KushCo Holdings, Inc. (OTCQB: KSHB) is the parent company to a diverse group of business units that are transformative leaders in the cannabis, CBD and other related industries. KushCo Holdings’ subsidiaries and brands provide exceptional customer service, product quality, compliancy knowledge and a local presence in serving its diverse customer base.

On Sep 18th, the parent company of innovative cannabis industry leaders such as Kush Bottles, Kush Energy, The Hybrid Creative, and Koleto Packaging Solutions, which provide a range of services and products for the regulated cannabis, CBD and other related industries, announced that the Company is expecting to report over $51 million in annual revenue for the fiscal year ended August 31st, 2018, representing an increase of approximately 171% compared with the fiscal year ended August 31st, 2017.

The record-setting revenue numbers demonstrate the continued rapid growth of the Company, following a series of initiatives to drive organic growth, as well as strategic M&A activity. These efforts have allowed the Company to expand its product portfolio and implement a more efficient distribution platform.

Nick Kovacevich, CEO, and Chairman of KushCo Holdings noted “Our fiscal year 2018 revenue serves as a historic milestone, not just for KushCo Holdings, but for the entire cannabis industry. We believe that no U.S. based public cannabis-related company has ever before generated this level of annual sales revenue. Building on the Company’s year to date momentum, our expected fourth quarter achievement of approximate revenues in excess of $19 million is a testament to the highly innovative and strategic work by our team, completing and integrating key acquisitions, and the effectiveness of our sales model in meeting the evolving needs of the market. We are witnessing just how our scale allows us to leverage synergies which benefit both us and our great customers.”

______________________________________________________________________

Our members have booked up to 800% with our recent (2018) NASDAQ and NYSE small cap alerts. We will be initiating coverage on another exciting small cap security mid-week this week (10/14/18). View our recent picks, track record and sign up for our real time mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

______________________________________________________________________

KushCo’ business risk profile is supported by multiple growing businesses offering a wide array of products and services to the cannabis industry. While the company sees its fiscal 2018 achievement as an important milestone, heading into the fiscal year 2019 KSHB is going to continue to put its heads down, invest in its platform and focus on gaining market share, growing revenues, and building value for both customers and shareholders.

Crossing the $51 million revenue mark is another significant indicator that the U.S. cannabis space is now a legitimate industry, producing major revenues, employment, and tax income. As more and more states move towards legalization of medical and adult use cannabis programs, the company expects that the industry would continue to see rapid growth and a race amongst businesses to achieve the scale needed to serve this major industry. Analyst tracking the stock believes that the revenue forecast over the medium term is extremely promising and the company is expected to outperform the market.

Per www.marketbeat.com, KSHB’ average twelve-month price target is $8.75, suggesting that the stock has a possible upside of 49.57%. Considering all this, the company is in an extremely favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains favorable.

Below are the excerpts of recent analyst rating/Price targets on the company:

About the Company: KushCo Holdings, Inc. (OTCQB: KSHB) is the parent company to a diverse group of business units that are transformative leaders in the cannabis, CBD and other related industries. KushCo Holdings’ subsidiaries and brands provide exceptional customer service, product quality, compliancy knowledge and a local presence in serving its diverse customer base.

KushCo Holdings’ brands include Kush Bottles, a dynamic sales platform that is the nation’s largest and most respected distributor of packaging, supplies, and accessories, Kush Energy, which provides ultra-pure hydrocarbon gases and solvents to the cannabis and CBD sector, Hybrid Creative, a premier creative design agency for cannabis and non-cannabis ventures, and Koleto Packaging Solutions, the research and development arm driving intellectual property development and acquisitions.

Key recent highlights:

- Signed an exclusive sales and innovation agreement with ExtractionTek Sales, LLC, dba. ExtractionTek Solutions (“ETS”), a leading provider of closed loop hydrocarbon extraction equipment, based in Colorado. The reciprocal agreement is designed to drive additional client expansion for both companies through their complementary operations.

- Officially changed its name to KushCo Holdings Inc., reflecting a shift to a more diversified business model

- The company expects to report over $51 million in annual revenue for the fiscal year ended August 31st, 2018, representing an increase of approximately 171% compared with the fiscal year ended August 31st, 2017

- Opened an office in the Jiangbei District of Ningbo, China, establishing a physical presence that will further enable the Company to develop stronger manufacturing relationships and maintain consistent, high-quality standards for customer needs globally

- Established Kush Energy, a new division focused on supplying the cannabis industry with tested, high-quality solvents and hydrocarbons.

- Acquired Zack Darling Creative Associates and its wholly-owned subsidiary, The Hybrid Creative which offers brand strategy, design, and marketing to cannabis and non-cannabis clients.

- Expanded internationally with the launch of Kush Supply Co. in Canada

- Opened several new warehouse facilities in Massachusetts to serve as the Company’s East Coast hub and Las Vegas, Nevada

- The launch of Koleto Packaging Solutions, the research and development arm focused on developing innovative packaging products and creating Intellectual Property.

Financial Results –

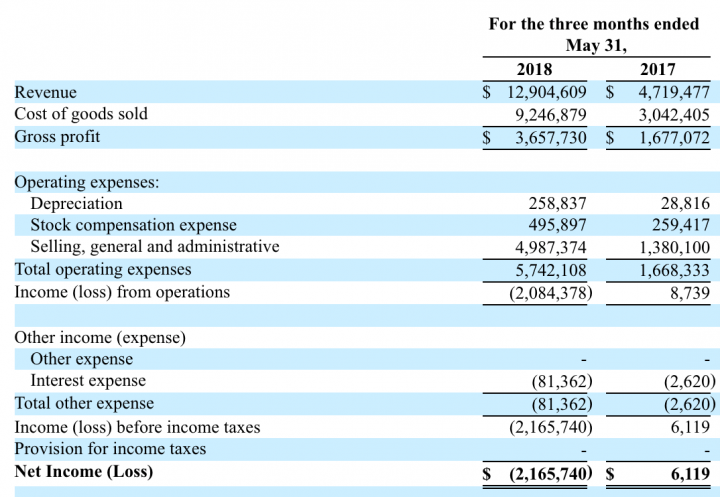

- Revenues: For the three months ended May 31, 2018, the company’ revenue increased to $12,904,609, compared to $4,719,477 for the comparable period in 2017, which represents an increase of $8,185,132 or 173%. KSHB experienced solid organic growth across all markets, namely in California following the adoption of adult use cannabis sales from January 1st, 2018. In addition, vaping product related sales remained strong as this sector of the cannabis industry continues to perform well. Additionally, KSHB witnessed strong growth of its custom branded product business as customers seek differentiated brand building solutions in line with regulatory requirements.

- Gross profit: for the three months ended May 31, 2018, was $3,657,730, or 28% of revenue, compared to $1,677,072, or 36% of revenue, for the three months ended May 31, 2017.

- Net Income (Loss): KSHB’ net result for the three months ended May 31, 2018, was a net loss of $2,165,740 or $0.03 per share, compared to net income of $6,119 or $0.00 per share, for the three months ended May 31, 2017.

- Liquidity and Capital Resources: At May 31, 2018, the company had cash of $3,574,430 and a working capital surplus of $15,755,775 compared to cash of $916,984 and working capital of $3,449,622 as of August 31, 2017.

Key risk factors and potential stock drivers:

- Continuing growth in the cannabis sector could act as a catalyst for the company shares.

- The company operation is still at an early stage and burning cash. Therefore, its ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a critical challenge for the company.

- The company’ business is exposed to risk related to competitive pressure, and its revenues may suffer from competitive pressure.

- Marijuana remains illegal under federal law. It is a Schedule I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized at the state level, its prescription is a violation of federal law.

- The company’s business is exposed to regulatory risk and its adverse impact on the overall business risk profile.

Stock Performance

Comments:

- On Monday, October 15th, 2018, in early trading, KSHB was at $6.02, on volume of 159K shares exchanging hands. Market capitalization is $457.872 million. The current RSI is 56.43

- In the past 52 weeks, shares of KSHB have traded as low as $1.82 and as high as $8.51

- At $6.02, shares of KSHB are trading above its 50-day moving average (MA) at $5.17 & above its 200-day moving average (MA) at $5.33.

- The present support and resistance levels for the stock are at $5.3767 & $6.1367 respectively.