Aradigm Corporation (NASDAQ: ARDM) is an emerging specialty pharmaceutical company focused on the development and commercialization of drugs for the prevention and treatment of severe respiratory diseases. Aradigm has completed two Phase 3 clinical trials with Linhaliq™.

On September 25, 2017, ARDM advised that the U.S. Food and Drug Administration (FDA) has accepted for filing with Priority Review its New Drug Application (NDA) for Linhaliq™ for the treatment of non-cystic fibrosis bronchiectasis (NCFBE) patients with chronic infections with Pseudomonas aeruginosa (P. aeruginosa).

The granting of Priority Review for the Linhaliq NDA accelerates the timing of the FDA review of the application compared to a standard review. The PDUFA (Prescription Drug User Fee Act) goal date for completion of the FDA review of the Linhaliq NDA is January 26, 2018.

Linhaliq was previously evaluated in two Phase 3 studies (ORBIT-3 and ORBIT-4) to determine its safety and effectiveness as a once-a-day inhaled formulation for the chronic treatment of patients with NCFBE who have chronic lung infections with P. aeruginosa.

Aradigm discussed the results of the Phase 3 studies at meetings with FDA in December 2016 and March 2017. Based on these discussions, the statistical analysis of the results was changed from the pre-specified plan to stratification based on sex and the frequency of pulmonary exacerbations in the prior year, as the stratum for current smokers contained a small number of subjects.

In neither trial did Linhaliq compared to placebo demonstrate a statistically significant improvement in the third secondary endpoint of the quality of life using the difference in the Respiratory Domain score of the QoL-B questionnaire between baseline and Week 48. Notwithstanding the earlier failures, the Phase 3 trial in fact succeeded in showing that Linhaliq offers both efficacy and safety and thus the company filed an NDA for the same.

Pulmonary infections with non-tuberculous mycobacteria (NTM) have become a serious growing public health problem in the U.S. and many other countries as they can result in debilitating lung disease and are costly to treat. Patients with NTM at present typically have to use several antibiotics to avoid the emergence of resistance. Therefore, the company has a large potential market, if it could deliver a much-needed new treatment for these patients with severe lung diseases.

Aradigm has a commercial partner i.e. Grifols who will fund the development cost, and $20M in milestones, in exchange for receiving part of the revenues. Grifols will fully commercialize Linhaliq in exchange for revenue sharing at a pre-determined ratio. It is to be noted that the agreed revenue sharing ratio would divide by half if there were a competitor in that country.

After approval, successful commercialization should not be a major issue. And after approval, “Aradigm believes the NCFBE indication for Linhaliq will exceed $500M of sales by 2021”. With more indications over the near to medium term.

The risk-reward tradeoff for the company is quite attractive for ARMD. In fact, The Company’s stock has unsurprisingly found enormous strength in the recent past and with the recent developments, analysts have revised their outlook on the stock. The stock currently has an average rating of “Buy” and a consensus price target of $7.10.

About the Company: Aradigm is an emerging specialty pharmaceutical company focused on the development and commercialization of drugs for the prevention and treatment of severe respiratory diseases.

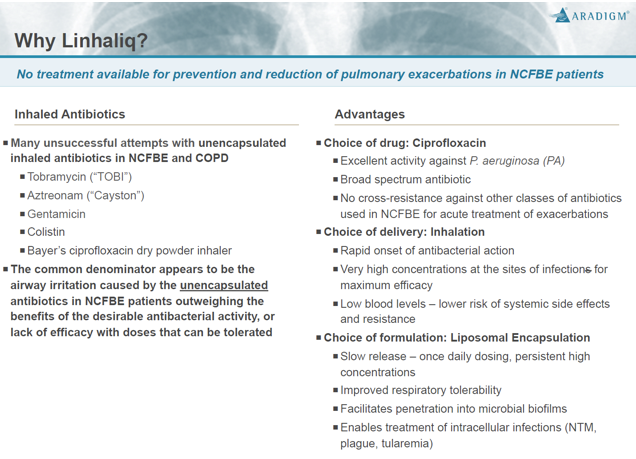

Aradigm has completed Phase 3 development of Linhaliq (an investigational proprietary formulation of ciprofloxacin for inhalation) for the treatment of NCFBE. Aradigm’s inhaled ciprofloxacin formulations including Linhaliq are also product candidates for treatment of patients with cystic fibrosis and non-tuberculous mycobacteria, and for the prevention and treatment of high threat and bioterrorism infections, such as inhaled tularemia, pneumonic plague, melioidosis, Q fever and inhaled anthrax.

About Linhaliq: Linhaliq, formerly known as Pulmaquin®, is composed of a mixture of liposome encapsulated and unencapsulated ciprofloxacin. Ciprofloxacin, available in oral and intravenous formulations, is a widely prescribed antibiotic.

It is used often to treat acute lung infections because of its broad-spectrum antibacterial activity against various bacteria, such as Pseudomonas aeruginosa. Aradigm’s once-a-day novel inhaled formulations of ciprofloxacin are encapsulated in liposomes, allowing for a sustained release of the drug within the lung and improving airway tolerability.

The formulations are to be used for chronic maintenance therapy as they are expected to achieve higher antibiotic concentration at the site of infection and relatively low systemic antibiotic concentrations to minimize side effects.

Grant to Investigate the Treatment of Pulmonary Non-Tuberculous Mycobacterial (PNTM) Infections with Linhaliq: The National Institute of Allergy and Infectious Diseases (NIAID) and National Institutes of Health (NIH) awarded Aradigm a grant to investigate the treatment of two pulmonary non-tuberculous mycobacteria infections, Mycobacterium avium and Mycobacterium abscessus, with Aradigm’s inhaled liposomal ciprofloxacin products Linhaliq™ and Lipoquin®. Professor Luiz Bermudez at Oregon State University, Corvallis, will lead the laboratory research as a part of the consortium funded by this two-year grant of approximately $972,000.

According to a report from NIH based on an epidemiological study in U.S. adults aged 65 years or older, PNTM infections are an important cause of morbidity among older adults in the United States. From 1997 to 2007, the annual prevalence significantly increased from 20 to 47 cases per 100,000 persons, or 8.2% per year. Forty-four percent of PNTM-affected people in the study had bronchiectasis compared to 1% in the non-PNTM cases, pointing to an important co-morbidity. PNTM infections are common also in patients with other chronic lung conditions, such as cystic fibrosis and emphysema.

Key milestone/highlights of the company:

2nd Quarter 2017 Financial Results:

The Company recorded $7.7 million in revenue in the second quarter of 2017 compared with $14,000 in revenue in the second quarter of 2016.

The Company recognized $7.5 million in contract revenue – related party, $196,000 in government contract revenue and $7,000 in government grant revenue for the second quarter of 2017, as compared to $14,000 in government grant revenue for the second quarter of 2016. The increase in revenue was from the Company’s adoption of ASC Topic 606 Revenue from Contracts with Customers and primarily resulted from a change in estimated variable consideration associated with the $5 million regulatory milestone for the New Drug Application (NDA) submittal.

Total operating expenses for the second quarter of 2017 were $5.7 million, compared with total operating expenses of $7.6 million for the second quarter of 2016.

The decrease in research and development expenses of $2.4 million was due to lower contract manufacturing and clinical trial costs because the Linhaliq™.

Net income for the second quarter of 2017 was $1.0 million or $0.07 per share, compared with a net loss of $8.7 million or $0.59 per share in the second quarter of 2016. For the quarter ended June 30, 2017, the increase in net income resulted primarily from an increase in revenue of $7.7 million and a decrease in operating expenses of $1.9 million.

As of June 30, 2017, the Company reported cash and cash equivalents of $12.0 million.

Key risk factors and potential stock drivers:

The recent FDA action is the most significant milestone in the history of Aradigm and will lead the future direction for the company.

The company expects a similar submission in the European Union early next year. Marketing authorizations in these two major territories would be transforming events for the company

ARDM is still at a research & development stage and has not yet generated meaningful revenue and will likely operate at a loss/thin profits as it grows its market position and seeks ways to monetize it.

Any time or cost overrun in its ongoing R&D activities and its impact on business & financial profile will remain a key business sensitivity factor.

Stock Chart:

On Tuesday, September 26, 2017, ARDM shares were at $3.52 (+ 4.76 %) on an above average volume of 1.9 million shares exchanging hands. Market capitalization is $38.23 million. The current RSI is 92.51.

In the past 52 weeks, shares of ARDM have traded as low as $0.78 and as high as $7.19.

At $2.53, shares of ARDM are trading above its 50-day moving average (MA) at $1.46 and above its 200-day MA at $1.56.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.