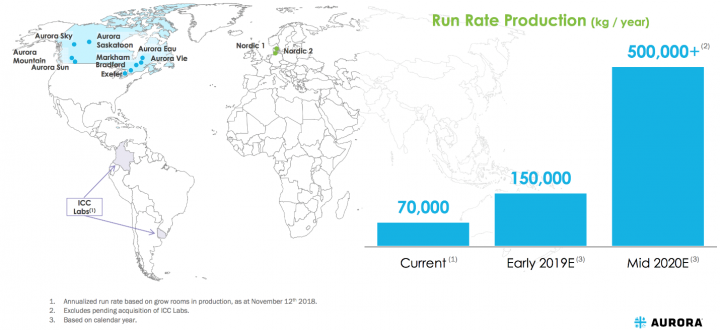

Aurora Cannabis Inc. (NYSE: ACB) is headquartered in Edmonton, Alberta, Canada with funded capacity in excess of 500,000 kg per annum and sales and operations in 19 countries across five continents, Aurora is one of the world’s largest and leading cannabis companies. Aurora is vertically integrated and horizontally diversified across every key segment of the value chain, from facility engineering and design to cannabis breeding and genetics research, cannabis and hemp production, derivatives, high value-add product development, home cultivation, wholesale and retail distribution.

Key and unique differentiating factor:

In the recent past, Aurora has well positioned itself to be one of the most significant suppliers of the surging demand for medical and legal recreational in Canada and other parts of the world. On October 17, 2018, sales of cannabis for adult consumer use in Canada, legalized through Bill C45, commenced. Aurora recorded a strong performance, ranking top or among the top-selling products and brands in many of the provinces the Company committed to supplying, for the first two weeks to October 31, 2018. Considering all this, Aurora Cannabis remains exceptionally well poised to continue trading as the backdrop and more importantly recent developments in the Canadian Cannabis landscape remains hugely positive.

_____________________________________________________________________

Our members have booked up to 800% with our recent well timed (2018) NASDAQ and NYSE small cap reports. We will be initiating coverage on another exciting small cap security within the next ten days (December 11th-20th, 2018). Stop missing out on stocks that run, receive our reports in real time on your cell phone, text the word “Traders” to “25827”

View our recent picks, track record, long term biotech picks and sign up for our real time, low float and breakout mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

_____________________________________________________________________

ACB continue to successfully execute its differentiated and diversified strategy committed towards domestic and international expansion in the medical cannabis market, adult consumer use sales, production scale-up, innovation, plant, and medical research, and product development. Given the strong unmet consumer demand evident across Canada, the management is confident that its rapidly increasing production capacity will result in the continued acceleration of revenue growth.

Furthermore, the company also continue to perform well in its international medical business. With the acquisition of ICC Labs, ACB is establishing leadership in Latin America. Across its international activities, ACB have established significant early mover advantage and market leadership. With the scale-up of Aurora’ domestic and international production facilities, analysts tracking the stock anticipates increased availability of the product to service these developing markets which will drive further global growth for the Company.

Recent announcements:

- On December 7th, the company announced that it had established an exclusive partnership with Farmacias Magistrales S.A. (“Farmacias”), an established Mexican pharmaceutical manufacturer and distributor with a broad reach to approximately 80,000 retail points and 500 pharmacies and hospitals across Mexico. Farmacias recently received the first and only import license granted to date, from the Federal Commission for Protection Against Health Risks (“COFEPRIS”), the Mexican government body responsible for medical cannabis licensing, which permits Farmacias to import Aurora medical cannabis products containing THC into Mexico.

- On Dec. 6, 2018, the company announced that through its wholly-owned subsidiary Aurora Europe GmbH, has been selected by the Luxembourg Health Ministry for the supply of medical cannabis to that country and an initial purchase order for approximately 20 kilograms has been received.

- On Dec. 3, 2018, the company announced that it had received a sales license from Health Canada permitting the sale of cannabis soft gel capsules, the Company has commenced shipments for both the Canadian medical and adult-use markets. Aurora expects to commence exports to international markets in early 2019.

- On Nov 28, 2018, the Company announced that it Completed Australis Distribution to Non-Resident Shareholders

- On Nov 27, 2018, Aurora Cannabis announced to Ship Medical Cannabis to the Czech Republic. International Expansion Extends to 21 Countries

- On Nov 22, 2018, Aurora Cannabis Receives Final Regulatory Approval and Completes Acquisition of ICC Labs

With this and other previous announcements, the company continues to exceed expectations. It is expected that the stock’s value will continue to appreciate as the market becomes more aware of its potential.

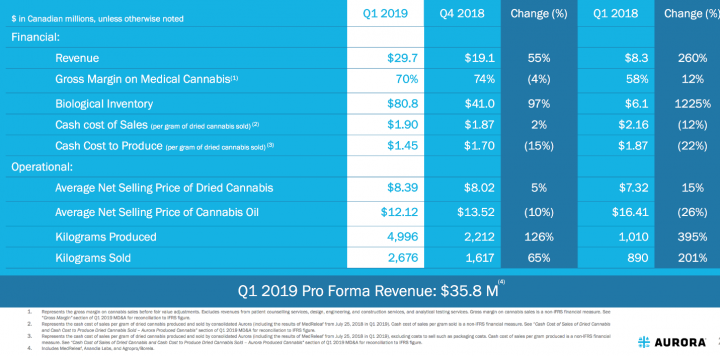

So far financials are concerned, the company has seen yet another quarter of robust Patient and Revenue Growth. Aurora’s financial performance in first quarter fiscal 2019 reflected the numerous achievements and quite gratifying progress. ACB had very strong quarter-over-quarter revenue growth with extract-based products continuing to comprise more than 31% of Aurora’s cannabis revenue resulting in a healthy gross margin of 70%. The Company achieved 260% Revenue Growth to $29.7 Million – Pro-Forma Revenues up 333% to $35.8 Million. Strong Adult Consumer Roll-out and Continued Production Scale-Up.

About the Company: Headquartered in Edmonton, Alberta, Canada with funded capacity in excess of 500,000 kg per annum and sales and operations in 22 countries across five continents, Aurora is one of the world’s largest and leading cannabis companies. Aurora is vertically integrated and horizontally diversified across every key segment of the value chain, from facility engineering and design to cannabis breeding and genetics research, cannabis and hemp production, derivatives, high value-add product development, home cultivation, wholesale and retail distribution.

Exceptional market risk profile:

Globally Positioned Industry Leading Production Capacity.

Ramping up 11 state-of-the-art cultivation facilities with expected production capacity of over 500,000 kg/year by Mid 2020

Successful Canadian Adult-Use Market Launch:

Q1 2019 Financial and Operational Highlights

- Revenue of $29,674, up 260% compared to the same period in 2018.

- Pro-forma Q1 2019 revenue of $35,752, including MedReleaf (consolidated as of July 25, 2018), Anandia (consolidated as of August 8, 2018) and Agropro (consolidated as of September 10, 2018)

- Revenue growth was mainly attributable to much higher patient numbers and increased product availability following the acquisition of CanniMed and MedReleaf, continuing development of its international markets and the first glimpses of the impact of the Canadian adult use market.

- Gross margin on cannabis of 70%, up 12% points compared to the first quarter of 2018, and down slightly by 4% points compared to Q4 2018. The increase versus Q1 2018 was primarily due to a higher average selling price per gram of dried cannabis, coupled with a higher proportion of cannabis oil sales in the Company’s sales mix ratio.

Outlook

- Aurora is exceptionally well‑positioned in all of its active markets, including adult consumer-use market, Canadian medical and the international medical markets, with compelling brands, a broad and expanding product portfolio, and strong patient and consumer recognition.

- In fiscal 2019, the Company will continue to focus on expanding capacity and sales growth in all its markets, in addition to exploiting further product development and innovation, medical research, continued international expansion and realization of acquisition synergies.

- Aurora also currently owns two of the seven cannabis production facilities in the world that are EU GMP certified, and additionally owns one EU GMP certified distribution facility in Germany, ensuring continued access to restrictive markets. Management believes this early mover advantage, coupled with the strength of its growing international management teams, will enable the Company to continue expanding its significant market share in the global medical market.

Key risk factors and potential stock drivers:

- The positive outcome of the upcoming catalyst (as outlined above), would be the key near-term trigger for the company

- Company’s ability to maintain its liquidity and financial flexibility to fund its incremental capital requirements.

- ACB’ ability to acquire and incubate other marijuana companies as the sector consolidates

- In this sector, the regulatory framework and science are rapidly changing and evolving. Therefore, new companies are emerging, and regulatory risk always exists for the players in the industry.

Stock Chart:

Comments:

- On Friday, Dec 7th, 2018, ACB closed at $5.75, on an above average volume of 14.925M shares exchanging hands. Market capitalization is $5.755 billion. The current RSI is 41.88

- In the past 52 weeks, shares of ACB have traded as low as $4.05 and as high as $12.52

- At $5.75, shares of ACB are trading below its 50-day moving average (MA) at $7.75 and its 200-day moving average (MA) at $7.01

- The present support and resistance levels for the stock are at $5.38 & $6.06 respectively.