Company Overview

Turquoise Hill Resources Ltd (NYSE: TRQ) is a Canadian mining and development company. The company’s primary asset is a 66 percent interest in Oyu Tolgoi LLC, which owns a copper-gold-silver mine located in southern Mongolia. The remaining 34 percent the entity is held by the Mongolian government.

Approximately 51 percent of the outstanding shares of Turquoise Hill are held by Rio Tinto plc, the London based mining conglomerate, which also serves as the manager of the Oyu Tolgoi project. Rio Tinto originally invested in Ivanhoe Mines Ltd. (the predecessor of the company) in 2006, and became the company’s controlling shareholder in 2012. Turquoise Hill is headquartered in Vancouver, British Columbia (Canada).

Oyu Tolgoi

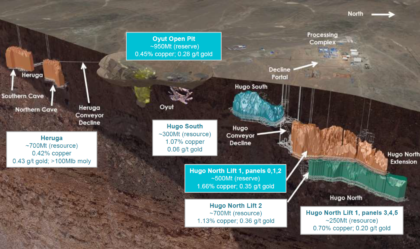

The Oyu Tolgoi mine is located 550 kilometers south of Ulaanbaatar, the capital of Mongolia. Oyu Tolgoi is also approximately 80 kilometers north of the Chinese border. The property’s mineralization consists of porphyry-style copper, gold, silver, and molybdenum in a series of linear deposits. These deposits include the Heruga Deposit, the Oyut Deposit, and the Hugo Dummett deposits.

Oyu Tolgoi was initially established as an open-pit mine, but is currently being developed for underground extraction. Below is a summary of the mine’s various deposits.

Source: Company Presentation

After a series of delays, the company resumed underground construction in May 2016. Turquoise Hill expects to complete two mine shafts by the end of 2017, with three additional shafts being completed between 2018 and 2021. Full production ramp-up is projected to be completed by 2027.

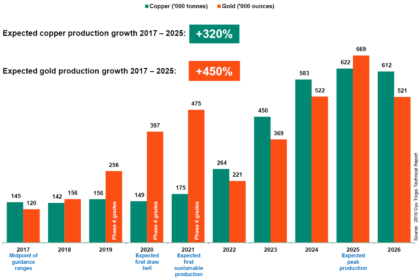

Between 2017 and 2025, Turquoise Hill expects significant production growth according to the following schedule:

Source: Company Presentation

Once Oyu Tolgoi attains peak production, it is expected to be the third-largest copper mine in the world. Turquoise hill estimates that between 2024 and 2036, annual copper production at Oyu Tolgoi will average 500,000 tonnes per year.

Market Outlook

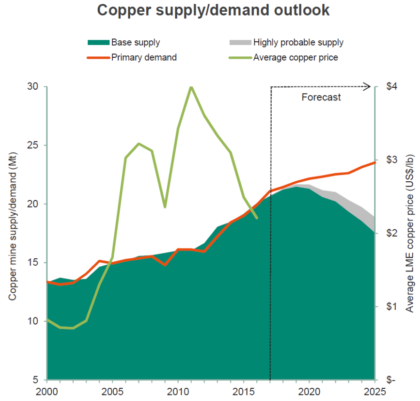

The long-term outlook for copper supports the company’s development plan for Oyu Tolgoi. In the short-term, Turquoise Hill is projecting a temporary copper deficit, driven by attrition at existing mines. The market is expected to balance by 2018, but increasing demand and attrition (due to declining grade) could produce a shortfall by early 2020.

Source: Company Presentation

China is now the largest buyer of gold, and continues to be the largest consumer of copper. Due to its geographical proximity, Oyu Tolgoi is well-positioned to service the Chinese market.

Recent Developments

- On May 18, 2017, it was reported that Rio Tinto had increased its stake in Turquoise Hill by six million shares, signaling a potential acquisition of the 49 percent of the company it does not already own. However, a Rio Tinto spokesman stated that the company had not increased its shareholding in Turquoise Hill since 2012, and it appears that the six million shares were connected to a transaction of another subsidiary, Entree Gold (now Entrée Resources).

- In May 2017, Oyu Tolgoi announced the appointment of Armando Torres as Chief Executive Officer of Oyu Tolgoi LLC. Mr. Torres was previously a managing director at Rio Tinto and will continue to serve as a board member of Oyu Tolgoi LLC.

First Quarter Earnings Review

The company’s revenue for the quarter ended March 31, 2017, totaled $238 million, nearly six percent more than the prior quarter. The company attributed stronger results to higher average selling prices for copper and higher volumes of copper in concentrates sold. Increased volume also led to a corresponding increase in cost of sales to $194 million. Operating cash costs[1] at Oyu Tolgoi totaled $168 million, down slightly from $175 million reported in the fourth quarter of 2016. Net income was $30 million, or $0.02 per share, as compared to $122 million, or $0.06 per share, in the first quarter of 2016.

Net cash provided by operations in the first quarter was $86 million, less than half of the $196 million generated in the same period one year ago. Cash used in investing activities increased significantly, including $148 million of capital expenditures.

At March 31, 2017, the company had approximately $1.4 billion in cash and equivalents, and net working capital of $2.5 billion. Turquoise Hill listed long-term debt of approximately $4.1 billion, yielding a debt-to-equity ratio of 0.5.

Full-Year Earnings Guidance

After a better than expected 2016, Turquoise Hill offered muted guidance for 2017 due to weaker copper and gold head grades. Guidance for copper production is between 130,000 and 160,000 tonnes, down from 201,300 in 2016. Gold production is expected to fall between 100,000 and 140,000 ounces, down from approximately 300,000 ounces in the prior year. Accordingly, Turquoise Hill expects a slight decrease in cash operating costs to $720 million.

Capital expenditures related to the underground expansion are expected to increase significantly, from $200 million to between $825 million and $925 million. The company expects open pit capital expenditures of $100 million to remain unchanged.

Stock Influences

- Changes in production estimates;

- Changes in commodity prices;

- Changes to the company’s development timeline; and

- Takeover activity by Rio Tinto.

Risk Factors.

- The company is subject to the volatility of the commodities market;

- The company may be unable to enforce its agreements with the Mongolian government;

- The company’s agreements with the Mongolian government contain several covenants with respect to its workforce and local development which it may be unable to meet; and

- Rio Tinto has the ability to exert significant control over both Turquoise Hill and Oyu Tolgoi LLC, and its interests may not be aligned with the company’s other shareholders.

Stock Performance

As of May 19, 2017, shares of Turquoise Hill closed at $2.76, up nearly eight percent on the day, yielding a market capitalization of $5.5 billion. As noted above this spike was driven by takeover rumors that were ultimately dispelled. The stock price is roughly the same as it was a year ago, but is down nearly 15 percent year-to-date.

Following are selected analyst ratings and price targets:

| Firm | Rating | Price Target (C$) | Price Target ($) | Date |

| RBC Capital Markets | Sector Perform | N/A | 4.00 | 5/12/2017 |

| TD Securities | Buy | 6.00 | 4.44 | 4/20/2017 |

| Credit Suisse | Neutral | 6.00 | 4.44 | 4/19/2017 |

| Scotiabank | Sector Outperform | 6.00 | 4.44 | 4/19/2017 |

Summary

Turquoise Hill’s primary asset, the Oyu Tolgoi mine, has value due to its expected production and proximity to China. If the underground development plan is implemented as expected, the company should generate strong cash flows for 10 years or more. However, there is political risk associated with the Mongolian government who is a partner on the project. Further, the company is subject to uncertainty regarding future commodity prices and production yields. Therefore, the consensus price target of C$6.00 ($4.44), based on the company’s net asset value, seems attainable in the next 12 to 18 months.

Welcome to Traders News Source

A Leading Small and Mid-Cap Research and Corporate Access Firm

About Traders News Source

Traders News Source recent profiles and track record, 176% in verifiable potential gains for our members with three of our actionable reports delivered via email alone!

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

February 6th, 2017- (NASDAQ: SCON) opened at $1.12/share hit a high of $1.80/share within 10 days our member potential gains- 60% – http://finance.yahoo.com/news/superconductor-technologies-potential-revolutionize-smart-130000844.html

May 9th, 2017 (NASDAQ: AMD) opened at $10.04/share and hit over $12.77/share within 7 days for gains of 27% for our members- https://finance.yahoo.com/news/advanced-micro-devices-analyst-ratings-120000313.html

These are numbers that make traders drool. Any trader in any market would fall all over themselves to see numbers like this. So, if you’ve been on the fence, perhaps it’s time to start doing some research and verify our numbers for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

We know with a large following comes a large responsibility as we have everyone from institutional investors to the beginner following our profiled securities in our newsletters. This is something we take very seriously always seeking small cap growth companies that have both near and long-term potential for our members.

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone.

What should I expect from Traders News Source?

Our team of financial writers offer their take and commentary on the public markets in order to weed through the fluff and give you our synopsis. We cover small and mid-cap stocks trading on the NYSE and NASDAQ exchanges.

How often will you send me email?

Typically, we cover one to four securities per month. We send one to three email updates per security.

Disclaimer and Privacy Policy

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Ivan Neilson, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

[1] This measure excludes depreciation and depletion, exploration and evaluation, and asset charges. This figure does include management fees paid to Turquoise Hill and Rio Tinto which are eliminated in the company’s consolidated financial statements.