KushCo Holdings, Inc. (OTCQB: KSHB) is the parent company to a diverse group of business units that are transformative leaders across several industries. KushCo Holdings’ subsidiaries and brands provide exceptional customer service, product quality, compliancy knowledge and a local presence in serving its diverse customer base.

On Nov 26th, the parent company of innovative industry leaders such as Kush Supply Co., Kush Energy, The Hybrid Creative, and Koleto Packaging Solutions, which provide a range of services and products for a variety of industries including the regulated cannabis and CBD industries, reported financial and operational results for its fiscal year 2018, for the period ended August 31, 2018.

_____________________________________________________________________

Our members have booked up to 800% with our recent well timed (2018) NASDAQ and NYSE small cap reports. We will be initiating coverage on another exciting small cap security within the next ten days (December 11th-20th, 2018). Stop missing out on stocks that run, receive our reports in real time on your cell phone, text the word “Traders” to “25827”

View our recent picks, track record, long term biotech picks and sign up for our real time, low float and breakout mobile/text alerts here – https://tradersnewssource.com/traders-news-source-new-members/

_____________________________________________________________________

Financial Update:

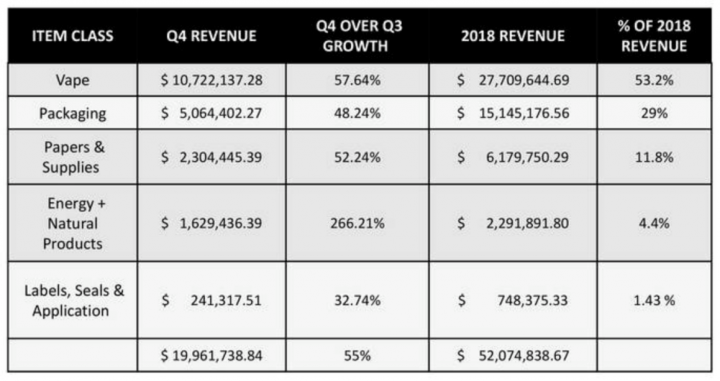

- Revenues were $52.1 million, representing a 177% growth compared to approximately $18.8 million in fiscal 2017.

- This includes the record fourth quarter of almost $20 million, which is greater than all of KushCo’s full year revenue for 2017 and represents a 55% increase over its Q3 2018 numbers. Of the $52.1 million in total annual sales, approximately 50 million is attributed to organic growth. These strong top-line revenue numbers were the result of several positive trends within the business, including greater customer numbers, increased spending per customer, effective cross-selling, as well as continued geographic expansion and broader product offerings.

Market & Business Profile Update:

- During 2018, KSHB has significantly outgrown the market in each state in relation to the growth of the industry. As a point of reference, Statista, which is a leading cannabis market research provider has projected the following overall cannabis growth rates for 2018; California 50%, Washington 31%, Colorado 25%, Nevada 131%, and Oregon 30%.

- KushCo’ business risk profile is supported by multiple growing businesses offering a wide array of products and services to the cannabis industry. While the company sees its fiscal 2018 achievement as an important milestone, heading into the fiscal year 2019 KSHB is going to continue to put its heads down, invest in its platform and focus on gaining market share, growing revenues, and building value for both customers and shareholders.

Management commentary: Nick Kovacevich, Chairman, and Chief Executive Officer, commented, “We are exceptionally pleased with the financial results we achieved during the fiscal year with revenues of $52.1 million, representing 177% growth compared to approximately $18.8 million in fiscal 2017. Our strong revenue growth was the result of dramatic growth in our most critical markets, with growing customer numbers, an increasingly diversified offering and expanded facility capabilities. Our growth was further supported by an expanded global presence with recently-opened offices in Canada and China. While we are disappointed with the impact our dramatic growth has had on margins, we believe they are short-term consequences, and we’re pleased to have already implemented several initiatives to improve margins on a go-forward basis.”

Industry growth and expected synergies:

As the industry continues to develop, KSHB has transformed its business model, now operating a diverse group of business units that are transformative leaders across several categories. The company’ dramatic expansion of services has enabled it to enter new markets and reach a wider customer base. This drove a number of positive trends within the business in 2018, including strong growth in customer numbers, increased spending per customer, increased product consumption and the continued investment in geographic expansion and broader product offerings. To support this growth, the company have implemented several initiatives designed to improve efficiencies and to establish, build and refine stronger, scalable and sustainable processes. These steps are expected to set it up to continue to capitalize on the continued growth of the industry effectively, and KSHB hopes to achieve between $110 million and $120 million in top-line revenue during the fiscal year 2019.

Per www.marketbeat.com, KushCo’s average twelve-month price target is $8.1250, suggesting that the stock has a possible upside of 39.85%. The high price target for KSHB is $8.75, and the low-price target for KSHB is $7.50. Considering all this, the company is in a favorable risk-reward position, and value investors should consider exposure in this sector as the backdrop remains favorable.

Below are the excerpts of recent analyst rating/Price targets on the company:

Source: www.marketbeat.com

About the Company: KushCo Holdings, Inc. (OTCQB: KSHB) is the parent company to a diverse group of business units that are transformative leaders in the cannabis, CBD and other related industries. KushCo Holdings’ subsidiaries and brands provide exceptional customer service, product quality, compliancy knowledge and a local presence in serving its diverse customer base.

KushCo Holdings’ brands include Kush Bottles, a dynamic sales platform that is the nation’s largest and most respected distributor of packaging, supplies, and accessories, Kush Energy, which provides ultra-pure hydrocarbon gases and solvents to the cannabis and CBD sector, Hybrid Creative, a premier creative design agency for cannabis and non-cannabis ventures, and Koleto Packaging Solutions, the research and development arm driving intellectual property development and acquisitions.

Key recent highlights: Fiscal Year 2018 and Recent Operational Summary

- Officially changed the Company’s name from Kush Bottles, Inc., to KushCo Holdings, Inc., reflecting a diversified business model, effective September 1, 2018.

- Appointed Christopher Tedford as Chief Financial Officer, allowing Jim McCormick to transition exclusively into the Chief Operating Officer role.

- Launched Kush Supply Co. Canada, a subsidiary based in Toronto, Ontario, with a national sales force leveraging the robust infrastructure of Kush Supply Co. distribution platform.

- Re-branded KushCo Holdings primary business unit Kush Bottles into Kush Supply Co.

- Launched Koleto, a division of KushCo led by president Steven Hwang, that is focused on building valuable proprietary intellectual property and designing unique FDA-compliant products.

- Launched Kush Energy, focused on supplying the cannabis industry with tested, high-quality solvents and hydrocarbons, after the completed acquisition of Summit Innovations in May 2018, and subsequently opened two hazmat facilities in Portland, OR and Seattle, WA metro areas.

- Launched creative design capabilities for clients across several industries, following the acquisition of The Hybrid Creative in July 2018.

- Initiated the Company’s second international expansion with a new office in the Jiangbei District of Ningbo, China, establishing a physical presence that will facilitate stronger manufacturing relationships and maintain consistent, high-quality standards.

- Engaged Manhattan Associates as the Company’s new Warehouse Management System provider and GoLeanSixSigma.com as consultants to build scalable and sustainable processes.

- Formed a three-member Advisory Board to provide strategic advice and expertise to help accelerate growth, manage risk and enhance operational performance.

- Opened a new warehouse facility in Worcester, Massachusetts to serve as the Company’s East Coast hub.

- Launched three new child-resistant product lines, including three proprietary packaging lines.

Financial Results FYE is 8-31

- Total revenue increased to 177% to 52.1 million in fiscal 2018 from $18.8 million in fiscal 2017. The increase in revenue was primarily due to overall growth in sales as a result of an increase in customer number, average orders size and expanded product offerings as well as the opening of the new market. Profit increased to 12.6 million in the fiscal year 2018 up from 6.6 million in the fiscal year 2017 as a result of the overall growth in sales.

- Gross margins were 24% in the fiscal year 2018 compared to 35% in the fiscal year 2017, reflecting a higher cost of sales resulting from the rapid growth. It should be noted that if the year-end inventory adjustment of 2.8 million has excluded the Company’s gross margin would have been 30% for the full year.

- Operating expenses in fiscal 2018 were 25 million compared with 6.2 million in fiscal 2017, primarily due to an increase in SG&A costs which were 24 million in fiscal 2018 as compared to 5.9 million in fiscal 2017. The cost reflected at the extended operational footprint as well as increased headcount at levels of the Company. The net loss for fiscal 2018 was 10.2 million or $0.16 per share as compared to net income of approximately 69,000 or $0.00 per share in fiscal 2017.

- Liquidity and Financial Flexibility – At August 31, 2018, KSHB had cash of 13.5 million and working capital surplus of 40.2 million compared with cash of approximately 917,000 and working capital of 3.4 million as of August 31, 2017.

Key risk factors and potential stock drivers:

- Continuing growth in the cannabis sector could act as a catalyst for the company shares.

- The company operation is still at an early stage and burning cash. Therefore, its ability to maintain liquidity and financial flexibility to fund its incremental capital requirements will remain a critical challenge for the company.

- The company’ business is exposed to risk related to competitive pressure, and its revenues may suffer from competitive pressure.

- Marijuana remains illegal under federal law. It is a Schedule I controlled substance. Even in those jurisdictions in which the use of medical marijuana has been legalized at the state level, its prescription is a violation of federal law.

- The company’s business is exposed to regulatory risk and its adverse impact on the overall business risk profile.

Stock Performance

Comments:

- On Friday, December 7th, 2018, KSHB closed at $5.81 (+9.62%), on an above average volume of 0.5 million shares exchanging hands. Market capitalization is $456.425 million. The current RSI is 54.23

- In the past 52 weeks, shares of KSHB have traded as low as $2.75 and as high as $8.51

- At $5.81, shares of KSHB are trading above its 50-day moving average (MA) at $5.62 & above its 200-day moving average (MA) at $5.81

- The present support and resistance levels for the stock are at $5.62 & $5.28 respectively.