- The present support and resistance levels for the stock are at $4.30 & $5.20 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.