There is no doubt that this deal could add millions to Vuzix bottom line as well as lead to more large contracts.

Good day everyone,

We are continuing coverage of Vuzix Corporation (NASDAQ: VUZI), a supplier of Smart-Glasses and Augmented Reality (AR) technologies and products for the consumer and enterprise (more product info below).

Current price $4.19 per share

VUZI shares gained 5% yesterday trading 6.19 million shares, 3X the average daily volume.

We have evaluated the catalysts currently in play for Vuzix and conclude the company shares may be headed toward their 2018 high of $9.00 per share or more.

BREAKING NEWS:

Yesterday, the company announced it has delivered a customized commercial and defense avionics waveguide-based head mounted display (HMD) system to a global Tier-1 Aerospace firm as part of the work effort associated with the fourth phase of product development for this customer.

The customer and Vuzix are now negotiating a supply agreement for volume production of this customized HMD waveguide and HD display engine product, with deliveries commencing as early as fall 2020. Contemplated quantities should represent a significant revenue opportunity for Vuzix.

We do not know who the customer is, but if you Google Tier 1 Aerospace companies, you will see a list of companies that can afford a lot of HMDs. To date, Vuzix has now received approximately $1,300,000 in non-recurring engineering services revenues on this program.

The development of this Tier 1 Aerospace supplier deal has been in the works for a while. The fact that the parties are discussing production schedules may indicate that product development is completed and its finally time to fatten the VUZI top line.

The announced future sales to a large aerospace contractor will tend to give credence to VUZI and their products, creating the potential for revenues to snowball for the company.

VUZI Tech:

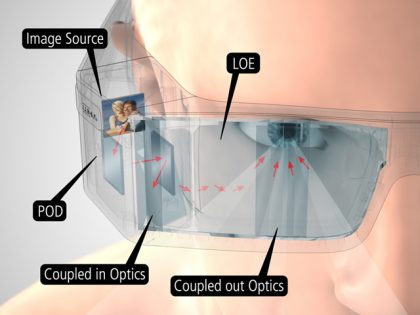

Waveguides are thin (about 1 mm thick for each individual plate), transparent, optical elements that take a projected virtual image and relay it to the eye while expanding the exit pupil (viewing window) at the same time.

Smart glasses offer the user the chance to immerse themselves in a digital world. By layering reality, one can navigate the world freely but with an extra element of engagement. The technology is growing rapidly, with many apps making the leap from phone to lens. Using maps and annotations via glasses is a more intuitive way to use apps.

Vuzix is emerging as a critical go-to supplier of smart glasses during a period when the world is turning to them as a needed solution. This fact is evidenced through their growth in orders, new partnerships, use cases, and the overall breadth of customer interest.

What we conclude as expectations from Vuzix during the balance of 2020:

The commencement of volume production of Vuzix’ new M4000 smart glasses this summer, which utilize the Company’s next generation see-through waveguides.

Ongoing improvements in waveguide manufacturing, resulting in higher yields and expanded production capacities.

The further expansion in contracts for engineering services program engagements, with others in the pipeline as well as OEM component and product programs.

Highlights regarding plans for the development of Vuzix’ next-generation waveguide optics for use with MicroLEDs that allow the creation of very small high performing display technologies.

Vuzix’ intellectual property portfolio, now consisting of 157 patents and patents pending, as part of the Company’s further expansion of its leadership position and in-depth knowledge of near-eye display technologies.

There is a Potential Short Squeeze Here

According to shortsqueeze.com, Vuzix has 4,140,000 shares (10.5% of the outstanding, 13% of the float) sold short. The holders of these short sales will do anything they can to drop the share price, but if the shares hit $4.50, $4.75, $5.00 and more they may be forced to cover those shares at any price they can to cut their losses, resulting in an even higher spike in price. VUZI does look like a textbook opportunity for a short squeeze.

VUZI shares have a lot of positives backing up their potential for gains:

Top of the class in smart glasses technology and available apps. Think of Apple and the development of the smart phone.

Emerging telemedicine opportunities. There is more development happening beyond the knee replacement we discussed before.

Vuzix works with large companies in various industries to develop this new mode of data consumption.

VUZI is at the cusp of taking a possible leap from $7M in annual revenues to untold millions in revenues.

There is a strong potential for a short squeeze.

VUZI shares have already exhibited that they can trade at $9.00 per share, a level they reached in 2018. The company and its technology have come a long way since then and we believe investors will continue to place investment dollars in VUZI as they continue to prove they can execute.

The Traders News Group

original report from 7/16/20 below

Vuzix (VUZI) Breaks Through Moving Averages in a Bullish Manner

“Producing Products Conducive to Our New Normal”

Vuzix has grown from 90 patents and patents pending to 166, over the last 36 months

Good day everyone,

We are continuing coverage of Vuzix Corporation (NASDAQ: VUZI), a supplier of Smart-Glasses and Augmented Reality (AR) technologies and products for the consumer and enterprise (more product info below).

Current price $3.90 per share

Outstanding (est.) 39.3 million shares

Float (est.) 30.5 million shares

Insider Holdings 12.99%

Institution Holdings 15.99%

Potential near to mid-term catalysts for VUZI shares:

VUZI shares have crossed their 50 DMA and 200 DMA of $2.60 and $1.95 respectively in a bullish manner.

VUZI has just announced a collaboration with Verizon to service EMTs with a connection to hospitals and doctors via 5G enabled smart glasses.

The company has begun to deliver product on a previously negotiated contract with a major defense contractor.

The potential catalysts listed above are all recent developments in the month of July.

Since bottoming out in mid-March under $1.00, VUZI shares have been on a steady climb to their current pricing over $3.50 per share. The company shares could be headed back to their 2018 levels in the range of $9.00 per share.

VUZI has always been a little bit ahead of the times with their technology, but the times are changing, and the VUZI product line is transcending into the mainstream.

Most of us love our data, screen time, virtual reality, online games, and searches but we currently need to be around a computer, tablet, smartphone, or some manner of screen device. Smart glasses have the potential to eliminate that tether and take us to a new level.

According to Paul Travers, President and Chief Executive Officer of Vuzix, “Worldwide travel restrictions and quarantine requirements related to COVID-19 continue to help expedite purchasing decisions related to smart glasses. Our M400, represents an effective solution to provide business continuity during the new normal.

The company’s M400 has become a benchmark for leading-edge performance in the smart glasses industry. The M400, combined with remote support applications like Vuzix Remote Assist, Zoom, WebEx Teams, Ubimax Frontline and many others, sets the Vuzix product line ahead of the competition. The M400 is now available in 52 countries around the world.

The VUZI patent portfolio has grown from 90 patents and patents pending to 166 over the last 36 months, including a range of IP including waveguides with holographic optics, laser, and micro LED display integration.

Pixee Medical, a France-based medical company, performed the world’s first Knee+ total knee replacement surgery on June 24th using the Vuzix M400 AR Smart Glasses. The Pixee Medical company was founded in 2017 with the goal of creating high-performance, computer-assisted surgical solutions using proprietary computer vision and artificial intelligence technologies. Pixee intends to continue and promote the use of the M400 technology for knee surgeries.

The Company has won Consumer Electronics Show (or CES) awards for innovation for the years 2005 to 2020 and several wireless technology innovation awards, among others. Vuzix keeps winning these awards because they always present the most innovative technology in their field.

VUZI has a significant insider ownership and an even larger institutional ownership. In 2020 there have been seven insider “buys” totaling 22,750 shares. There have been no insider sales recorded in the past six years. Nine institutions have purchased VUZI shares in 2020 and one institution has sold shares.

5/13/2020 Maxim Group Reiterated Rating Buy

VUZI products include monocular smart glasses for enterprise, industrial, commercial, and medical markets; and blade smart sunglasses for applications ranging from basic text messaging and answering the phone to overlaying mapping directions, menus, weather, events, stock quotes, video conferencing, sports updates, social feeds, bio-metrics, and others. The company is also developing a binocular AR smart glasses product that provides the user a live, direct, or indirect view of a real-world environment. Its AR wearable display devices are worn like eyeglasses or attach to a head worn mount to view, record, and interact with video and digital content, such as computer data, the Internet, social media, and entertainment applications.

We anticipate the company revenues could begin to accelerate as they develop more contracts and increase production. VUZI shares may be at the onset of significant gains as they are the leader in the smart glasses sector, and they produce products that are conducive to our “new normal”.

Full report coming soon,

The Traders News Group

______________________________________________

Privacy Policy and Disclaimer

Your Consent

By using our site, you consent to our online privacy policy and disclaimer.

Do we disclose any information to outside parties?

We hate spam and we do not sell, trade, or otherwise transfer to outside parties your personally identifiable information.

What information do we collect?

We collect information from you when you subscribe to our newsletter or fill out a form. This includes your email address only.

When registering on our site, as appropriate, you may be asked to enter your: e-mail address

What do we use your information for?

When we collect your email it is used for one purpose to send you the free information you requested about small cap stocks. Please read our disclaimer carefully before viewing our emails.

Your information, whether public or private, will not be sold, exchanged, transferred, or given to any other company for any reason whatsoever, other than for the express purpose of delivering the information on small cap stocks that you requested.

We send periodic emails

The email address you provide may be used to send you information, respond to inquiries, and/or other requests or questions.

How do we protect your information?

We implement a variety of security measures to maintain the safety of your personal information when you enter, submit, your email address. We use a secure third party to send email to you.

Because we value your privacy we have taken the necessary precautions to be in compliance with the California Online Privacy Protection Act. We therefore will not distribute your personal information to outside parties without your consent.

Online Privacy Policy Only

This online privacy policy applies only to information collected through our website and not to information collected offline.

Contacting Us

If there are any questions regarding this privacy policy or disclaimer you may contact us using the information below.

Editor@TradersNewsSource.com

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operators owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. TNS LLC’s parent compoany has been compensate.d twenty five thousand dollars cas.h via ban.k wir.e by venado media llc for this week and continuing coverage of vuzi. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.

TNS LLC is not affiliated with any exchange, electronic quotation system, the Securities Exchange Commission or FINRA. TNS LLC is not a Broker/Dealer and does not engage in high frequency trading.