Builders FirstSource (NASDAQ: BLDR) is one of the largest national supplier and manufacturer of building materials, components and construction services to professional homebuilders, sub-contractors, remodelers, and consumers.

On Feb. 28, 2018, the company reported its results for the fourth quarter and Fiscal year ended December 31, 2017.

BLDR had a strong finish to the year, growing sales per day, excluding closed locations, by 13.2 percent in the fourth quarter. The company had an increase in sales volume in the single-family construction end market of 7.5 percent, and 5.2 percent in the repair and remodeling / other end market. Additionally, it witnessed a growth in manufactured products of 11.3 percent.

BLDR continues to deliver sales growth and strong financial results while executing on its strategic priorities and capacity expansion. The company is investing in augmenting its manufacturing capacity to drive enhanced growth in margin-accretive products and markets while making further progress in its capital structure.

In fact, In the latest quarter, BLDR further refined its capital structure by redeeming its most expensive debt, the 10.75% unsecured notes, reducing go forward interest expense by $35 million annually. As per management, cash flow generation and debt reduction will continue to be a priority for 2018, as it executes its multi-year plan to de-lever the balance sheet and fund growth initiatives.

Analysts tracking the stock believes that the fundamental need for infrastructure investment in the U.S. is higher than ever and therefore company’s like Builders FirstSource is at a critical inflection point and has significant opportunities to enhance its business risk profile in 2018 and beyond.

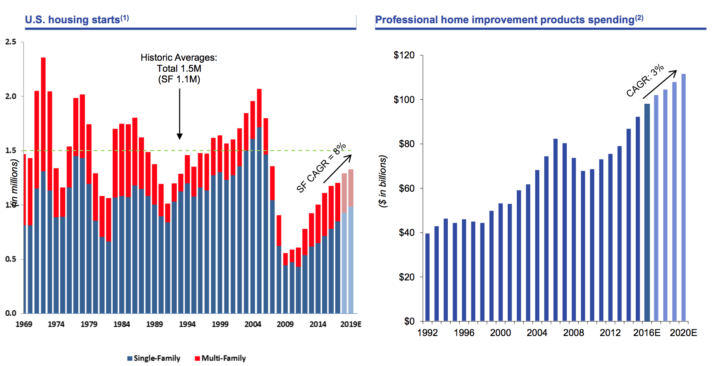

In fact, as housing starts level is still significantly below the long-term historical average and residential repair & remodel spending continues to show consistent growth, BLDR is well positioned to capitalize on the opportunities that its national footprint, strong customer relationships, and end market diversity provide.

Driven by abovementioned factors, several equities research analysts recently issued favorable reports on BLDR shares.

- Wedbush set a $30.00 price target and gave the stock an “outperform” rating on, January 12th.

- Stifel Nicolaus boosted target price from $23.00 to $26.50 and gave a “buy” rating on, January 22nd.

- Stephens reissued “buy” rating and issued a $27.00 target price on, January 17th.

Three equities research analysts have rated the stock with a hold rating, and ten have issued a buy rating to the company. The company has a consensus rating of “Buy” and an average price target of $24.50.

About the company: Headquartered in Dallas, Texas, Builders FirstSource is one of the largest U.S supplier of building products, prefabricated components, and value-added services to the professional market segment for new residential construction and repair and remodeling.

It provides customers an integrated homebuilding solution, offering manufacturing, supply, delivery, and installation of a full range of structural and related building products.

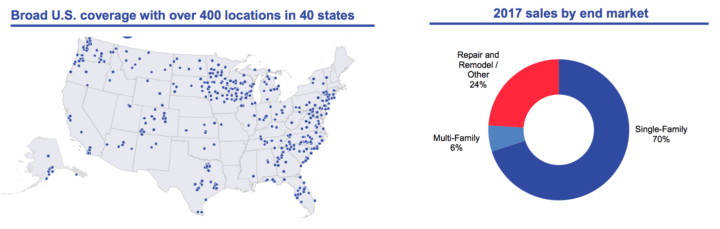

It operates in 40 states with 402 locations and has a market presence in 75 of the top 100 Metropolitan Statistical Areas, providing geographic diversity and balanced end market exposure.

Key achievements of 2017:

- Market risk profile: 2017 revenue growth of 10.7%. Added +120 sales professionals and trainees in 2017

- Business risk profile: 11.0% growth in manufactured products in 2017, four new component plants in 2017

- Operational risk profile: Roadmap for multi-year cost savings, Integration of delivery management system to core ERP completed in December, Customer to Cash project begun

- Financial risk profile & Liquidity: Cash flow of $119M after $62M in CapEx investments, called 10.75% notes, saving $35M go forward cash interest

Unique differentiating factors of BLDR and demand drivers:

- The highly fragmented homebuilding market provides a diverse customer base, where no one customer accounts for more than 5% of sales and top 10 accounts for ~16%

- National scale facilitates strategic partnerships with customers and suppliers

- Presence in 75 of top 100 MSAs and in 40 states

- Housing starts level is still significantly below the long-term historical average

- Residential repair & remodel spending continues to show consistent growth

Long-term guidance:

BLDR continues to invest to further leverage its advantaged product portfolio to capture growth in the coming years. It is enthusiastic about its plans to create meaningful value through the Company’s identified initiatives as well as capitalizing on a growing single-family housing market.

- Double 2016 EBITDA,

- EPS $3.00 – $3.50

- ~ 2.5 – 3.0 x 2016 Free Cash Flow

- ~ Over $1B Cumulative Cash Generation

Fourth Quarter 2017 Compared to Fourth Quarter 2016:

Revenue and Profitability:

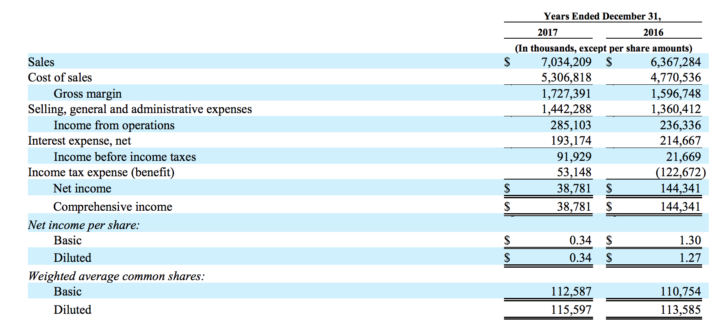

- Net sales for the quarter ended December 31, 2017, were $1.8 billion, a sales increase of 15.0 percent over net sales for the fourth quarter of 2016. Sales per day, excluding closed locations, grew 13.2 percent in the quarter, which was benefited approximately 7.6 percent from the impact of commodity lumber price inflation on sales and 5.6 percent from sales volume growth.

- Gross margin of $431.2 million in the fourth quarter of 2017 increased by $39.6 million over the fourth quarter of 2016. Gross margin percentage was 24.2 percent, a decrease of 110 basis points from 25.3 percent in the fourth quarter of 2016. The gross margin percentage decreased primarily due to the impact of commodity price inflation relative to short-term customer pricing commitments.

Liquidity:

- On December 29, 2017, the Company redeemed all of the outstanding $367.6 million aggregate principal amounts of its 10.75% Senior Notes due 2023, which limited the future deductibility of interest expense.

- This transaction is expected to generate $35 million in annual go forward cash interest savings.

- Liquidity at December 31, 2017, was $494.3 million, which consisted of net borrowing availability under the revolving credit facility and cash on hand.

Key risk factors and potential stock drivers:

- The working capital requirement is relatively large, as is inherent in this industry. Sustained efficient working capital management as the business grows, would be a key sensitivity factor for the company.

- The financial risk profile should improve supported by better working capital management and improving cash accruals/profitability.

- Weakening of the financial risk profile due to slower than expected pace of operating performance improvement, or significant, debt-funded capital expenditure could adversely affect the sentiments.

- Vulnerability to volatility in raw material prices is likely to persist over the medium term, given the limited flexibility to pass on price increases owing to competition.

Stock Chart:

- On Thursday, March 1st, 2018, BLDR is trading at $21.67 (up 13%) on an above average volume of 1.37 million shares exchanging hands. Market capitalization is $2.45 billion. The current RSI is 57.31

- In the past 52 weeks, shares of BLDR have traded as low as $13.33 and as high as $23.28

- At $21.75, shares of BLDR are trading above its 50-day moving average (MA) at $21.31 and above its 200-day MA at $17.83.

- The present support and resistance levels for the stock are at $21.10 & $23.00 respectively.

Welcome to Traders News Source,

Our track record speaks for itself…

Small Cap Stocks could and should be the next to RUN in 2018 !

***Get our small cap profiles, special situation and watch alerts in real time. We are now offering our VIP – SMS/text alert service for free, simply text the word “Traders” to the phone number “25827” from your cell phone***

Traders News Source recent profiles and track record, 487% in verifiable potential gains for our members on 3 well timed small cap alerts alone! These are just three examples from over two dozen recent winners.

January 31st, 2017 (NASDAQ: HIMX) opened at $5.10/share and hit a high of $9.68/share March 24th, 2017 for gains of 89% within 60 days- http://finance.yahoo.com/news/himax-technologies-review-4q-2016-130000319.html

May 23rd, 2016- (NYSE: XXII) opened at $.87/share hit a high of $3.03/share so far our member potential gains- 248% – http://mailchi.mp/tradersnewssource/updates-5-of-our-profiles-for-212-400-and-whats-coming-next?e=[UNIQID]

October 31st, 2017 (NASDAQ: PYDS) Although we have been covering this security for over a year, our recent coverage October 31st, 2017 opened at $1.45/share hit $4.10 within three days for gains of over 150%- http://mailchi.mp/tradersnewssource/update-pyds-back-in-the-value-zone-with-news-out?e=[UNIQID]

Start doing your due diligence and watch the stocks in our actionable reports for yourself. We are constantly raising the bar and separate ourselves from the rest of the small-cap newsletters as the best in business.

***Our next newsletter is due out March 6th, 2018 at 9:45 AM, covering a low float NASDAQ company in a high growth industry that is very active in M&A.

Disclaimer

Traders News Source is a wholly owned subsidiary of Traders News Source LLC, herein referred to as TNS LLC.

Traders News Source has not been compensated for this report by anyone and the opinions if any are that of the author Vikas Agrawal, CFA. Author’s Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I, wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in the article.

This web site, published by TNS LLC, and is an investment newsletter that is built on the premise of assisting individual investors in learning about investing. Our goal as publishers of financial information is to provide research and analysis of investments to our subscribers. TNS LLC does not give buy or sell recommendations. We do purchase distribution rights from analyst, financial writers and bloggers for a fee that may be licensed to issue price targets and recommendations. Furthermore, we encourage you to speak to a licensed professional prior to making an investment in any type of publicly traded security.

We do sell advertising to other companies including brokerage firms, web sites, publicly traded issuers, investor relations firms, and investment publications, among others. TNS LLC makes no warranty as to the policies of these organizations, and in no way endorses their offers, services, or the content of their advertisements.

When an advertiser is a publicly traded company or a third party acting on behalf of a public company, we fully disclose all compensation in the email advertisement. Such disclosure is included in a disclosure statement in each of the advertisements sent via email.

17B Disclosure

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use.

PLEASE NOTE WELL: TNS LLC and its employees are not a Registered Investment Advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold TNS LLC, its operator’s owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. TNS LLC encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and TNS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead TNS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

TNS LLC is compliant with the Can Spam Act of 2003. TNS LLC does not offer such advice or analysis, and TNS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a ‘safe harbor’ in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “forward looking statements”. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions & quote; “may”, “could”, or “might” occur.

Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, TNS LLC has relied upon information supplied by its customers, publicly available information and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, TNS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. TNS LLC is not responsible for any claims made by the companies advertised herein, nor is TNS LLC responsible for any other promotional firm, its program or its structure.