Auxly Cannabis Group Inc. (OTCQX – CBWTF) is creating a world-class platform by forming partnerships with best-in-class cultivators, product innovators, and developers, researchers, and marketers. The company provides its partners with ongoing cornerstone support in cultivation, regulatory, construction, retail, branding and financing to help them realize their full potential.

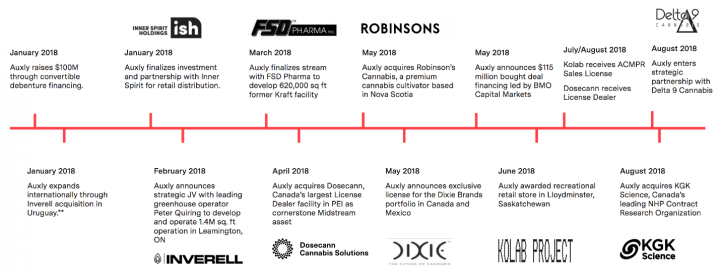

The Company continues to move forward and execute its business plan of building a vertically integrated global cannabis company. Originally founded with the primary intent of providing financing solutions to licensed producers and licensed producer applicants, the Company has since evolved into a worldwide cannabis company with assets in each key segment of the cannabis value chain. The Company remains confident in its business strategy as the Canadian market enters legalization of recreational cannabis on October 17, 2018.

______________________________________________________________________

Our members have booked up to 800% with our recent (2018) NASDAQ and NYSE small cap alerts. We will be initiating coverage on another exciting small cap security mid-week this week (10/14/18). View our recent picks, track record and sign up for our real time mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

______________________________________________________________________

The company’s stock has unsurprisingly found enormous strength in the recent past. It has been powering due to the favorable impact of the company’s recent announcements and the growing popularity of the industry. All the above have positioned the company for the future as it continues to execute on its vertically integrated strategy.

Key Financial and Operational Highlights

- Positioned Auxly as a vertically integrated cannabis company with wholly-owned assets at each segment of the value chain

- Auxly Cannabis Group and Kaneh Bosm BioTechnology Inc. Announce Strategic Investment and Partnership and Name Change of KBB to ICC International Cannabis Corp. Auxly has subscribed for $5,000,000 of senior unsecured convertible debentures (the “Debentures”) of Kaneh Bosm by way of a non-brokered private placement.

- Five wholly owned subsidiaries and 13 streaming partners**

- Auxly strategically organized into three segments of the industry value-chain: Upstream, Midstream, and Downstream

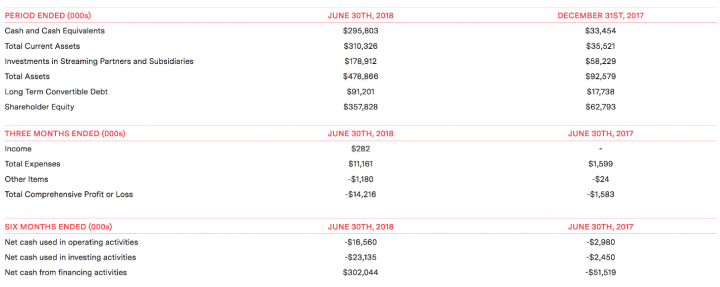

- A significant working capital balance of $303M, inclusive of a $115M bought deal financing led by BMO Capital Markets

- A fully Funded capacity of 160,000kg per annum by 2021

- Expanded Internationally with the acquisition of Inverell S.A.

** The Inverell acquisition remains subject to final regulatory approvals in Uruguay

Analyst tracking the stock and the industry believes that the Auxly platform is about more than just deploying capital, as the company is diversifying its streaming deals and have developed the ancillary tools and infrastructure to make those streams successful. Consequently, the company’ is well positioned to capture high-margin segments of the market through extracted products, infused functional foods and Natural Health Products. Considering all this, the company is in an extremely favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains extremely favorable.

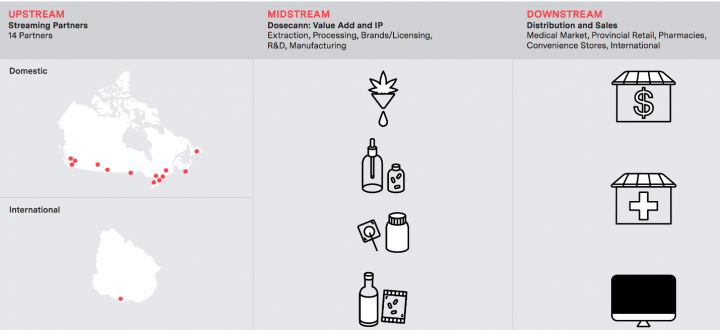

Auxly’ business model: Auxly’s business is divided into three distinct verticals and management has prioritized the following objectives for each of the Company’s business segments:

- Upstream: The Company has continued to acquire cultivation capacity by developing cannabis cultivation facilities in Canada and internationally. Auxly remains focused on building a diverse cultivation platform comprised of wholly-owned assets, streaming partnerships, joint venture partnerships, and commercial offtake arrangements.

- Midstream: The most notable progress in the Company’s evolution over the past 12 months has been the development of its midstream business. The strategic focus of Auxly’s midstream business segment is to add value to the cannabis produced in the upstream business segment through the application of intellectual property.

- Downstream: The Company has made strategic decisions on which distribution channels to prioritize based on its production ramp-up, choosing to focus on higher margin medical channels and those non-medical channels that are owned by Auxly or where Auxly holds an equity interest in the retailer.

Cannabis Industry Overview: The legalization of an existing market is predicted to reap enormous benefits.

- Market Research CIBC World Markets believes that the cannabis market will reach $6.8 billion by 2020, outpacing the spirits industry

- The overall industry is projected to generate $1 billion in EBITDA in 2020 with manufacturing companies accounting for over 85% of it and retailers accounting for the remaining 15%

- Active M&A market as companies look to create vertical integration partnerships similar to Auxly + Dosecann

- Similar to the alcoholic beverages industry, brand loyalty and repeat customers will be crucial in obtaining market share

Projected stabilized value by 2024 and beyond ($ billions)

Second Quarter 2018 Financial Results

- In order to fund the execution of its business plan, the Company successfully raised in excess of $215,000,000 by way of the two separate financing transactions described below as well as $94,039,000 from the exercise of warrants. The proceeds of the financings and warrant exercises help ensure that Auxly has sufficient capital to fund its business in the short term and gives the Company the flexibility to consider new opportunities as they arise.

- $100,000,000 Financing: Auxly completed a $100,000,000 financing by way of 6% convertible debenture.

- $115,100,000 Bought Deal Financing: Auxly completed a “bought-deal” financing led by BMO Capital Markets, pursuant to which the Company issued 82,225,000 units for aggregate gross proceeds of $115,100,000.

- $94,039,000 in Warrant Exercises: Auxly received $94,039,000 from the exercise of warrants and broker warrants.

Key risk factors and potential stock drivers:

- Licensing Risk – While the number of LPs continues to climb, sales approval remains a significant constraint to supplying the market. Despite Health Canada’s “expedited licensing,” it is estimated that Health Canada has approved less than 4% of all licensed producer applications. Regulatory uncertainty is obstructing some LPs ability to make definitive expansion plans

- Scaling Problems – Cannabis is a difficult plant to grow at scale while meeting Health Canada quality standards and no LP has yet demonstrated the ability to cultivate cannabis on a large scale

- Auxly is on the verge of seeing meaningful results from their current investments. Analysts remain hopeful that these payoffs will take shape quite soon and remain bullish about the stock price.

- Auxly is still an early stage company and has not yet generated meaningful revenue and will likely operate at a loss as it grows its market position and seeks ways to monetize it. Therefore, its ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a challenge for the company.

- Notwithstanding recent positive developments, Marijuana remains illegal under federal law. It is a Schedule I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized at the state level, its prescription is a violation of federal law.

Stock Performance

Comments:

- On Friday, October 12th, 2018, CBWTF closed at $0.9174, on an above average volume of 1.2M shares exchanging hands. Market capitalization is $529.989 million. The current RSI is 53.00

- In the past 52 weeks, shares of CBWTF have traded as low as $0.56 and as high as $2.70

- At $0.9174, shares of CBWTF are trading above its 50-day moving average (MA) at $0.82 and below its 200-day moving average (MA) at $1.11

- The present support and resistance levels for the stock are at $0.8759 & $0.9306 respectively.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.